WeightWatchers 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

annual report 2002

real food.real life.real results.

Table of contents

-

Page 1

annual report 2002 real food. real life. real results. -

Page 2

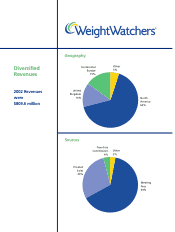

Geography Diversified Revenues 2002 Revenues were $809.6 million Continental Europe 15% Other 5% United Kingdom 14% North America 66% Sources Franchise Commissions 4% Other 3% Product Sales 29% Meeting Fees 64% -

Page 3

...us, constantly evaluating our programs and products while monitoring the latest studies and health trends. Combined with the support from our meetings and the trust inspired by our Leaders, consumers know they are getting the very best from Weight Watchers. For example, in a recent U.S. survey, when... -

Page 4

... at our international efforts, in 2002 we launched the POINTS Plus Plan in Continental Europe, our ï¬rst innovation of the POINTS Weight-Loss offerings such as our Just 2-POINTS!® Bars, provide members with helpful tools to manage their diets, as well as delicious low-POINT snacks to satisfy... -

Page 5

... in the market. Exciting key events in 2003 include the launch of new innovations to our POINTS Weight-Loss System in both the United Kingdom and North America. In January, the U.K. introduced "Time to Eat," offering members 52 weeks of seasonally appropriate program materials that correspond... -

Page 6

... the launch of new innovations to our POINTS System in both the United Kingdom and North America...and working with the American Cancer Society on the Great American Weigh In. I look forward to reporting another successful year in 2003, and would like to personally thank our members for their belief... -

Page 7

... 10-K ᤠANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 28, 2002. អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File no 000-03389 Weight Watchers International, Inc... -

Page 8

... and brand on the following core principles: Effective Healthy Supportive Flexible Balanced Weight Watchers Meetings We present our program in a series of weekly classes of approximately one hour in duration. Classes are conveniently scheduled throughout the day. Typically, we hold classes in... -

Page 9

... weight-loss topics, achievements people have made in the prior week and celebrating and applauding successes. Members who have reached their weight goal are singled out for their accomplishment. Discussions can range from dealing with a holiday office party to making time to exercise. The leader... -

Page 10

...long-term weight loss. Our international members learn similar principles and receive similar publications. Healthful Eating Our food plans allow our members to eat regular meals instead of pre-packaged meals. By giving members the freedom to choose what to eat, our plans are flexible and adjustable... -

Page 11

... typically pay us a fee equal to 10% of their meeting fee revenues. Our franchisees are responsible for operating classes in their territory using the program and marketing materials we have developed. We provide a central support system for the program and our brand. Franchisees purchase products... -

Page 12

... dietary principles or weight-loss program, which WW Foods sublicensed in turn to us. Third Party Licenses During the period that Heinz owned our company, it developed a number of food product lines under the Weight Watchers brand, with hundreds of millions of dollars of retail sales, mostly in the... -

Page 13

...Pricing Structure and Promotions Our most popular payment structure is a ''pay-as-you-go'' arrangement. Typically, a new member pays an initial registration fee and then a weekly fee for each class attended, although free registration is often offered as a promotion. Our Liberty/Loyalty payment plan... -

Page 14

... by promoting our brand, advertising Weight Watchers classes and keeping members involved with the program outside the classroom through useful offerings, such as a meeting locator, low calorie recipes, weight-loss news articles, success stories and on-line forums. During fiscal 2002, approximately... -

Page 15

...commercial weight-loss industry, although we believe that the businesses are not comparable. For example, many of these competitors' businesses are based on the sale of pre-packaged meals and meal replacements. Our classes use group support, education and behavior modification to help members change... -

Page 16

... Europe, Australia and New Zealand. None of our service providers or employees is represented by a labor union. We consider our employee relations to be satisfactory. Corporate Information Corporate information, press releases and our periodic reports (e.g. 10-K's, 10-Q's, 8-K's) are available free... -

Page 17

... and meal replacement products, and other weight-loss programs and products; • risks associated with the relative success of our marketing and advertising; • risks associated with the continued attractiveness of our programs; • risks associated with our ability to meet our obligations related... -

Page 18

... of WeightWatchers.com's office facility. We typically hold our classes in third-party locations (typically meeting rooms in well-located civic or religious organizations) or space leased in retail centers (typically leased spaces in strip malls for short terms, generally less than five years). As... -

Page 19

... from the sale of shares of our common stock pursuant to this secondary offering. The following table sets forth, for the period indicated, the high and low sales prices per share for our common stock as reported on the New York Stock Exchange consolidated tape (NYSE ticker symbol: ''WTW''). Fiscal... -

Page 20

..., April 26, 2002 2001 (35 Weeks) 2000 1999 1998 1997 Revenues, net ...Net income (loss) ...Working capital (deficit) ...Total assets ...Long-term obligations ...Basic Net income (loss) Per Share: Income (loss) before extraordinary item Extraordinary item, net of taxes ...Net income (loss) ...Diluted... -

Page 21

... the strategic decision to discontinue the sale of pre-packaged frozen meals in our NACO meetings (which were added in 1990 by our former owner, Heinz) and to introduce to our NACO operations some of the best practices developed by our European managers, including our new POINTS-based program. 14 -

Page 22

... our international operations. We derive our revenues principally from: • Meeting fees. Our members pay us a weekly fee to attend our classes. • Product sales. We sell proprietary products that complement our program, such as snack bars, books, CD-ROMs and POINTS calculators, to our members and... -

Page 23

... programs tailored to the local markets and increasing the number of meetings ahead of anticipated demand. Between fiscal 1997 and fiscal 2002, attendance in our Continental European operations grew at a compound annual rate of 16.4%. • Increased product sales. We have increased our product sales... -

Page 24

...in our meetings and to our franchisees, collecting commissions from franchisees operating under the Weight Watchers name and collecting royalties related to licensing agreements. Revenue is recognized when registration fees are paid, services are rendered, products are shipped to customers and title... -

Page 25

.... Fair value adjustments for non-qualifying derivative instruments are recorded in our results of operations. Equity Investee We own approximately 19.9% of our affiliate and licensee, WeightWatchers.com, or approximately 38% on a fully diluted basis (including the exercise of all options and all the... -

Page 26

... of franchise revenues, $4.2 million of royalties from our licensee, WeightWatchers.com, and $6.3 million attributable to our publications and other licensing sources. On a geographical basis, meeting fees and product sales increased 37.4% in North America and 16.5% internationally, with 5.1% of... -

Page 27

...royalty income from WeightWatchers.com of $4.2 million, which we began accruing in 2002. Other areas of growth included international licensing revenues and advertising revenues from our publications. Cost of revenues was $370.3 million for the fiscal year ended December 28, 2002, an increase of $83... -

Page 28

... current fiscal year. Additionally, the increases in NACO and international company-owned meeting fees were the result of increased member attendance and the roll-out of new program innovations and price increases in select markets, offset in part by negative exchange rate variances. Product sales... -

Page 29

... $3.5 million for the twelve months ended December 30, 2000. This increase was primarily due to changes in unrealized currency gains and losses and advances to WeightWatchers.com. Provision for (benefit from) income taxes was ($23.2) million for the fiscal year ended December 29, 2001, a decrease... -

Page 30

... taxes ($4.8 million) and deferred revenue and other current liabilities ($10.6 million). Capital spending has averaged approximately $4.0 million annually over the last three years and has consisted primarily of leasehold improvements, furniture and equipment for meeting locations and information... -

Page 31

... rating for the senior subordinated notes to ''B+''. We are obligated under non-cancelable operating leases primarily for office and rent facilities. We guarantee the performance of part of WeightWatchers.com's lease of its office space at 888 Seventh Avenue, New York, New York. The annual rent rate... -

Page 32

... $16.3 million. The following schedule sets forth our year-by-year long-term obligations as of December 28, 2002. Long-Term Obligations As of December 28, 2002 (in millions) Debt (including current portion) Payments Due by Fiscal Year Lease Commitments Total 2003 ...2004 ...2005 ...2006... -

Page 33

... Our business is seasonal, with revenues generally decreasing at year end and during the summer months. Our advertising schedule supports the three key enrollment-generating seasons of the year: winter, spring and fall. Due to the timing of our marketing expenditures, particularly the higher level... -

Page 34

... and interest rate changes. Our exposure to market risk for changes in interest rates relates to the fair value of long-term fixed rate debt and interest expense of variable rate debt. We have historically managed interest rates through the use of, and our long-term debt is currently composed of... -

Page 35

... our Chief Executive Officer in December 2000. Ms. Huett joined our company in 1984 as a classroom leader. Ms. Huett was promoted to U.K. Training Manager in 1986. In 1990, Ms. Huett was appointed Director of the United Kingdom operation and in 1993 was appointed Vice President of Weight Watchers... -

Page 36

...promoted to General Manager-Marketing and Finance. Ann M. Sardini. Ms. Sardini has served as our Vice President and Chief Financial Officer since April 2002 when she joined our company. Ms. Sardini has over 20 years of experience in senior financial management positions in branded media and consumer... -

Page 37

...Bard. Mr. Bard is currently a director of Wm. Wrigley Jr. Company. Mr. Bard joined Wrigley in 1991 as Senior Vice President and Chief Financial Officer with subsequent additional responsibilities for world-wide manufacturing, U.S. marketing and information systems. Prior to joining Wrigley, Mr. Bard... -

Page 38

... and corporate policy; • to review our annual and quarterly financial statements prior to their filing or prior to the release of earnings; • to oversee the performance of the independent accountants and to retain or terminate the independent accountants and approve all engagement fees and terms... -

Page 39

... our Chief Executive Officer and other executive officers. It is the responsibility of the board of directors to review, recommend and approve changes to our compensation policies and benefits programs, to administer our stock plans, including approving stock option grants to executive officers and... -

Page 40

... most highly compensated executive officers whose total annual salary and bonus was in excess of $100,000. Summary Compensation Table Long-term Compensation Awards, Securities Underlying Options (No. Awarded) All Other Weight Watchers Int'l Compensation(4) Name and principal position Twelve Months... -

Page 41

... options, restricted stock, stock appreciation rights and other stock-based awards on shares of WeightWatchers.com common stock. Generally, stock options under the plan vest in annual increments over five years upon our achievement of certain performance targets. These options are not exercisable... -

Page 42

...28, 2002. None of our executive officers exercised any WeightWatchers.com options and they do not have any stock appreciation rights. Aggregated Options Values as of December 28, 2002 Fiscal Year Ended Number of Weight Watchers Value of Weight Watchers December 28, 2002 Securities Unexercised Shares... -

Page 43

...Artal Group and Artal International is the same as the address of Artal Luxembourg. (2) Our executive officers and directors may be contacted c /o Weight Watchers International, Inc., 175 Crossways Park West, Woodbury, New York, 11797. (3) Includes shares subject to purchase upon exercise of options... -

Page 44

The following table summarizes our equity compensation plan information as of December 28, 2002. Equity Compensation Plan Information Number of securities to be issued upon exercise of outstanding options, warrants and rights Weighted average exercise price of outstanding options, warrants and ... -

Page 45

... number of directors. We have agreed with Artal Luxembourg that both we and Artal Luxembourg have the right to: • engage in the same or similar business activities as the other party; • do business with any customer or client of the other party; and • employ or engage any officer or employee... -

Page 46

... than WeightWatchers.com can continue using the trademarks in connection with online advertising and promotion of activities conducted offline); and (4) use any materials related to the Weight Watchers program, including any text, artwork and photographs, and advertising, marketing and promotional... -

Page 47

... registered offerings. WeightWatchers.com Lease Guarantee The Company has guaranteed the performance of part of WeightWatchers.com's lease of its office space at 888 Seventh Avenue, New York, New York. The annual rental rate is $0.5 million plus increases for operating expenses and real estate taxes... -

Page 48

... for successive one-year periods by providing written notice to Nellson Nutraceutical. Item 14. Controls and Procedures Based on their evaluation, as of a date within 90 days of the filing of this Annual Report on Form 10-K, our Chief Executive Officer and Chief Financial Officer have concluded... -

Page 49

..., Financial Statement Schedule, and Report on Form 8-K. (a) 1. Financial Statements The financial statements listed in the Index to Financial Statements and Financial Statement Schedule on page F-1 are filed as part of this Form 10-K. 2. Financial Statement Schedule The financial statement schedule... -

Page 50

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES INDEX TO FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULE COVERED BY REPORT OF INDEPENDENT ACCOUNTANTS Items 15(a) 1&2 Pages Consolidated Balance Sheets at December 28, 2002 and December 29, 2001 ...Consolidated Statements of Operations for ... -

Page 51

... taxes ...Deferred revenue ...TOTAL CURRENT LIABILITIES ...Long-term debt ...Deferred income taxes ...Other ...TOTAL LONG-TERM DEBT AND OTHER LIABILITIES ...Commitments and contingencies (Note 15) Redeemable preferred stock ...SHAREHOLDERS' EQUITY (DEFICIT) Common stock, $0 par 1,000,000 shares... -

Page 52

... PER SHARE AMOUNTS) December 28, 2002 (52 Weeks) December 29, 2001 (52 Weeks) December 30, 2000 (35 Weeks) April 29, 2000 (53 Weeks) Meeting fees, net ...Product sales and other, net ...Revenues, net ...Cost of revenues ...Gross profit ...Marketing expenses ...Selling, general and administrative... -

Page 53

......Stock options exercised ...Tax benefit of stock options exercised . Cost of secondary public equity offering ... ...for as ... Total Comprehensive Income ... Balance at December 28, 2002 ... 111,988 $ - 5,711 $(23,061) $ The accompanying notes are an integral part of the consolidated financial... -

Page 54

...Net Parent settlements ...Purchase of treasury stock ...Cost of public equity offering ...Proceeds from sale of common stock ...Proceeds from stock options exercised ... Cash (used for) provided by financing activities ...Effect of exchange rate changes on cash and cash equivalents ...Net increase... -

Page 55

.... Common Stock Offering: On November 15, 2001, the Company traded 17,400 shares of its common stock on the New York Stock Exchange at an initial price to the public of $24.00 per share. The Company did not receive any of the proceeds from the sale of shares of the Company's common stock pursuant to... -

Page 56

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 1. Basis of Presentation (Continued) result, all costs incurred in connection with the Company's common stock offering have been recorded in ... -

Page 57

... at cost. For financial reporting purposes, equipment is depreciated on the straight-line method over the estimated useful lives of the assets (5 to 10 years). Leasehold improvements are amortized on the straight-line method over the shorter of the term of the lease or the useful life of the related... -

Page 58

... earned. From time to time, the Company provides various discounts to customers, including free registration offers, which are deducted from gross revenue. Advertising Costs: Advertising costs consist primarily of national and local direct mail, television, and spokesperson's fees. All costs related... -

Page 59

... of its credit facilities. Such costs are being amortized using the interest rate method over the term of the related debt. Amortization expense for the fiscal years ended December 28, 2002 and December 29, 2001, the eight months ended December 30, 2000 and the fiscal year ended April 29, 2000 was... -

Page 60

... for Stock Issued to Employees,'' and related Interpretations in accounting for those plans. No compensation expense for employee stock options is reflected in earnings, as all options granted under the plans had an exercise price equal to the market value of the common stock on the date of... -

Page 61

..., 2002 December 29, 2001 April 29, 2000 Net income, as reported ...Deduct: Total stock-based employee compensation expense determined under the fair value method for all stock options awards, net of related tax effect . . Pro forma net income ...Earnings per share: Basic-as reported ...Basic-pro... -

Page 62

... one of its franchisees, Weight Watchers of North Jersey, Inc., pursuant to the terms of an Asset Purchase Agreement executed on December 31, 2001 among Weight Watchers of North Jersey, Inc., the Company and Weight Watchers North America, Inc. Substantially all of the purchase price in excess of the... -

Page 63

... companies. The impact of fiscal 2002 acquisitions was not material to the results of operations, and therefore pro forma information is not included for these acquisitions. Pro Forma Eight Months Ended December 30, 2000 Revenue ...Net income ...Per share information: Basic and diluted earnings... -

Page 64

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 4. Goodwill and Intangible Assets (Continued) Also, in accordance with SFAS No. 142, aggregate amortization expense for definite lived intangible ... -

Page 65

... December 29, 2002 2001 Eight Months Ended December 30, 2000 Fiscal Years Ended April 29, 2000 Reported net income available to common shareholders ...Addback: goodwill amortization (net of tax) ...Adjusted net income available to common shareholders ...Basic earnings per share: Reported net income... -

Page 66

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 6. Long-Term Debt December 28, 2002 Effective Balance rate December 29, 2001 Effective Balance rate EURO 100.0 million 13% Senior Subordinated Notes ... -

Page 67

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 6. Long-Term Debt (Continued) all existing and future senior indebtedness of the Company, including the Credit Facility. The notes are guaranteed by ... -

Page 68

... the board of directors adopted the 1999 Stock Purchase and Option Plan of Weight Watchers International, Inc. and Subsidiaries (the ''Plan''). The Plan is designed to promote the long-term financial interests and growth of the Company and its subsidiaries by attracting and retaining management with... -

Page 69

... is estimated on the date of grant using the Black-Scholes option pricing model with the following weighted average assumptions: Eight Months Ended December 30, 2000 December 28, 2002 December 29, 2001 April 29, 2000 Dividend yield ...Volatility ...Risk-free interest rate Expected term (years... -

Page 70

...The following table summarizes information about stock options outstanding at December 28, 2002 by range of exercise price: Options Outstanding Weighted Average Weighted Remaining Average Shares Contractual Exercise Outstanding Life Price Options Exercisable Weighted Average Exercise Price Range of... -

Page 71

... Company's stock option activity is as follows: Eight Months December 28, December 29, Ended December 2002 2001 30, 2000 April 29, 2000 Weighted Weighted Weighted Weighted Number average Number average Number average Number average of exercise of exercise of exercise of exercise Shares price Shares... -

Page 72

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 11. Income Taxes The following tables summarize the provision (benefit) for U.S. federal, state and foreign taxes on income: Eight Months Ended ... -

Page 73

...INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 11. Income Taxes (Continued) The difference between the U.S. federal statutory tax rate and the Company's consolidated effective tax rate are as follows: Eight Months... -

Page 74

...loss business. The license agreement provides the Company with control of how its intellectual property is used. In particular, the Company has the right to approve WeightWatchers.com's e-commerce activities, strategies and operational plans, marketing programs, privacy policy and materials publicly... -

Page 75

... certain types of services. The Company is required to pay for all expenses incurred by WeightWatchers.com directly attributable to the services it performs under this agreement, plus a fee of 10% of those expenses. The Company recorded service expense for the year ended December 28, 2002 of $1,862... -

Page 76

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 12. Related Party Transactions (Continued) nutrition bar products. The term of the agreement runs through December 31, 2004, and the Company has the ... -

Page 77

... the Company's board of directors. The Company also reserves the right to make additional discretionary contributions to the Profit Sharing Plan. For certain senior management personnel, the Company sponsors the Weight Watchers Executive Profit Sharing Plan. Under the Internal Revenue Service (''IRS... -

Page 78

...post-retirement health care and life insurance benefits for employees who meet the eligibility requirements of the Heinz plans. Retirees share in the cost of these benefits based on age and years of service. Company contributions to the Heinz Savings Plan include a qualified age-related contribution... -

Page 79

...expected to have a material effect on the Company's results of operations and consolidated financial condition. Lease Commitments: Minimum rental commitments under non-cancelable operating leases, primarily for office and rental facilities at December 28, 2002, consist of the following: 2003 ...2004... -

Page 80

...and cash equivalents, short and long-term debt, current and noncurrent notes receivable, currency exchange agreements and guarantees. In evaluating the fair value of significant financial instruments, the Company generally uses quoted market prices of the same or similar instruments or calculates an... -

Page 81

... gains or losses from changes in foreign exchange rates related to Euro denominated debt, the Company expects reclassification from accumulated other comprehensive loss to net income. For the fiscal year ended December 28, 2002, the Company reclassed $2,258 ($3,702 before taxes, included within... -

Page 82

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 18. Quarterly Financial Information (Unaudited) (Continued) The Company reclassified certain expenses from other expense, net to selling, general and ... -

Page 83

... Service Corp.; Weight Watchers North America, Inc.; Weight Watchers U.K. Holdings Ltd.; Weight Watchers International Holdings Ltd.; Weight Watchers (U.K.) Limited; Weight Watchers (Exercise) Ltd.; Weight Watchers (Accessories & Publications) Ltd.; Weight Watchers (Food Products) Limited; Weight... -

Page 84

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES SUPPLEMENTAL CONSOLIDATING BALANCE SHEET AS OF DECEMBER 28, 2002 (IN THOUSANDS) NonGuarantor Subsidiaries Parent Company Guarantor Subsidiaries Eliminations Consolidated ASSETS CURRENT ASSETS Cash and cash equivalents ...Receivables, net ...... -

Page 85

... STOCK AND SHAREHOLDERS' (DEFICIT) EQUITY CURRENT LIABILITIES Portion of long-term debt due within one year ...Accounts payable ...Salaries and wages ...Accrued interest ...Foreign currency contract payable . . Other accrued liabilities ...Income taxes ...Deferred revenue ...TOTAL CURRENT Long-term... -

Page 86

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES SUPPLEMENTAL CONSOLIDATING STATEMENT OF OPERATIONS FOR THE FISCAL YEAR ENDED DECEMBER 28, 2002 (IN THOUSANDS) NonGuarantor Subsidiaries Parent Company Guarantor Subsidiaries Eliminations Consolidated Revenues, net ...Cost of revenues ...Gross... -

Page 87

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES SUPPLEMENTAL CONSOLIDATING STATEMENT OF OPERATIONS FOR THE FISCAL YEAR ENDED DECEMBER 29, 2001 (IN THOUSANDS) NonGuarantor Subsidiaries Parent Company Guarantor Subsidiaries Eliminations Consolidated Revenues, net ...Cost of revenues ...Gross... -

Page 88

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES SUPPLEMENTAL CONSOLIDATING STATEMENT OF OPERATIONS FOR THE EIGHT MONTHS ENDED DECEMBER 30, 2000 (IN THOUSANDS) NonGuarantor Subsidiaries Parent Company Guarantor Subsidiaries Eliminations Consolidated Revenues, net ...Cost of revenues ...... -

Page 89

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES SUPPLEMENTAL CONSOLIDATING STATEMENT OF OPERATIONS FOR THE FISCAL YEAR ENDED APRIL 29, 2000 (IN THOUSANDS) NonGuarantor Subsidiaries Parent Company Guarantor Subsidiaries Eliminations Consolidated Revenues, net ...Cost of revenues ...Gross ... -

Page 90

... ...Payments on long-term debt ...Redemption of redeemable preferred stock ...Net Parent advances ...Cost of public equity offering ...Proceeds from stock options exercised ... Cash used for financing activities ...Effect of exchange rate changes on cash and cash equivalents Net increase (decrease... -

Page 91

... on long-term debt ...Deferred financing costs ...Net Parent advances ...Purchase of treasury stock ...Cost of public equity offering ...Proceeds from sale of common stock ...Proceeds from stock options exercised ... Cash (used for) provided by financing activities ...Effect of exchange rate changes... -

Page 92

... used for investing activities ...Financing activities: Net increase (decrease) in short-term borrowings Parent company investment in subsidiaries ...Payment of dividends ...Payments on long-term debt ...Net Parent advances ... Cash used for financing activities ...Effect of exchange rate changes... -

Page 93

... ...Repurchase of common stock ...Payment of dividends ...Payments on long-term debt ...Deferred financing costs ...Net Parent (settlements) advances ... Cash (used for) provided by financing activities ...Effect of exchange rate changes on cash and cash equivalents Net increase in cash and cash... -

Page 94

..., in all material respects, the financial position of Weight Watchers International, Inc. and its subsidiaries at December 28, 2002 and December 29, 2001, and the results of their operations and their cash flows for each of the two years in the period ended December 28, 2002, the eight months ended... -

Page 95

... Charged to Costs and Expenses Balance at End of Period Deductions (1) FISCAL YEAR ENDED DECEMBER 28, 2002 Allowance for doubtful accounts ...Inventory reserves, other ...FISCAL YEAR ENDED DECEMBER 29, 2001 Allowance for doubtful accounts ...Inventory reserves, other ...EIGHT MONTHS ENDED DECEMBER... -

Page 96

...of Section 13 or 15 (d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on his behalf by the undersigned, thereunto duly authorized. WEIGHT WATCHERS INTERNATIONAL, INC. Date: March 28, 2003 By: /s/ LINDA HUETT Linda Huett President and Director II-1 -

Page 97

... of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. Date: March 28, 2003 By: /s/ LINDA HUETT Linda Huett President and Director (Principal Executive Officer) Date: March 28... -

Page 98

... Service Corp., Weight Watchers North America, Inc., Weight Watchers U.K. Holdings Ltd., Weight Watchers International Holdings, Ltd., Weight Watchers U.K. Limited, Weight Watchers (Accessories & Publications) Ltd., Weight Watchers (Food Products) Limited, Weight Watchers New Zealand Limited, Weight... -

Page 99

... and various financial institutions is incorporated herein by reference to Exhibit 10.1 filed with the Registrant's Annual Report on Form 10-K for the fiscal year ended December 29, 2001. License Agreement, dated as of September 29, 1999, between WW Foods, LLC and Weight Watchers International, Inc... -

Page 100

.... Weight Watchers Executive Profit Sharing Plan, dated as of October 4, 1999 is incorporated herein by reference to Exhibit 10.18 filed with the Registrant's Annual Report on Form 10-K for the fiscal year ended April 29, 2000. 1999 Stock Purchase and Option Plan of Weight Watchers International, Inc... -

Page 101

...with Amendment No. 2 to the Registrant's Registration Statement on Form S-1 (File No. 333-69362) as filed on November 9, 2001. Service Agreement, dated as of September 10, 2001, between Weight Watchers International, Inc. and WeightWatchers.com, Inc. is incorporated herein by reference to Exhibit No... -

Page 102

Exhibit Number Description **10.38 Registration Rights Agreement, dated as of September 29, 1999, among Weight Watchers International, Inc., H.J. Heinz Company and Artal Luxembourg S.A. is incorporated herein by reference to Exhibit No. 10.38 filed with Amendment No. 1 to the Registrant's ... -

Page 103

... Huett, President and Chief Executive Officer of Weight Watchers International, Inc., certify that: 1. 2. I have reviewed this annual report on Form 10-K of Weight Watchers International, Inc.; Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit... -

Page 104

..., Vice President and Chief Financial Officer of Weight Watchers International, Inc., certify that: 1. 2. I have reviewed this annual report on Form 10-K of Weight Watchers International, Inc.; Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit... -

Page 105

... Street, Garden City, NY 11530 on Monday, May 19, 2003, at 10 A.M. Eastern Time. Corporate Headquarters Weight Watchers International, Inc. 175 Crossways Park West Woodbury, NY 11797-2055 www.weightwatchersinternational.com Investor Relations Contact Common Stock New York Stock Exchange Symbol: WTW... -

Page 106

2049-AR-03