Walmart 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 Retirement Related Benefits

In the United States, the Company maintains a Profit Sharing Plan which is entirely funded by the Company and under

which most full-time and many part-time Associates become participants following one year of employment. The

Company also maintains a 401(k) retirement savings plans with the same eligibility requirements as the profit sharing

plan under which Associates may elect to contribute a percentage of their earnings. During fiscal 2003 participants could

contribute up to 15% of their pretax earnings, but not more than statutory limits.

The Company made annual contributions in cash to these plans on behalf of all eligible Associates, including those

who did not elect to contribute to the 401(k) plan. Associates may choose from among 14 different 401(k) investment

options. For Associates who did not make any election, their 401(k) balance is placed in a balanced fund. Associates are

immediately vested in their 401(k) funds and may change their investment options at any time.

Annual contributions to the United States and Puerto Rico 401(k) and profit sharing plans are made at the sole

discretion of the Company, and were $593 million, $500 million and $435 million in 2003, 2002 and 2001, respectively.

In addition, in fiscal 2002, eligible Associates could choose to receive a cash payout equal to one-half of the Company

contribution that otherwise would have been made into the 401(k) plan. The Company paid $34 million in cash to

Associates in lieu of Company contributions to the 401(k) plan in fiscal 2002.

Employees in foreign countries who are not U.S. citizens are covered by various postemployment benefit arrangements.

These plans are administered based upon the legislative and tax requirements in the country in which they are established.

Annual contributions to foreign retirement savings and profit sharing plans are made at the sole discretion of the

Company, and were $73 million, $55 million and $51 million in 2003, 2002 and 2001, respectively.

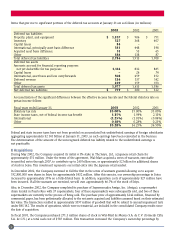

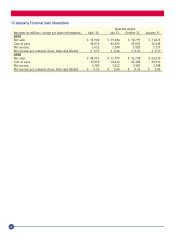

The Company’s United Kingdom subsidiary, ASDA, has in place a defined benefit plan. The following table provides a

summary of benefit obligations and plan assets of the ASDA defined benefit plan (in millions):

2003

Benefit obligation at January 31, $807

Fair value of plan assets at January 31, $601

Funded status of the plan ($ 206)

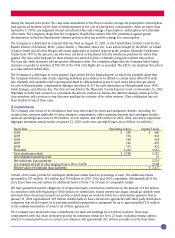

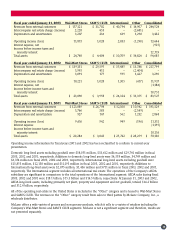

11 Segments

The Company and its subsidiaries are principally engaged in the operation of mass merchandising stores located in

all 50 states, Argentina, Canada, Germany, South Korea, Puerto Rico, and the United Kingdom, through joint ventures

in China, through majority-owned subsidiaries in Brazil and Mexico and through minority investment in Japan.

The Company identifies segments based on management responsibility within the United States and geographically

for all International units. The Wal-Mart Stores segment includes the Company’s discount stores, Supercenters and

Neighborhood Markets in the United States as well as Wal-Mart.com. The SAM’S CLUB segment includes the warehouse

membership clubs in the United States. The Company’s operations in Argentina, Brazil, China, Germany, South Korea,

Mexico, the United Kingdom and the Amigo operation in Puerto Rico are consolidated using a December 31 fiscal year

end, generally due to statutory reporting requirements. There were no significant intervening events which materially

affected the financial statements. The Company’s operations in Canada and Puerto Rico are consolidated using a

January 31 fiscal year end. The Company measures segment profit as operating profit, which is defined as operating

income, which is defined as income before net interest expense, income taxes and minority interest. Information on

segments and a reconciliation to income, before income taxes, and minority interest, are as follows (in millions):

48