Walmart 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The fiscal 2002 increase in segment operating income as a percentage of segment sales resulted from an improvement in

gross margin and a reduction in operating expenses as a percentage of segment sales in fiscal 2002 from fiscal 2001.

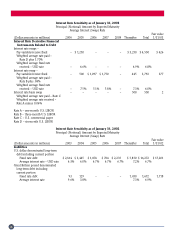

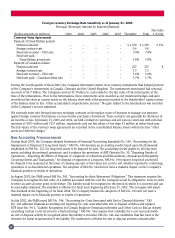

Our financial results from our foreign operations could be affected by factors such as changes in foreign currency exchange

rates or weak economic conditions in the foreign markets in which the Company does business. The Company minimizes

exposure to the risk of devaluation of foreign currencies by operating in local currencies and through buying forward

currency contracts, where feasible, for certain known funding requirements.

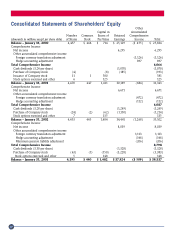

In fiscal 2003, the foreign currency translation adjustment decreased from the fiscal 2002 level by $1.1 billion leaving

a balance of $1.1 billion. This decrease is due to a weakening in the United States dollar against the United Kingdom

pound, the euro and the Canadian dollar which was somewhat offset by a strengthening in the United States dollar against

the Mexican peso. In fiscal 2002, the foreign currency translation adjustment increased from the fiscal 2001 level by

$472 million to a balance $2.2 billion at the end of fiscal 2002. This increase was primarily due to a strengthening in the

United States dollar against the local currencies of the countries in which the Company has operations with the exception

of Mexico where the peso strengthened against the dollar.

Other

Sales in the Other segment result from sales to third parties by the Company’s wholly owned subsidiary, McLane Company,

Inc. (“McLane”), a wholesale distributor. McLane offers a wide variety of grocery and non-grocery products, which it sells

to a variety of retailers including the Company’s Wal-Mart Stores and SAM’S CLUB segments.

Segment Sales Increase Segment Operating Segment Operating Loss Operating Loss as a

Fiscal year from Prior Fiscal Year Loss (in Billions) Increase from Prior Year Percentage of Segment Sales

2003 8.1% ($ 1.290) (109.1%) (8.7%)

2002 30.8% ($ 0.617) (214.8%) (4.5%)

2001 20.3% ($ 0.196) 34.0% (1.9%)

McLane net sales to unaffiliated purchasers accounted for approximately 6.1% of total Company sales in fiscal 2003

compared with 6.3% in fiscal 2002 and 5.5% in fiscal 2001.

Operating losses for the segment in each of the fiscal years presented primarily resulted from corporate overhead expenses

including insurance costs, corporate bonuses, various other expenses and in fiscal 2003, the unfavorable impact of a

$30 million LIFO adjustment. These corporate overhead expenses are partially offset by McLane operating income and

the favorable impact of LIFO adjustments of $67 million and $176 million in fiscal 2002 and 2001, respectively.

Summary of Critical Accounting Policies

Management strives to report the financial results of the Company in a clear and understandable manner, even though in

some cases accounting and disclosure rules are complex and require us to use technical terminology. We follow generally

accepted accounting principles in the U.S. in preparing our consolidated financial statements. These principles require us

to make certain estimates and apply judgments that affect our financial position and results of operations. Management

continually reviews its accounting policies, how they are applied and how they are reported and disclosed in our financial

statements. Following is a summary of our more significant accounting policies and how they are applied in preparation of

the financial statements.

Inventories

We use the retail last-in, first-out (LIFO) inventory accounting method for the Wal-Mart Stores segment, cost LIFO for the

SAM’S CLUB segment and other cost methods, including the retail first-in, first-out (FIFO) and average cost methods, for

the International segment. Inventories are not recorded in excess of market value. Historically, we have rarely experienced

significant occurrences of obsolescence or slow moving inventory. However, future changes in circumstances, such as

changes in customer merchandise preference or unseasonable weather patterns, could cause the Company’s inventory to

be exposed to obsolescence or be slow moving.

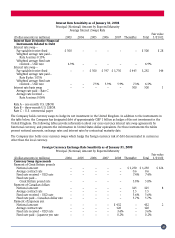

Financial Instruments

We use derivative financial instruments for purposes other than trading to reduce our exposure to fluctuations in foreign

currencies and to minimize the risk and cost associated with financial and global operating activities. Generally, the

contract terms of hedge instruments closely mirror those of the item being hedged, providing a high degree of risk

reduction and correlation. Contracts that are highly effective at meeting the risk reduction and correlation criteria are

22