Walmart 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

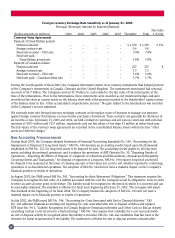

recorded using hedge accounting. On February 1, 2001, we adopted Financial Accounting Standards Board (FASB)

Statements No. 133, 137 and 138 (collectively “FAS 133”) pertaining to the accounting for derivatives and hedging

activities. FAS 133 requires all derivatives, which are financial instruments used by the Company to protect (hedge) itself

from certain risks, to be recorded on the balance sheet at fair value and establishes accounting treatment for hedges. If a

derivative instrument is a hedge, depending on the nature of the hedge, changes in the fair value of the instrument will

either be offset against the change in fair value of the hedged assets, liabilities, or firm commitment through earnings or

recognized in other comprehensive income until the hedged item is recognized in earnings. The ineffective portion of an

instrument’s change in fair value will be immediately recognized in earnings. Most of the Company’s interest rate hedges

qualify for the use of the “short-cut” method of accounting to assess hedge effectiveness. The Company uses the

hypothetical derivative method to assess the effectiveness of certain of its net investment and cash flow hedges.

Instruments that do not meet the criteria for hedge accounting or contracts for which we have not elected hedge

accounting are marked to fair value with unrealized gains or losses reported currently in earnings. Fair values are based

upon management’s expectation of future interest rate curves and may change based upon changes in those expectations.

Impairment of Assets

We periodically evaluate long-lived assets other than goodwill for indicators of impairment and test goodwill for

impairment annually. Management’s judgments regarding the existence of impairment indicators are based on market

conditions and operational performance. Future events could cause management to conclude that impairment indicators

exist and that the value of long-lived assets and goodwill associated with acquired businesses is impaired. Goodwill is

evaluated for impairment annually under the provisions of FAS 142 which requires us to make judgments relating to future

cash flows and growth rates as well as economic and market conditions.

Revenue Recognition

We recognize sales revenue at the time a sale is made to the customer, except for the following types of transactions.

Layaway transactions are recognized when the customer satisfies all payment obligations and takes possession of the

merchandise. We recognize SAM’S CLUB membership fee revenue over the 12-month term of the membership. Customer

purchases of Wal-Mart/SAM’S CLUB shopping cards are not recognized until the card is redeemed and the customer

purchases merchandise using the shopping card. Defective merchandise returned by customers is either returned to the

supplier or is destroyed and reimbursement is sought from the supplier.

Insurance/Self-Insurance

We use a combination of insurance, self-insured retention, and/or self-insurance for a number of risks including workers’

compensation, general liability, vehicle liability and employee-related health care benefits, a portion of which is paid by

the Associates. Liabilities associated with the risks that we retain are estimated in part by considering historical claims

experience, demographic factors, severity factors and other actuarial assumptions. The estimated accruals for these liabilities

could be significantly affected if future occurrences and claims differ from these assumptions and historical trends.

For a complete listing of our accounting policies, please see Note 1 to our consolidated financial statements that appear

after this discussion.

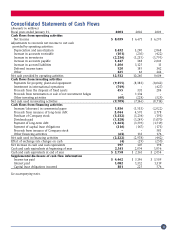

Liquidity and Capital Resources Cash Flows Information

Our cash flows from operating activities were $12.5 billion in fiscal 2003, up from $10.3 billion in fiscal 2002. In fiscal

2003, we invested $9.4 billion in capital assets, paid $3.2 billion to repurchase Company stock, received $2.0 billion from

the issuance of long-term debt and paid $1.3 billion in the repayment of long-term debt.

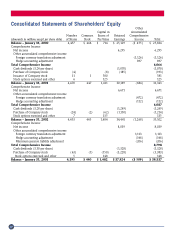

Company Stock Repurchase and Common Stock Dividends

In August 2002, our Board of Directors reset the common stock repurchase program authorization so that the Company

may make future repurchases of its stock of up to $5 billion. During fiscal 2003 we repurchased 63.2 million shares of our

common stock for approximately $3.4 billion. Of the fiscal 2003 common stock repurchases, approximately $1.7 billion

of the repurchases were made under prior stock repurchase authorization and approximately $1.7 billion of the repurchases

were made under the August 2002 authorization. At January 31, 2003 we had approximately $3.3 billion remaining on our

common stock repurchase authorization. Shares purchased under our share repurchase program are constructively retired

and returned to unissued status. We consider several factors in determining when to make share repurchases, including

among other things our cost of equity, our after-tax cost of borrowing, our position relative to our debt to total

capitalization targets and our expected future cash needs. There is no expiration date or other restriction governing the

period over which we can make our share repurchases under the program.

23