Walmart 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

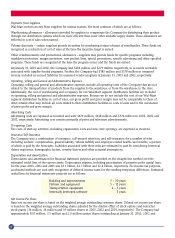

Payments from Suppliers

Wal-Mart receives money from suppliers for various reasons, the most common of which are as follows:

Warehousing allowances – allowances provided by suppliers to compensate the Company for distributing their product

through our distribution systems which are more efficient than most other available supply chains. These allowances are

reflected in cost of sales when earned.

Volume discounts – certain suppliers provide incentives for purchasing certain volumes of merchandise. These funds are

recognized as a reduction of cost of sales at the time the incentive target is earned.

Other reimbursements and promotional allowances – suppliers may provide funds for specific programs including

markdown protection, margin protection, new product lines, special promotions, specific advertising and other specified

programs. These funds are recognized at the time the program occurs and the funds are earned.

At January 31, 2003 and 2002, the Company had $286 million and $279 million respectively, in accounts receivable

associated with supplier funded programs. Further, the Company had $185 million and $178 million in unearned

revenue included in accrued liabilities for unearned vendor programs at January 31, 2003 and 2002, respectively.

Operating, Selling and General and Administrative Expenses

Operating, selling and general and administrative expenses include all operating costs of the Company that are not

related to the transportation of products from the supplier to the warehouse or from the warehouse to the store.

Additionally, the cost of warehousing and occupancy for our Wal-Mart segment distribution facilities are included

in operating, selling and general and administrative expenses. Because we do not include the cost of our Wal-Mart

segment distribution facilities in cost of sales, our gross profit and gross margin may not be comparable to those of

other retailers that may include all costs related to their distribution facilities in costs of sales and in the calculation

of gross profit and gross margin.

Advertising Costs

Advertising costs are expensed as incurred and were $676 million, $618 million and $574 million in 2003, 2002 and

2001, respectively. Advertising cost consists primarily of print and television advertisements.

Pre-opening Costs

The costs of start-up activities, including organization costs and new store openings, are expensed as incurred.

Insurance/Self-Insurance

The Company uses a combination of insurance, self-insured retention, and self-insurance for a number of risks

including workers’ compensation, general liability, vehicle liability and employee related health care benefits, a portion

of which is paid by the Associates. Liabilities associated with these risks are estimated in part by considering historical

claims experience, demographic factors, severity factors and other actuarial assumptions.

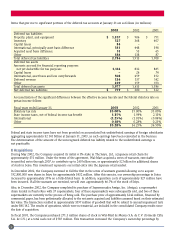

Depreciation and Amortization

Depreciation and amortization for financial statement purposes are provided on the straight-line method over the

estimated useful lives of the various assets. Depreciation expense, including amortization of property under capital lease,

for the years 2003, 2002 and 2001 was $3.1 billion, $2.7 billion and $2.4 billion, respectively. For income tax purposes,

accelerated methods are used with recognition of deferred income taxes for the resulting temporary differences. Estimated

useful lives for financial statements purposes are as follows:

Building and improvements 5 – 50 years

Fixtures and equipment 5 – 12 years

Transportation equipment 2 – 5 years

Internally developed software 3 years

Net Income Per Share

Basic net income per share is based on the weighted average outstanding common shares. Diluted net income per share

is based on the weighted average outstanding shares adjusted for the dilutive effect of stock options and restricted

stock grants (16 million, 16 million and 19 million shares in 2003, 2002 and 2001, respectively). The Company had

approximately 10.0 million, 3.5 million and 2.0 million option shares outstanding at January 31, 2003, 2002 and

36