Walmart 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

approximately 6% and resulted in goodwill of $422 million. As a result of that acquisition, Wal-Mart de Mexico’s share

repurchase program and a stock dividend paid by Wal-Mart de Mexico, the Company holds approximately 62% of the

outstanding voting shares of Wal-Mart de Mexico at the end of fiscal 2003.

7 Stock Option Plans

The Company follows Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees”

(APB 25) and related interpretations to account for its employee stock options. Because the exercise price of the

Company’s employee stock options generally equals the market price of the underlying stock on the date of the grant,

no compensation expense is recognized. The options granted under the stock option plans generally expire 10 years from

the date of grant. Options granted prior to November 17, 1995, may be exercised in nine annual installments. Generally,

options granted on or after November 17, 1995 and before fiscal 2001, may be exercised in seven annual installments.

Options granted after fiscal 2001 may be exercised in five annual installments.

The Company issues restricted (non-vested) stock to certain of our Associates. These shares are granted at market price on

the date of grant with varying vesting provisions. Most restricted stock grants vest 25 percent after three years, 25 percent

after five years and 50 percent at age 65. Three million restricted shares were outstanding at January 31, 2003 with a

weighted average grant date value of $38.44.

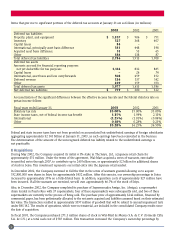

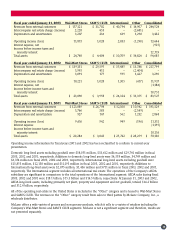

The following table summarizes information about stock options outstanding as of January 31, 2003:

Weighted Weighted Average

Range Number of Average Weighted Average Number of Exercise Price

of Exercise Outstanding Remaining Exercise Price of Options of Exercisable

Prices Options Life in Years Outstanding Options Exercisable Options

$ 4.24 to 7.25 61,000 3.6 $ 5.74 56,000 $ 5.88

10.81 to 15.41 11,429,000 3.0 11.75 8,388,000 11.79

17.53 to 23.33 5,881,000 5.0 19.30 3,662,000 19.36

24.72 to 38.72 4,656,000 7.7 35.59 385,000 27.25

39.88 to 45.75 4,857,000 6.1 40.57 2,187,000 40.06

46.00 to 54.56 22,176,000 8.2 49.20 3,903,000 47.75

55.25 to 60.90 10,045,000 8.8 56.41 1,472,000 55.88

$ 4.24 to 60.90 59,105,000 6.8 $ 38.38 20,053,000 $ 26.77

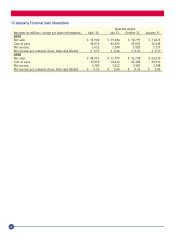

Further information concerning the options is as follows:

Option Price Weighted Average

Shares Per Share Per Share Total

January 31, 2000 51,314,000 $ 5.33 – 63.44 $ 20.38 $ 1,045,702,000

(12,967,000 shares exercisable)

Options granted 12,046,000 45.38 – 58.94 46.55 560,710,000

Options canceled (3,444,000) 6.75 – 54.56 26.79 (92,274,000)

Options exercised (7,865,000) 6.75 – 46.00 13.50 (106,145,000)

January 31, 2001 52,051,000 $ 5.33 – 63.44 $ 27.05 $ 1,407,993,000

(15,944,000 shares exercisable)

Options granted 12,821,000 4.24 – 56.80 46.46 595,639,000

Options canceled (1,969,000) 11.13 – 54.56 34.04 (67,030,000)

Options exercised (9,433,000) 4.24 – 47.56 22.48 (212,065,000)

January 31, 2002 53,470,000 $ 4.24 – 63.44 $ 32.25 $ 1,724,537,000

(16,823,000 shares exercisable)

Options granted 15,267,000 48.41 – 57.80 54.32 829,244,000

Options canceled (3,037,000) 4.24 – 63.44 42.07 (127,752,000)

Options exercised (6,595,000) 4.24 – 55.94 23.90 (157,588,000)

January 31, 2003 59,105,000 $ 4.24 – 60.90 $ 38.38 $ 2,268,441,000

(20,053,000 shares exercisable)

Shares available for option:

January 31, 2002 134,430,000

January 31, 2003 124,589,000

45