Walmart 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

evaluated periodically when events or circumstances indicate a possible inability to recover the carrying amount. These

evaluations are based on undiscounted cash flow and profitability projections that incorporate the impact of existing

Company businesses. The analyses require significant management judgment to evaluate the capacity of an acquired

business to perform within projections. Historically, the Company has generated sufficient returns from acquired

businesses to recover the cost of the goodwill and other intangible assets.

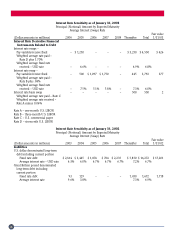

Goodwill is recorded on the balance sheet in the operating segments as follows (in millions):

January 31, 2003 January 31, 2002

International $ 8,985 $ 8,028

SAM’S CLUB 305 305

Other 231 233

Total Goodwill $ 9,521 $ 8,566

Changes in International segment goodwill are the result of foreign currency exchange rate fluctuations and the addition

of $197 million of goodwill resulting from the Company’s Amigo acquisition. See Note 6.

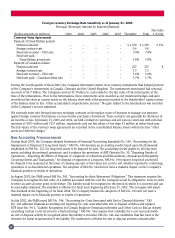

Foreign Currency Translation

The assets and liabilities of all foreign subsidiaries are translated at current exchange rates. Related translation

adjustments are recorded as a component of other accumulated comprehensive income.

Revenue Recognition

The Company recognizes sales revenue at the time it sells merchandise to the customer, except for layaway transactions.

The Company recognizes layaway transactions when the customer satisfies all payment obligations and takes possession

of the merchandise. The Company recognizes SAM’S CLUB membership fee revenue over the twelve-month term of

the membership. Customer purchases of Wal-Mart/SAM’S CLUB shopping cards are not recognized until the card is

redeemed and the customer purchases merchandise by using the shopping card.

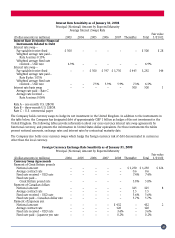

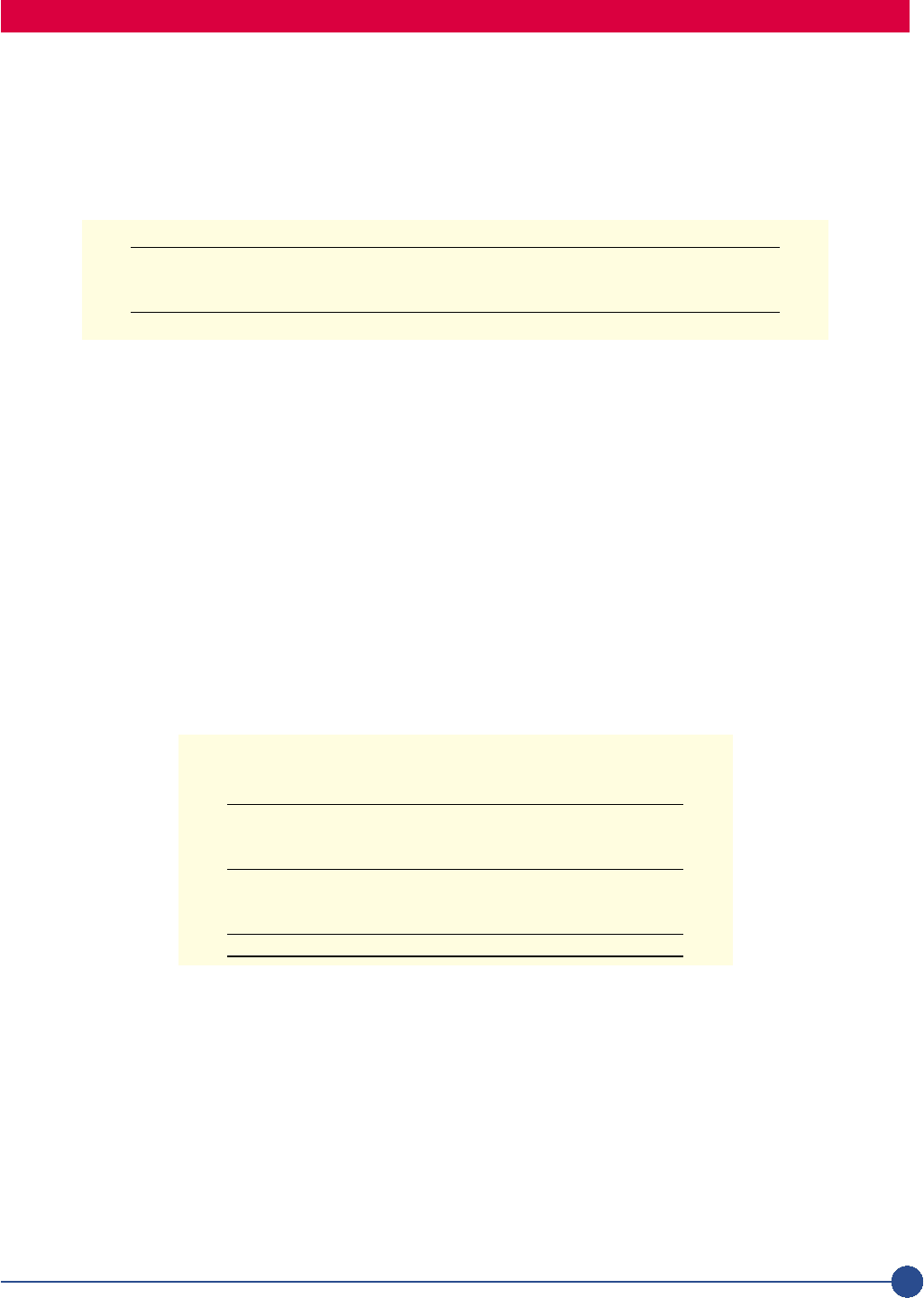

SAM’S CLUB Membership Revenue Recognition

The Company recognizes SAM’S CLUB membership fee revenues both domestically and internationally over the term of

the membership, which is 12 months. The following table provides unearned revenues, membership fees received from

members and the amount of revenues recognized in earnings for each of the fiscal years 2001, 2002 and 2003:

Deferred revenue January 31, 2000 $ 337

Membership fees received 706

Membership revenue recognized (674)

Deferred revenue January 31, 2001 369

Membership fees received 748

Membership revenue recognized (730)

Deferred revenue January 31, 2002 387

Membership fees received 834

Membership revenue recognized (784)

Deferred revenue January 31, 2003 $ 437

SAM’S CLUB membership revenue is included in the other income line in the revenues section of the consolidated

statements of income.

The Company’s deferred revenue is included in accrued liabilities in the consolidated balance sheet. The Company’s

analysis of historical membership fee refunds indicates that such refunds have been insignificant. Accordingly, no reserve

exists for membership fee refunds at January 31, 2003.

Cost of Sales

Cost of sales includes actual product cost, change in inventory, buying allowances received from our suppliers, the

cost of transportation to the Company’s warehouses from suppliers and the cost of transportation from the Company’s

warehouses to the stores and Clubs and the cost of warehousing for our SAM’S CLUB segment.

35