Walmart 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

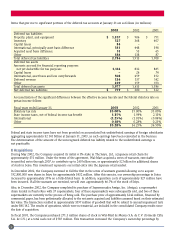

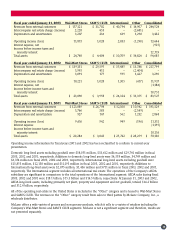

Items that give rise to significant portions of the deferred tax accounts at January 31 are as follows (in millions):

2003 2002 2001

Deferred tax liabilities

Property, plant, and equipment $ 1,357 $ 906 $ 751

Inventory 527 368 407

Capital leases 34 ––

International, principally asset basis difference 581 448 398

Acquired asset basis difference 51 53 65

Other 186 138 87

Total deferred tax liabilities 2,736 1,913 1,708

Deferred tax assets

Amounts accrued for financial reporting purposes

not yet deductible for tax purposes 1,114 832 865

Capital leases –26 74

International, asset basis and loss carryforwards 508 459 352

Deferred revenue 136 137 142

Other 219 159 153

Total deferred tax assets 1,977 1,613 1,586

Net deferred tax liabilities $ 759 $ 300 $ 122

A reconciliation of the significant differences between the effective income tax rate and the federal statutory rate on

pretax income follows:

Fiscal years ended January 31, 2003 2002 2001

Statutory tax rate 35.00% 35.00% 35.00%

State income taxes, net of federal income tax benefit 1.35% 1.98% 2.13%

International (1.25%) (1.01%) (0.84%)

Other 0.18% 0.28% 0.21%

35.28% 36.25% 36.50%

Federal and state income taxes have not been provided on accumulated but undistributed earnings of foreign subsidiaries

aggregating approximately $2.141 billion at January 31, 2003, as such earnings have been reinvested in the business.

The determination of the amount of the unrecognized deferred tax liability related to the undistributed earnings is

not practicable.

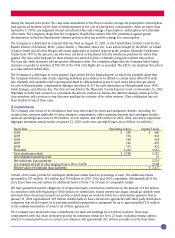

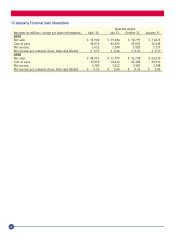

6 Acquisitions

During May 2002, the Company acquired its initial 6.1% stake in The Seiyu, Ltd., a Japanese retail chain for

approximately $51 million. Under the terms of the agreement, Wal-Mart acquired a series of warrants, exercisable

in specified series through 2007, to contribute up to 260 billion yen, or approximately $2 billion for additional shares

of stock in Seiyu. This investment represents our initial entry into the Japanese retail market.

In December 2002, the Company exercised in full the first in the series of warrants granted allowing us to acquire

192,800,000 new shares in Seiyu for approximately $432 million. After this exercise, our ownership percentage in Seiyu

increased to approximately 35% on a fully diluted basis. In addition, acquisition costs of approximately $27 million have

been incurred. If all the warrants are exercised, we will own approximately 66.7% of the stock of Seiyu.

Also, in December 2002, the Company completed its purchase of Supermercados Amigo, Inc. (Amigo), a supermarket

chain located in Puerto Rico with 37 supermarkets; four of these supermarkets were subsequently sold, and two of these

supermarkets are currently in the process of being sold. The purchase price of approximately $242 million, financed by

commercial paper, has been preliminarily allocated to the net assets acquired and liabilities assumed based on their estimated

fair value. The transaction resulted in approximately $197 million of goodwill that will be subject to annual impairment tests

under FAS 142. The results of operations, which were not material, are included in the consolidated Company results since

the date of acquisition.

In fiscal 2001, the Company purchased 271.3 million shares of stock in Wal-Mart de Mexico S.A. de C.V. (formerly Cifra

S.A. de C.V.) at a total cash cost of $587 million. This transaction increased the Company’s ownership percentage by

44