Walmart 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 Summary of Significant Accounting Policies

Consolidation

The consolidated financial statements include the accounts of subsidiaries. Significant intercompany transactions have

been eliminated in consolidation.

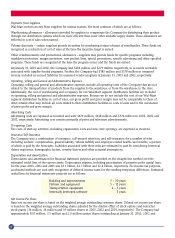

Cash and Cash Equivalents

The Company considers investments with a maturity of three months or less when purchased to be cash equivalents.

The majority of payments due from banks for customer credit card transactions process within 24-48 hours. All credit

card transaction that process in less than seven days are classified as cash and cash equivalents. Amounts due from banks

for credit card transactions that were classified as cash totaled $276 million and $173 million at January 31, 2003

and 2002, respectively.

Receivables

Accounts receivable consist primarily of trade receivables from customers of our McLane subsidiary, receivables from

insurance companies generated by our pharmacy sales, receivables from real estate transactions and receivables from

suppliers for marketing or incentive programs. Additionally, amounts due from banks for customer credit card

transactions that take in excess of seven days to process are classified as accounts receivable.

Inventories

The Company uses the retail last-in, first-out (LIFO) method for general merchandise within the Wal-Mart Stores

segment, cost LIFO for the SAM’S CLUB segment and grocery items within the Wal-Mart Stores segment, and other

cost methods, including the retail first-in, first-out (FIFO) and average cost methods, for the International segment.

Inventories are not recorded in excess of market value.

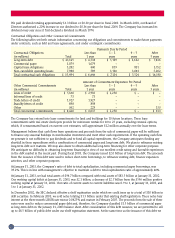

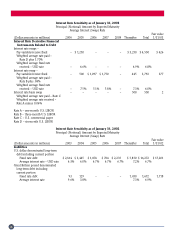

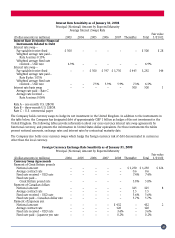

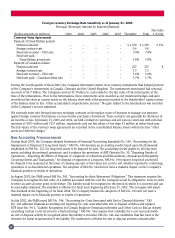

Financial Instruments

The Company uses derivative financial instruments for purposes other than trading to reduce its exposure to fluctuations

in foreign currencies and to minimize the risk and cost associated with financial and global operating activities. Generally,

contract terms of a hedge instrument closely mirror those of the hedged item providing a high degree of risk reduction

and correlation. Contracts that are highly effective at meeting the risk reduction and correlation criteria are recorded

using hedge accounting. On February 1, 2001, the Company adopted Financial Accounting Standards Board (FASB)

Statements No. 133, 137 and 138 (collectively “FAS 133”) pertaining to the accounting for derivatives and hedging

activities. FAS 133 requires all derivatives to be recorded on the balance sheet at fair value and establishes accounting

treatment for three types of hedges. If a derivative instrument is a hedge, depending on the nature of the hedge, changes

in the fair value of the instrument will either be offset against the change in fair value of the hedged assets, liabilities, or

firm commitments through earnings or recognized in other comprehensive income until the hedged item is recognized

in earnings. The ineffective portion of an instrument’s change in fair value will be immediately recognized in earnings.

Instruments that do not meet the criteria for hedge accounting or contracts for which the Company has not elected hedge

accounting, are marked to fair value with unrealized gains or losses reported currently in earnings. At January 31, 2001,

the majority of the Company’s derivatives were hedges of net investments in foreign operations, and as such, the fair

value of these derivatives had already been recorded on the balance sheet as either assets or liabilities and in other

comprehensive income under the current accounting guidance. As the majority of the Company’s derivative portfolio

was already recorded on the balance sheet, the adoption of FAS 133 did not have a material impact on the Company’s

consolidated financial statements taken as a whole.

Interest During Construction

For interest costs to properly reflect only that portion relating to current operations, interest on borrowed funds

during the construction of property, plant and equipment is capitalized. Interest costs capitalized were $124 million,

$130 million, and $93 million in 2003, 2002 and 2001, respectively.

Long-lived Assets

The Company periodically reviews long-lived assets, if indicators of impairments exist and if the value of the assets is

impaired, an impairment loss would be recognized.

Goodwill and Other Acquired Intangible Assets

Following the adoption of FAS 142, see the new accounting pronouncements section of this note, goodwill is not

amortized, instead it is evaluated for impairment annually. Other acquired intangible assets are amortized on a straight-

line basis over the periods that expected economic benefits will be provided. The realizability of other intangible assets is

34