Walmart 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

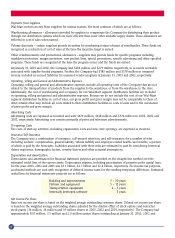

The Company has agreed to observe certain covenants under the terms of its note agreements, the most restrictive of

which relates to amounts of additional secured debt and long-term leases.

The Company has entered into sale/leaseback transactions involving buildings while retaining title to the underlying

land. These transactions were accounted for as financings and are included in long-term debt and the annual maturities

schedules above. The resulting obligations are amortized over the lease terms. Future minimum lease payments for each

of the five succeeding years as of January 31, 2003, are (in millions):

Fiscal Year Ended January 31, Minimum Payments

2004 $ 59

2005 75

2006 60

2007 58

2008 55

Thereafter 230

At January 31, 2003 and 2002, the Company had trade letters of credit outstanding totaling $1,927 million and

$1,578 million, respectively. At January 31, 2003 and 2002, the Company had standby letters of credit outstanding

totaling $898 million and $743 million, respectively. These letters of credit were issued primarily for the purchase

of inventory.

In December 2002, the Securities and Exchange Commission declared effective a shelf registration statement under

which the Company may issue up to a total of $10 billion in debt securities. In February 2003, we sold notes totaling

$1.5 billion under that shelf registration statement. These notes bear interest at the three-month LIBOR rate minus

0.0425% and mature in February 2005. The proceeds from the sale of these notes were used to reduce commercial paper

debt and, therefore, the Company classified $1.5 billion of commercial paper as long-term debt on the January 31, 2003

balance sheet. After consideration of this debt issuance, we are permitted to sell up to $8.5 billion of public debt under

our shelf registration statement. Contemporaneously with the issuance of this debt we entered into an interest rate swap

with a notional amount of $1.5 billion. Under the terms of this swap we will pay interest at a fixed rate of 1.915% and

receive interest at the three-month LIBOR rate minus 0.0425%. This swap will mature in February 2005.

3 Financial Instruments

The Company uses derivative financial instruments for hedging and non-trading purposes to manage its exposure to

interest and foreign exchange rates. Use of derivative financial instruments in hedging programs subjects the Company

to certain risks, such as market and credit risks. Market risk represents the possibility that the value of the derivative

instrument will change. In a hedging relationship, the change in the value of the derivative is offset to a great extent by

the change in the value of the underlying hedged item. Credit risk related to derivatives represents the possibility that the

counterparty will not fulfill the terms of the contract. Credit risk is monitored through established approval procedures,

including setting concentration limits by counterparty, reviewing credit ratings and requiring collateral (generally cash)

when appropriate. The majority of the Company’s transactions are with counterparties rated A or better by nationally

recognized credit rating agencies.

Adoption of FASB 133

On February 1, 2001, the Company adopted Financial Accounting Standards Board Statement No. 133, “Accounting

for Derivative and Hedging Activities” (FAS 133), as amended. Because most of the derivatives used by the Company at

the date of adoption were designated as net investment hedges, the fair value of these instruments was included in the

balance sheet prior to adoption of the standard. As a result, the adoption of this standard did not have a significant effect

on the consolidated financial statements of the Company.

Fair Value Instruments

The Company enters into interest rate swaps to minimize the risks and costs associated with its financing activities. Under

the swap agreements, the Company pays variable rate interest and receives fixed interest rate payments periodically over

the life of the instruments. The notional amounts are used to measure interest to be paid or received and do not represent

the exposure due to credit loss. All of the Company’s interest rate swaps are designated as fair value hedges. In a fair value

hedge, the gain or loss on the derivative instrument as well as the offsetting gain or loss on the hedged item attributable

to the hedged risk are recognized in earnings in the current period. Ineffectiveness results when gains and losses on the

40