Walmart 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

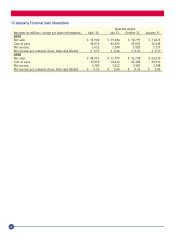

Income tax benefit recorded as a result of the tax deductions triggered by employee exercise of stock options amounted to

$84 million, $106 million and $118 million in fiscal 2003, 2002 and 2001, respectively.

8 Litigation

The Company is involved in a number of legal proceedings, including antitrust, consumer, employment, tort, and

other litigation. The lawsuits discussed below, which are among the matters pending against the Company, if decided

adversely, may result in liability material to the Company’s consolidated financial statements. The Company may enter

into discussions regarding settlement of certain cases, and may enter into settlement agreements, if it believes settlement

is in the best interests of the Company’s Shareholders.

The Company is a defendant in thirty-three putative class action lawsuits, in thirty-one states, in which the plaintiffs

allege that the Company violated the Fair Labor Standards Act, corresponding state laws, or both. The plaintiffs are hourly

associates who allege, among other things, that the Company forced them to work “off the clock” and failed to provide

work breaks. The complaints generally seek unspecified actual damages, injunctive relief, or both. Class certification

has been addressed in six cases: in Texas, Ohio, Louisiana and Michigan the trial or appellate courts have denied class

certification. In Oregon a Federal Court has denied statewide certification as to state contract claims but allowed a limited

class of opt-in plaintiffs to proceed with Fair Labor Standards Act and state statutory claims. A state-wide class was

certified in Colorado, but the Order was vacated after settlement. The California Department of Labor Standards

Enforcement has initiated an investigation of Wal-Mart and SAM’S CLUB for alleged failures to comply with California

Wage and Hour laws.

The Company is a defendant in five putative class actions brought by Associates who challenge their exempt status under

the Fair Labor Standards Act, and allege that the Company failed to pay overtime as required by the Act. Three cases

regarding SAM’S CLUB managers are pending in California state court. One case regarding store assistant managers is

pending in federal court in Michigan. One case regarding Home Office managers is pending in federal court in Arkansas.

No determination has been made as to certification in these cases.

The Company is a defendant in three putative class action lawsuits brought on behalf of pharmacists who allege, among

other things, that the Company failed to pay overtime in violation of the Fair Labor Standards Act or in breach of

contract. The complaints seek actual damages, injunctive relief, or both. In each of these cases, the trial court has certified

a class. Trial is set for June 3, 2003, in one of the cases and August 4, 2003, in another.

The Company is a defendant in Dukes v. Wal-Mart Stores, Inc., a putative class action lawsuit pending in the United

States District Court for the Northern District of California. The case was brought on behalf of all past and present

female employees in all of the Company’s retail stores and wholesale clubs in the United States. The complaint alleges

that the Company has a pattern and practice of discriminating against women in promotions, pay, training, and job

assignments. The complaint seeks, among other things, injunctive relief, compensatory damages including front pay

and back pay, punitive damages, and attorney fees. Class certification has not yet been decided, and we cannot predict

whether a class will be certified and, if a class is certified, the geographic or other scope of such a class. If the Court

certifies a class in this action and there is an adverse verdict on the merits, the Company may be subject to liability for

damages that could be material to the Company and to employment-related injunctive measures that could

be material to the Company and result in increased costs of operations on an ongoing basis.

The Company is a defendant in three putative class action lawsuits in Texas, one in New Hampshire, and one in

Oklahoma. In each of the lawsuits, the plaintiffs seek a declaratory judgment that Wal-Mart and the other defendants

who purchased Corporate Owned Life Insurance (COLI) policies lack an insurable interest in the lives of the class-

members, who were the insureds under the policies, and seek to recover the proceeds of the policies under theories of

unjust enrichment and constructive trust. In some of the suits the plaintiffs attempt to state claims for alleged violations

of their privacy rights, as well as various other causes of action, and assert they are entitled to punitive damages. In

August 2002, the court in the lead Texas lawsuit denied the Company’s motion for summary judgment, and granted

partial summary judgment, in favor of the plaintiffs on certain issues. The Texas litigation has been stayed while the

Fifth Circuit Court of Appeals reviews these rulings. Class certification has not been decided in any of these cases.

The Company is a defendant in Lisa Smith Mauldin v. Wal-Mart Stores, Inc. a lawsuit that was filed on October 16, 2001,

in the United States District Court for the Northern District of Georgia, Atlanta Division. The lawsuit was certified by the

court as a class action on August 30, 2002. The class is composed of female Wal-Mart Associates who were participants in

the Associates Health and Welfare Plan from March 8, 2001 to the present and who were using prescription contraceptives

46