Walmart 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

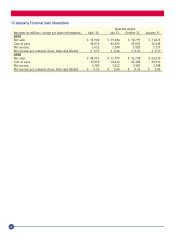

Fair Value of Financial Instruments

Instrument Notional Amount Fair Value

(amounts in millions) 1/31/2003 1/31/2002 1/31/2003 1/31/2002

Derivative financial instruments designated for hedging:

Receive fixed rate, pay floating rate interest rate swaps

designated as fair value hedges $ 8,292 $ 3,792 $ 803 $172

Receive fixed rate, pay fixed rate cross-currency interest

rate swaps designated as net investment hedges

(FX notional amount: GBP 795 at 1/31/2003

and 2002) 1,250 1,250 126 192

Receive fixed rate, pay fixed rate cross-currency interest

rate swap designated as cash flow hedge (FX notional

amount: CAD 503 at 1/31/2003 and 2002) 325 325 88

Receive fixed rate, pay fixed rate cross-currency interest

rate swap designated as cash flow hedge (FX notional

amount: JPY 52,056 at 1/31/2003 and 2002) 432 –2–

10,299 5,367 939 372

Derivative financial instruments not designated for hedging:

Foreign currency exchange forward contracts

(various currencies) 185 117 ––

Basis swap 500 500 21

685 617 21

Non-derivative financial instruments:

Long-term debt 21,145 17,944 20,464 18,919

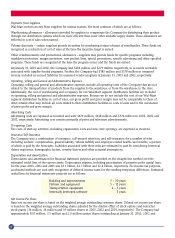

Cash and cash equivalents: The carrying amount approximates fair value due to the short maturity of these instruments.

Long-term debt: Fair value is based on the Company’s current incremental borrowing rate for similar types of borrowing

arrangements.

Interest rate instruments and net investment instruments: The fair values are estimated amounts the Company would receive

or pay to terminate the agreements as of the reporting dates.

Foreign currency contracts: The fair value of foreign currency contracts are estimated by obtaining quotes from external

sources.

42