Walmart 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

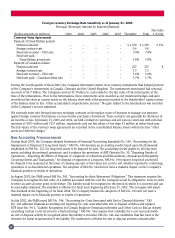

entered into an interest rate swap with a notional amount of $1.5 billion. Under the terms of this swap we will pay interest

at a fixed rate of 1.915% and receive interest at the three-month LIBOR rate minus 0.0425%. This swap will mature in

February 2005.

Future Expansion

In the United States, we plan to open approximately 45 to 55 new Wal-Mart stores and approximately 200 to 210 new

Supercenters in fiscal 2004. Relocations or expansions of existing discount stores will account for approximately 140 of

the new Supercenters, with the balance being new locations. We also plan to further expand our Neighborhood Market

concept by adding approximately 20 to 25 new units during fiscal 2004. The SAM’S CLUB segment plans to open 40 to

45 Clubs during fiscal 2004, approximately two-thirds of which will be relocations or expansions of existing Clubs. The

SAM’S CLUB segment will also continue its remodeling program. In order to serve these and future developments, the

Company plans to construct six new distribution centers in the next fiscal year. Internationally, the Company plans to

open 120 to 130 new units. Projects scheduled to open within the International segment include new stores and Clubs as

well as relocations of a few existing units in existing markets. The units also include restaurants, specialty apparel retail

stores and supermarkets in Mexico. The Company also currently owns 35% of the equity interests (on a dilutive basis) in

The Seiyu Ltd. Additionally, we have the ability to acquire additional ownership in Seiyu and could increase our ownership

to 66.7% over time. Total planned capital expenditures for fiscal 2004 approximate $11.5 billion. We plan to finance

expansion primarily out of cash flow and with a combination of commercial paper and the issuance of long-term debt.

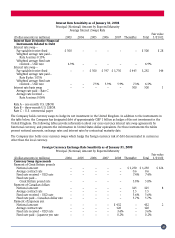

Market Risk

Market risks relating to our operations include changes in interest rates and changes in foreign exchange rates. We

enter into interest rate swaps to minimize the risk and costs associated with financing activities, as well as to attain an

appropriate mix of fixed and floating rate debt. The swap agreements are contracts to exchange fixed or variable rates

for variable or fixed interest rate payments periodically over the life of the instruments. The following tables provide

information about our derivative financial instruments and other financial instruments that are sensitive to changes in

interest rates. For debt obligations, the table presents principal cash flows and related weighted-average interest rates by

expected maturity dates. For interest rate swaps, the table presents notional amounts and interest rates by contractual

maturity dates. The applicable floating rate index is included for variable rate instruments. All amounts are stated in

United States dollar equivalents.

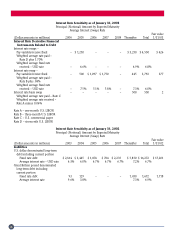

Interest Rate Sensitivity as of January 31, 2003

Principal (Notional) Amount by Expected Maturity

Average Interest (Swap) Rate Fair value

(Dollar Amounts in Millions) 2004 2005 2006 2007 2008 Thereafter Total 1/31/03

Liabilities

U.S. dollar denominated long-term

debt including current portion

Fixed rate debt $ 4,529 $ 2,290 $ 2,755 $ 2,019 $ 1,576 $ 6,201 $ 19,370 $ 18,604

Average interest rate – USD rate 5.4% 6.4% 6.0% 6.2% 6.6% 6.9% 6.3%

Great Britain pound denominated

long-term debt including

current portion

Fixed rate debt 9 94 – 37 – 1,635 1,775 1,860

Average interest rate 9.6% 4.4% 8.4% 5.2% 5.2%

25