Walmart 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

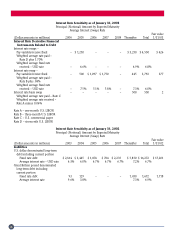

Interest Rate Sensitivity as of January 31, 2002

Principal (Notional) Amount by Expected Maturity

Average Interest (Swap) Rate Fair value

(Dollar amounts in millions) 2003 2004 2005 2006 2007 Thereafter Total 1/31/02

Interest Rate Derivative Financial

Instruments Related to Debt

Interest rate swap –

Pay variable/receive fixed $ 500 – – – – – $ 500 $ 28

Weighted average rate paid –

Rate A minus 0.15%

Weighted average fixed rate

received – USD rate 6.9% – – – – – 6.9%

Interest rate swap –

Pay variable/receive fixed – – $ 500 $ 597 $ 1,750 $ 445 3,292 144

Weighted average rate paid –

Rate B plus 1.01%

Weighted average fixed rate

received – USD rate – – 7.5% 5.9% 5.9% 7.3% 6.3%

Interest rate basis swap – – – – – 500 500 1

Average rate paid – Rate C

Average rate received –

Rate A minus 0.06%

Rate A – one-month U.S. LIBOR

Rate B – three-month U.S. LIBOR

Rate C – U.S. commercial paper

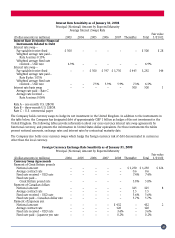

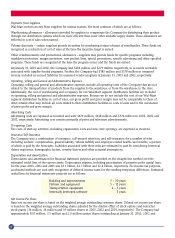

The Company holds currency swaps to hedge its net investment in the United Kingdom. In addition to the instruments in

the table below, the Company has designated debt of approximately GBP 1 billion as hedges of the net investment in the

United Kingdom. The following tables provide information about our cross-currency interest rate swap agreements by

functional currency, and presents the information in United States dollar equivalents. For these instruments the tables

present notional amounts, exchange rates and interest rates by contractual maturity date.

The Company also holds cross currency swaps which hedge the foreign currency risk of debt denominated in currencies

other than the local currency.

Foreign Currency Exchange Rate Sensitivity as of January 31, 2003

Principal (Notional) Amount by Expected Maturity Fair value

(Dollar amounts in millions) 2004 2005 2006 2007 2008 Thereafter Total 1/31/03

Currency Swap Agreements

Payment of Great Britain pounds

Notional amount – – – – – $ 1,250 $ 1,250 $ 126

Average contract rate – – – – – 0.6 0.6

Fixed rate received – USD rate – – – – – 7.4% 7.4%

Fixed rate paid –

Great Britain pound rate – – – – – 5.8% 5.8%

Payment of Canadian dollars

Notional amount – – – – – 325 325 8

Average contract rate – – – – – 1.5 1.5

Fixed rate received – USD rate – – – – – 5.6% 5.6%

Fixed rate paid – Canadian dollar rate – – – – – 5.7% 5.7%

Payment of Japanese yen

Notional amount – – – – $ 432 – 432 2

Average contract rate – – – – 120 – 120

Fixed rate received – USD rate – – – – 3.6% – 3.6%

Fixed rate paid – Japanese yen rate – – – – 0.2% – 0.2%

27