Walmart 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

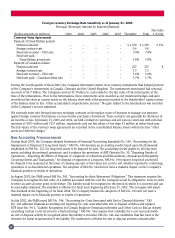

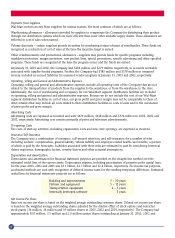

December 31, 2002. The Company believes the adoption of FAS No. 146, which will occur in fiscal 2004, will not have a

material impact on its financial position or results of operations.

In November, 2002, the FASB’s Emerging Issues Task Force (EITF) reached a consensus on EITF 02-16 “Accounting by

a Reseller for Cash Consideration Received from a Vendor”, which addresses the accounting for ‘Cash Consideration’

(which includes slotting fees, cooperative advertising payments etc.) and ‘Rebates or Refunds’ from a vendor that are

payable only if the merchant completes a specified cumulative level of purchases or remains a customer of the vendor

for a specified period of time. With regards to the ‘cash considerations,’ the EITF agreed that the consideration should

be treated as a reduction of the prices of the vendor products or services and should therefore be included as a reduction

of cost of sales unless the vendor receives, or will receive, an identifiable benefit in exchange for the consideration. With

respect to the accounting for a rebate or refund, the EITF agreed that such refunds or rebates should be recognized as

a reduction of the cost of sales based on a systematic and rational allocation of the consideration to be received. This

guidance should be applied prospectively to arrangements entered into after December 15, 2002. The Company is

currently evaluating the impact of this new guidance which will be applied in the first quarter of fiscal 2004.

The Company has various stock option compensation plans for Associates. The Company currently accounts for those

plans under the recognition and measurement provisions of APB Opinion No. 25, “Accounting for Stock Issued to

Employees,” and related interpretations. Historically, no significant stock-based employee compensation has been

recognized under APB Opinion No. 25. In August 2002, the Company announced that on February 1, 2003, it will adopt

the expense recognition provisions of the Financial Accounting Standards Board Statement No. 123, “Accounting and

Disclosure of Stock-Based Compensation” (“FAS 123”). Under FAS 123, compensation expense is recognized based on

the fair value of stock options granted. The Company has chosen to retroactively restate its results of operations for this

accounting change. The adoption of the fair value method will result in a reduction of retained earnings at that date of

$348 million, representing the cumulative stock option compensation recorded for prior years net of the tax effect. The

Company’s estimates that the impact of changing the accounting method for the adoption of FAS 123 will have an

impact of $0.02 to $0.03 per share in the year of adoption.

Forward-Looking Statements

This Annual Report contains statements that Wal-Mart believes are “forward-looking statements” within the meaning

of the Private Securities Litigation Reform Act of 1995, and intended to enjoy the protection of the safe harbor for

forward-looking statements provided by that Act. These forward-looking statements generally can be identified by use of

phrases such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee” or other similar words or phrases. Similarly,

descriptions of our objectives, strategies, plans, goals or targets are also forward-looking statements. These statements

discuss, among other things, expected growth, future revenues, future cash flows, future performance and the anticipation

and expectations of Wal-Mart and its management as to future occurrences and trends. These forward-looking statements

are subject to risks, uncertainties and other factors, in the United States and internationally, including, the cost of goods,

competitive pressures, inflation, consumer spending patterns and debt levels, currency exchange fluctuations, trade

restrictions, changes in tariff and freight rates, interest rate fluctuations and other capital market conditions, and other

risks. We discuss certain of these matters more fully in other of our filings with the SEC, including our Annual Report on

Form 10-K. We filed our Annual Report on Form 10-K for our fiscal year 2003 with the SEC on or about April 11, 2003.

Actual results may materially differ from anticipated results described in these statements as a result of changes in facts,

assumptions not being realized or other circumstances. You are urged to consider all of these risks, uncertainties and other

factors carefully in evaluating the forward-looking statements. As a result of these matters, including changes in facts,

assumptions not being realized or other circumstances, our actual results may differ materially from historical results

or from anticipated results expressed or implied in these forward-looking statements. The forward-looking statements

included in this Annual Report are made only as of the date of this report and we undertake no obligation to update these

forward-looking statements to reflect subsequent events or circumstances.

29