Walmart 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2001, respectively, that were not included in the dilutive earnings per share calculation because the effect would have

been antidilutive.

Estimates and Assumptions

The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires

management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets

and liabilities. They also affect the disclosure of contingent assets and liabilities at the date of the consolidated financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ

from those estimates.

Stock-based Compensation

The Company has various stock option compensation plans for Associates. The Company currently accounts for those

plans under the recognition and measurement provisions of APB Opinion No. 25, “Accounting for Stock Issued to

Employees,” and related interpretations. Historically, no significant stock-based employee compensation has been

recognized under APB Opinion No. 25. In August 2002, the Company announced that on February 1, 2003, it will adopt

the expense recognition provisions of the Financial Accounting Standards Board Statement No. 123, “Accounting and

Disclosure of Stock-Based Compensation” (“FAS 123”). Under FAS 123, compensation expense is recognized based on

the fair value of stock options granted. The Company has chosen to retroactively restate its results of operations for this

accounting change. The adoption of the fair value method will result in a reduction of retained earnings at that date of

$348 million, representing the cumulative stock option compensation recorded for prior years net of the tax effect. The

Company’s estimates that the impact of changing the accounting method for the adoption of FAS 123 will have an

impact of $0.02 to $0.03 per share in the year of adoption.

Pro forma information, regarding net income and income per share is required by FAS Statement 123, “Accounting for

Stock-Based Compensation,” (FAS No. 123) and has been determined as if the Company had accounted for its employee

stock option plans granted since February 1, 1995 under the fair value method of that statement.

The effect of applying the fair value method of FAS No. 123 to the stock option grants subsequent to February 1, 1995,

results in the following net income and net income per share (amounts in millions except per share data):

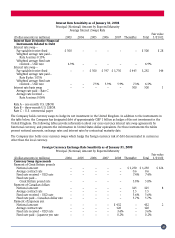

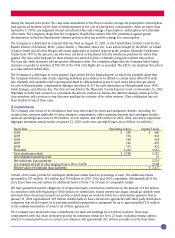

Fiscal Years Ended January 31, 2003 2002 2001

Net income as reported $ 8,039 $ 6,671 $ 6,295

Less total stock-based employee compensation

expense determined under fair value based method

for all awards, net of related tax effects (84) (79) (60)

Pro forma net income 7,955 6,592 6,235

Pro forma earnings per share – basic $ 1.80 $ 1.48 $ 1.40

Pro forma earnings per share – dilutive $ 1.79 $ 1.47 $ 1.39

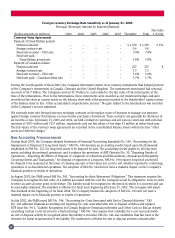

The fair value of these options was estimated at the date of the grant using the Black-Scholes option pricing model with

the following assumption ranges: risk-free interest rates between 2.5% and 7.2%, dividend yields between 0.4% and

1.3%, volatility factors between 0.23 and 0.41, and an expected life of the option of 7.4 years for the options issued

prior to November 17, 1995, and 3 to 7 years for options issued thereafter.

The Black-Scholes option valuation model was developed for use in estimating the fair value of traded options, which

have no vesting restrictions and are fully transferable. In addition, option valuation methods require the input of highly

subjective assumptions including the expected stock price volatility. Using the Black-Scholes option evaluation model, the

weighted average value of options granted during the years ended January 31, 2003, 2002, and 2001, were $18, $24, and

$22, per option, respectively.

New Accounting Pronouncements

On February 1, 2002, the Company adopted Financial Accounting Standards Board Statements of Financial Accounting

Standards No. 141, “Business Combinations” (“FAS 141”), and No. 142, “Goodwill and Other Intangible Assets” (“FAS

142”). Under FAS 142, goodwill and intangible assets deemed to have indefinite lives are no longer amortized but are

subject to annual impairment reviews. The following tables adjust certain information for fiscal 2002 and 2001, as if the

37