Walmart 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

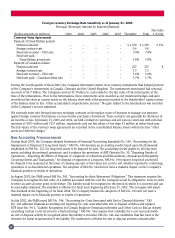

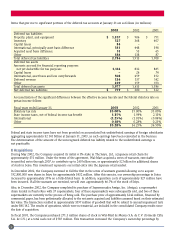

non-amortization provisions of FAS 142 had been in place at that time and compares that adjusted information to the

comparable information for fiscal 2003:

Net Income Basic Earnings Diluted Earnings

(in Millions) Per Share Per Share

2003 2002 2001 2003 2002 2001 2003 2002 2001

As reported $ 8,039 $ 6,671 $ 6,295 $ 1.81 $ 1.49 $ 1.41 $ 1.81 $ 1.49 $ 1.40

Add back: Goodwill amortization

(net of $11 million tax impact

in each of fiscal 2002 and 2001) –235 235 –0.06 0.05 –0.05 0.05

As adjusted $ 8,039 $ 6,906 $6,530 $ 1.81 $ 1.55 $ 1.46 $ 1.81 $ 1.54 $ 1.45

During fiscal 2003, the Company adopted FAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived

Assets.” FAS No. 144 develops an accounting model, based upon the framework established in FAS No. 121, for long-lived

assets to be disposed by sales. The accounting model applies to all long-lived assets, including discontinued operations,

and it replaces the provisions of ABP Opinion No. 30, “Reporting Results of Operations – Reporting the Effects of

Disposal of a Segment of a Business and Extraordinary, Unusual and Infrequently Occurring Events and Transactions,”

for disposal of segments of a business. FAS No. 144 requires long-lived assets held for disposal to be measured at the

lower of carrying amount or fair values less costs to sell, whether reported in continuing operations or in discontinued

operations. The adoption of FAS No. 144 did not have a material impact on the Company’s financial position or results

of operations.

In August 2001, the FASB issued FAS No. 143, “Accounting for Asset Retirement Obligations.” This statement requires

the Company to recognize the fair value of a liability associated with the cost the Company would be obligated to incur in

order to retire an asset at some point in the future. The liability would be recognized in the period in which it is incurred

and can be reasonably estimated. The standard is effective for fiscal years beginning after June 15, 2002. The Company

will adopt this standard at the beginning of its fiscal 2004. The Company believes the adoption of FAS No. 143 will not

have a material impact on its financial position or results of operations.

In July 2002, the FASB issued FAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities.” FAS

No. 146 addresses financial accounting and reporting for costs associated with exit or disposal activities and replaces

EITF Issue No. 94-3, “Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity

(including Certain Costs Incurred in a Restructuring).” FAS No. 146 requires that a liability for a cost associated with an

exit or disposal activity be recognized when the liability is incurred. FAS No. 146 also establishes that fair value is the

objective for initial measurement of the liability. The statement is effective for exit or disposal activities initiated after

December 31, 2002. The Company believes the adoption of FAS No. 146, which will occur in fiscal 2004, will not have

a material impact on its financial position or results of operations.

In November 2002, the FASB’s Emerging Issues Task Force (EITF) reached a consensus on EITF 02-16 “Accounting by

a Reseller for Cash Consideration Received from a Vendor,” which addresses the accounting for ‘Cash Consideration’

(which includes slotting fees, cooperative advertising payments etc.) and ‘Rebates or Refunds’ from a vendor that are

payable only if the merchant completes a specified cumulative level of purchases or remains a customer of the vendor

for a specified period of time. With regards to the ‘cash considerations,’ the EITF agreed that the consideration should

be treated as a reduction of the prices of the vendor products or services and should therefore be included as a reduction

of cost of sales unless the vendor receives, or will receive, an identifiable benefit in exchange for the consideration. With

respect to the accounting for a rebate or refund again, the EITF agreed that such refunds or rebates should be recognized

as a reduction of the cost of sales based on a systematic and rational allocation of the consideration to be received. This

guidance should be applied prospectively to arrangements entered into after December 15, 2002. The Company is

currently evaluating the impact of this new guidance which will be applied in the first quarter of fiscal 2004.

Reclassifications

Certain reclassifications have been made to prior periods to conform to current presentations.

38