Walmart 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

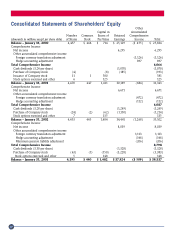

We paid dividends totaling approximately $1.3 billion or $0.30 per share in fiscal 2003. In March 2003, our Board of

Directors authorized a 20% increase in our dividend to $0.36 per share for fiscal 2004. The Company has increased its

dividend every year since it first declared a dividend in March 1974.

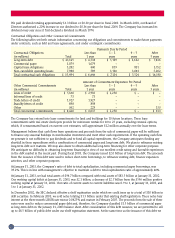

Contractual Obligations and Other Commercial Commitments

The following tables set forth certain information concerning our obligations and commitments to make future payments

under contracts, such as debt and lease agreements, and under contingent commitments.

Payments Due by Period

Contractual Obligations Less than 1 – 3 4 – 5 After

(in millions) Total 1 year years years 5 years

Long-term debt $ 21,145 $ 4,538 $ 5,139 $ 3,632 $ 7,836

Commercial paper 1,079 1,079 – – –

Capital lease obligations 5,282 440 859 831 3,152

Non-cancelable operating leases 7,988 589 1,136 1,061 5,202

Total contractual cash obligations $ 35,494 $ 6,646 $ 7,134 $ 5,524 $ 16,190

Amount of Commitment Expiration Per Period

Other Commercial Commitments Less than 1 – 3 4 – 5 After

(in millions) Total 1 year years years 5 years

Lines of credit $ 5,160 $ 2,910 $ 2,250 $ – $ –

Informal lines of credit 73 73 – – –

Trade letters of credit 1,927 1,927 – – –

Standby letters of credit 898 898 – – –

Other 362 229 – – 133

Total commercial commitments $ 8,420 $ 6,037 $ 2,250 $ – $ 133

The Company has entered into lease commitments for land and buildings for 10 future locations. These lease

commitments with real estate developers provide for minimum rentals for 10 to 25 years, excluding renewal options,

which, if consummated based on current cost estimates, will approximate $12 million annually over the lease terms.

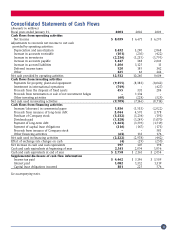

Management believes that cash flows from operations and proceeds from the sale of commercial paper will be sufficient

to finance any seasonal buildups in merchandise inventories and meet other cash requirements. If the operating cash flow

we generate is not sufficient to pay dividends and to fund all capital expenditures, the Company anticipates funding any

shortfall in these expenditures with a combination of commercial paper and long-term debt. We plan to refinance existing

long-term debt as it matures. We may also desire to obtain additional long-term financing for other corporate purposes.

We anticipate no difficulty in obtaining long-term financing in view of our excellent credit rating and favorable experiences

in the debt market in the recent past. During fiscal 2003, the Company issued $2.0 billion of long-term debt. The proceeds

from the issuance of this debt were used to reduce short-term borrowings, to refinance existing debt, finance expansion

activities, and other corporate purposes.

At January 31, 2003, the Company’s ratio of debt to total capitalization, including commercial paper borrowings, was

39.2%. This is in line with management’s objective to maintain a debt to total capitalization ratio of approximately 40%.

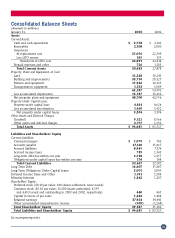

At January 31, 2003, we had total assets of $94.7 billion compared with total assets of $83.5 billion at January 31, 2002.

Our working capital deficit at January 31, 2003, was $2.1 billion, a decrease of $2.7 billion from the $596 million positive

working capital at January 31, 2002. Our ratio of current assets to current liabilities was 0.9 to 1, at January 31, 2003, and

1 to 1 at January 31, 2002.

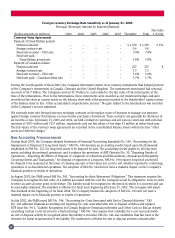

In December 2002, the SEC declared effective a shelf registration under which we could issue up to a total of $10 billion in

debt securities. In February 2003, we sold notes totaling $1.5 billion under that existing shelf registration. These notes bear

interest at the three-month LIBOR rate minus 0.0425% and mature in February 2005. The proceeds from the sale of these

notes were used to reduce commercial paper debt and, therefore, the Company classified $1.5 billion of commercial paper

as long-term debt on the January 31, 2003 balance sheet. After consideration of this debt issuance, we are permitted to sell

up to $8.5 billion of public debt under our shelf registration statement. At the same time as the issuance of this debt we

24