Walmart 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Commercial Paper and Long-term Debt

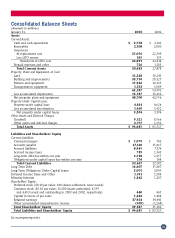

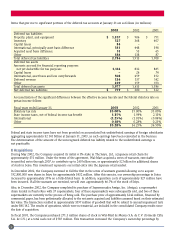

Information on short-term borrowings and interest rates is as follows (dollar amounts in millions):

Fiscal Years Ended January 31, 2003 2002 2001

Maximum amount outstanding at month-end $ 4,226 $ 4,072 $ 6,732

Average daily short-term borrowings 1,549 2,606 4,528

Weighted average interest rate 1.7% 3.7% 6.4%

At January 31, 2003 and 2002, short-term borrowings consisting of $1,079 million and $743 million of commercial

paper were outstanding, respectively. At January 31, 2003, the Company had committed lines of $5,160 million with

73 firms and banks and informal lines of credit with various banks totaling an additional $73 million, which were used

to support commercial paper.

Long-term debt at January 31, consists of (amounts in millions):

2003 2002

6.875% Notes due August 2009 $ 3,500 $ 3,500

various Notes due 2005 2,597 597

5.450% – 8.000% Notes due 2006 2,084 2,075

5.750% – 7.550% Notes due 2030 1,823 1,714

6.550% – 7.500% Notes due 2004 1,750 1,750

4.375% Notes due 2007 1,500 –

4.750% – 7.250% Notes due 2013 1,265 445

6.562% – 8.246% Obligations from sale/leaseback transactions due 2012-2015 338 580

8.500% Notes due 2024 250 250

6.750% Notes due 2023 250 250

3.250% – 6.50% Notes due 2003 –3,382

4.410% – 10.88% Notes acquired in ASDA acquisition due 2003-2015 122 797

Other, including adjustments to debt hedged by derivatives 1,128 347

$ 16,607 $ 15,687

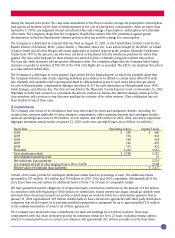

The Company has two separate issuances of $500 million debt with embedded put options. For the first issuance,

beginning June 2001, and each year thereafter, the holders of $500 million of the debt may require the Company to

repurchase the debt at face value, in addition to accrued and unpaid interest. The holders of the other $500 million

issuance may put the debt back to the Company at par plus accrued interest at any time. Both of these issuances have

been classified as a current liability in the January 31, 2003 consolidated balance sheet.

Long-term debt is unsecured except for $83 million, which is collateralized by property with an aggregate carrying value

of approximately $237 million. Annual maturities of long-term debt during the next five years are (in millions):

Fiscal Year Ended January 31, Annual Maturity

2004 $ 4,538

2005 2,384

2006 2,755

2007 2,056

2008 1,576

Thereafter 7,836

39