Walmart 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

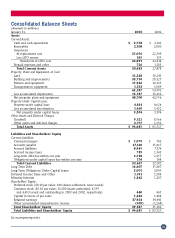

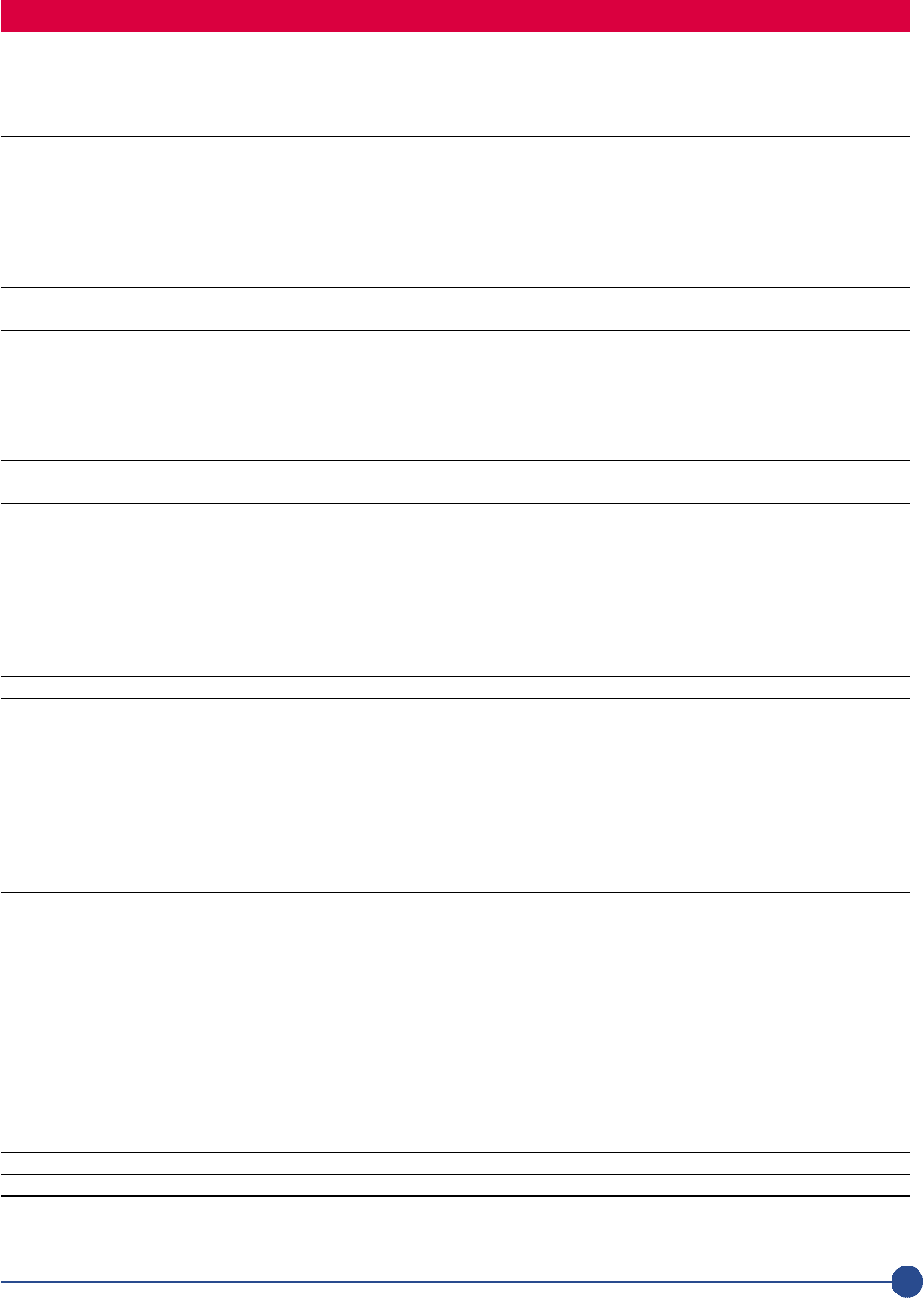

Consolidated Balance Sheets

(Amounts in millions)

January 31, 2003 2002

Assets

Current Assets:

Cash and cash equivalents $ 2,758 $ 2,161

Receivables 2,108 2,000

Inventories

At replacement cost 25,056 22,749

Less LIFO reserve 165 135

Inventories at LIFO cost 24,891 22,614

Prepaid expenses and other 726 1,103

Total Current Assets 30,483 27,878

Property, Plant and Equipment, at Cost:

Land 11,228 10,241

Building and improvements 33,750 28,527

Fixtures and equipment 15,946 14,135

Transportation equipment 1,313 1,089

62,237 53,992

Less accumulated depreciation 13,537 11,436

Net property, plant and equipment 48,700 42,556

Property Under Capital Lease:

Property under capital lease 4,814 4,626

Less accumulated amortization 1,610 1,432

Net property under capital leases 3,204 3,194

Other Assets and Deferred Charges:

Goodwill 9,521 8,566

Other assets and deferred charges 2,777 1,333

Total Assets $ 94,685 $ 83,527

Liabilities and Shareholders’ Equity

Current Liabilities:

Commercial paper $ 1,079 $743

Accounts payable 17,140 15,617

Accrued liabilities 8,945 7,174

Accrued income taxes 739 1,343

Long-term debt due within one year 4,538 2,257

Obligations under capital leases due within one year 176 148

Total Current Liabilities 32,617 27,282

Long-Term Debt 16,607 15,687

Long-Term Obligations Under Capital Leases 3,001 3,045

Deferred Income Taxes and Other 1,761 1,204

Minority Interests 1,362 1,207

Shareholders’ Equity:

Preferred stock ($0.10 par value; 100 shares authorized, none issued)

Common stock ($0.10 par value; 11,000 shares authorized, 4,395

and 4,453 issued and outstanding in 2003 and 2002, respectively) 440 445

Capital in excess of par value 1,482 1,484

Retained earnings 37,924 34,441

Other accumulated comprehensive income (509) (1,268)

Total Shareholders’ Equity 39,337 35,102

Total Liabilities and Shareholders’ Equity $ 94,685 $ 83,527

See accompanying notes.

31