Walmart 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

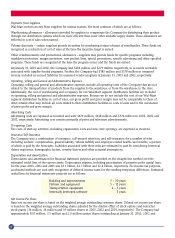

hedged item are not completely offset by gains and losses in the hedge instrument. No ineffectiveness was recognized in

fiscal 2003 related to these instruments. The fair value of these contracts is included in the balance sheet in the line titled

‘Other assets and deferred charges.’

Net Investment Instruments

At January 31, 2003, the Company is a party to cross-currency interest rate swaps that hedge its net investment in

the United Kingdom. The agreements are contracts to exchange fixed rate payments in one currency for fixed rate

payments in another currency. The Company also holds approximately GBP 1 billion of debt that is designated as hedges

of net investment.

During the fourth quarter of fiscal 2002, the Company terminated or sold cross currency instruments that hedged

portions of the Company’s investments in Canada, Germany and the United Kingdom. These instruments had notional

amounts of $6.7 billion. The Company received $1.1 billion in cash related to the fair value of the instruments at the

time of the terminations. Prior to the terminations, these instruments were classified as net investment hedges and had

been recorded at fair value as current assets on the balance sheet with a like amount recorded on the balance sheet

shareholders’ equity section in the line “other accumulated comprehensive income.” No gain related to the terminations

was recorded in the Company’s income statement. The fair value of these contracts is included in the balance sheet in the

line titled “Other assets and deferred charges.”

Cash Flow Hedge

The Company entered into a cross-currency interest rate swap to hedge the foreign currency risk of certain yen

denominated intercompany debt. The Company has entered into a cross-currency interest rate swap related to U.S. dollar

denominated debt securities issued by a Canadian subsidiary of the Company. These swaps are designated as cash flow

hedges of foreign currency exchange risk. No ineffectiveness was recognized during fiscal 2003 related to these

instruments. The Company expects that the amount of gain existing in other comprehensive income that is expected

to be reclassified into earnings within the next 12 months will not be significant. Changes in the foreign currency spot

exchange rate result in reclassification of amounts from other comprehensive income to earnings to offset transaction

gains or losses on foreign denominated debt. The fair value of these hedges are included in the balance sheet in the line

titled “Other assets and deferred charges.”

Instruments Not Designated for Hedging

The Company enters into forward currency exchange contracts in the regular course of business to manage its exposure

against foreign currency fluctuations on cross-border purchases of inventory. These contracts are generally for short

durations of six months or less. Although these instruments are economic hedges, the Company did not designate these

contracts as hedges as required in order to obtain hedge accounting. As a result, the Company marks the contracts to

market through earnings. The fair value of these contracts is included in the balance sheet in the line titled “Prepaid

expenses and other.”

41