Walmart 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our total cost of sales as a percentage of our total net sales increased for fiscal 2002 when compared to fiscal 2001,

resulting in an overall decrease in gross margin of 0.24% from 21.47% for fiscal 2001 to 21.23% in fiscal 2002. This

reduction in gross margin resulted primarily due to a shift in customer buying patterns to products that carry lower

margins and an increase in food sales as a percent of our total sales. Partially offsetting the overall decrease in gross

margin in fiscal 2002, the Company reduced cost of sales by $67 million as a result of a LIFO inventory adjustment.

Our operating, selling, general and administrative expenses (“SG&A expenses”) increased 0.17% as a percentage of total

net sales to 16.78% in fiscal 2003 when compared with 16.61% in fiscal 2002. This increase was primarily due to increased

insurance costs, including Associate medical, property and casualty insurance, as well as increased payroll and payroll

related costs. Management believes that the trend of increasing insurance costs will continue for at least the near future.

The change in accounting for goodwill required by the Company’s adoption of Financial Accounting Standards Board

Statement No. 142, “Goodwill and Other Intangible Assets” (“FAS 142”) also affected the comparison of fiscal 2003 with

fiscal 2002. FAS 142 requires that companies no longer amortize goodwill. Instead, we must perform an annual review to

determine if the goodwill shown on our balance sheet is impaired and should be written-down. The comparison of this

fiscal year to the last fiscal year is positively impacted by this accounting change since we have not recorded any goodwill

amortization expense since January 31, 2002. If our SG&A expense for fiscal 2002 were adjusted to remove the goodwill

amortization recorded for fiscal 2002 (but which would not have been recorded had FAS 142 been in place during that

year), our operating expenses would have been reduced by $246 million. If fiscal 2002 operating expenses were adjusted

to remove that goodwill amortization, our operating expenses as a percent of sales would be 16.50% rather than the

16.61% reported above.

Our SG&A expense increased 0.12% as a percentage of total net sales to 16.61% in fiscal 2002 when compared with fiscal

2001. This increase was primarily due to increased utility and insurance costs, including Associate medical, property and

casualty insurance.

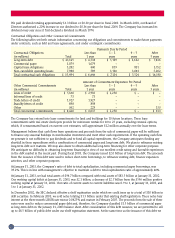

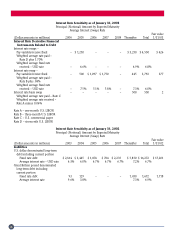

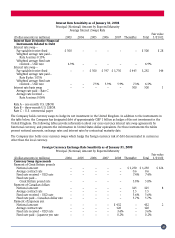

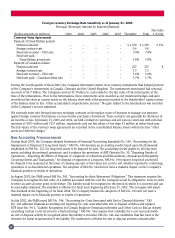

Interest Costs

For fiscal 2003, interest costs on debt and capital leases, net of interest income, as a percentage of net sales decreased

0.17% when compared to fiscal 2002. These decreases resulted from lower average interest rates on our outstanding

indebtedness, less need for debt financing due to our efforts to reduce our average inventory balances and the positive

impact of our fixed to variable interest rate swap program. In prior years we reported the majority of interest income under

the caption “miscellaneous income.” In the current year interest income is netted against interest cost. Interest income in

previous years has been reclassified for a consistent presentation. Both our U.S. and International operating units generate

interest income; however, the largest contributor of interest income is our operation in Mexico. Interest income expressed

as a percent of net sales decreased by 0.02% when comparing fiscal 2003 to fiscal 2002. This decrease was caused primarily

by a decline in interest rates in Mexico. For fiscal 2002, our interest costs on debt and capital leases, net of interest income

as a percentage of net sales decreased 0.08% from 0.62% in fiscal 2001 to 0.54% in fiscal 2002. This decrease resulted from

lower interest rates, less need for debt financing of the Company’s operations due to the Company’s inventory reduction

efforts and the positive impacts of the Company’s fixed rate to variable rate interest rate swap program. Interest income

stated as a percentage of net sales for fiscal 2002 was 0.02% less than in fiscal 2001. See the “Market Risk” section of this

discussion for further detail regarding the Company’s fixed to floating interest rate swaps.

Net Income

During fiscal 2003, we earned net income of $8.039 billion, a 20.5% increase over our net income for fiscal 2002. Our net

income for fiscal 2003 increased at a rate in excess of that by which our total net sales grew in fiscal 2003 largely as a result

of the increase in our overall gross margin and a reduction in net interest expense. Partially offsetting gross margin and net

interest expense improvements were increased SG&A expenses in fiscal 2003 as discussed above. Additionally, as discussed

above, the comparison of net income earned in fiscal 2003 with the net income earned in fiscal 2002 is positively impacted

by an accounting change related to goodwill amortization. As the tax impact of not amortizing goodwill would have been

minimal in dollars, increasing tax expense by only $11 million for fiscal 2002, our fiscal 2002 net income would have

increased by $235 million and basic earnings per share would have increased by $0.06 if we had not amortized goodwill

in fiscal 2002.

In fiscal 2002, we earned net income of $6.671 billion, a 6.0% increase over the aggregate net income of the Company in

fiscal 2001. Our net income did not grow in fiscal 2002 by the same percentage as our total net sales grew in fiscal 2002

largely as a result of the reduction in the overall gross margin and increased costs and expenses of the Company in fiscal

2002 as discussed above.

19