Walmart 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

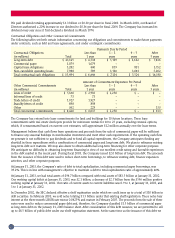

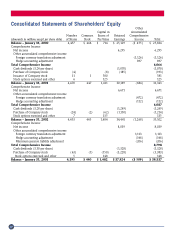

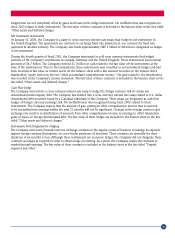

Consolidated Statements of Shareholders’ Equity

Other

Capital in Accumulated

Number Common Excess of Retained

Comprehensive

(Amounts in millions except per share data) of Shares Stock Par Value Earnings Income Total

Balance – January 31, 2000 4,457 $ 446 $ 714 $ 25,129 ($ 455) $ 25,834

Comprehensive Income

Net income 6,295 6,295

Other accumulated comprehensive income

Foreign currency translation adjustment (1,126) (1,126)

Hedge accounting adjustment 897 897

Total Comprehensive Income 6,066

Cash dividends ($.24 per share) (1,070) (1,070)

Purchase of Company stock (4) (8) (185) (193)

Issuance of Company stock 11 1 580 581

Stock options exercised and other 6 125 125

Balance – January 31, 2001 4,470 447 1,411 30,169 (684) 31,343

Comprehensive Income

Net income 6,671 6,671

Other accumulated comprehensive income

Foreign currency translation adjustment (472) (472)

Hedge accounting adjustment (112) (112)

Total Comprehensive Income 6,087

Cash dividends ($.28 per share) (1,249) (1,249)

Purchase of Company stock (24) (2) (62) (1,150) (1,214)

Stock options exercised and other 7 135 135

Balance – January 31, 2002 4,453 445 1,484 34,441 (1,268) 35,102

Comprehensive Income

Net income 8,039 8,039

Other accumulated comprehensive income

Foreign currency translation adjustment 1,113 1,113

Hedge accounting adjustment (148) (148)

Minimum pension liability adjustment (206) (206)

Total Comprehensive Income 8,798

Cash dividends ($.30 per share) (1,328) (1,328)

Purchase of Company stock (63) (5) (150) (3,228) (3,383)

Stock options exercised and other 5 148 148

Balance – January 31, 2003 4,395 $ 440 $ 1,482 $ 37,924 ($ 509) $ 39,337

32