Walmart 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

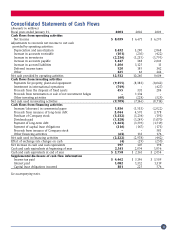

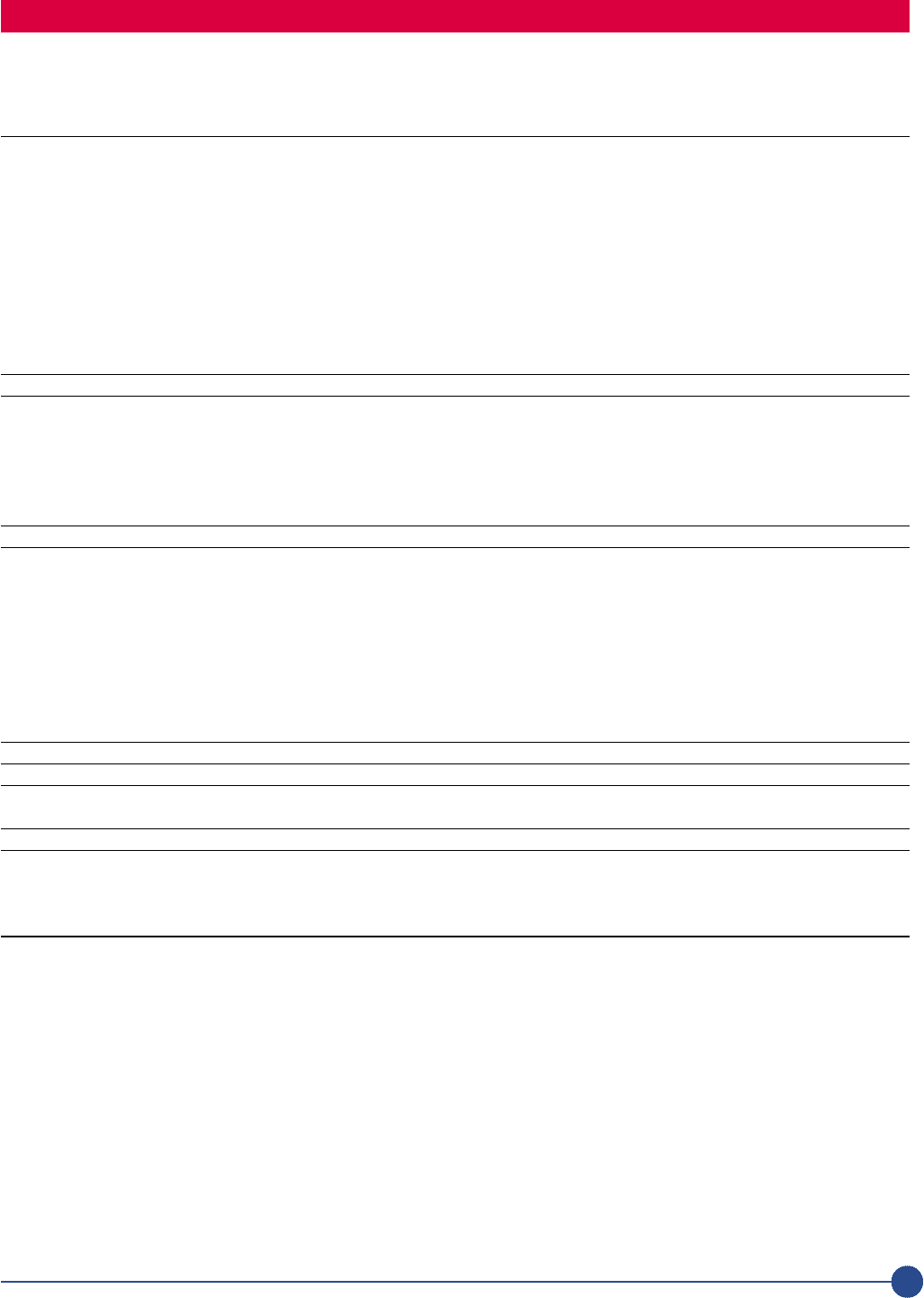

Consolidated Statements of Cash Flows

(Amounts in millions)

Fiscal years ended January 31, 2003 2002 2001

Cash flows from operating activities

Net Income $ 8,039 $ 6,671 $ 6,295

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation and amortization 3,432 3,290 2,868

Increase in accounts receivable (101) (210) (422)

Increase in inventories (2,236) (1,235) (1,795)

Increase in accounts payable 1,447 368 2,061

Increase in accrued liabilities 1,106 1,125 11

Deferred income taxes 520 185 342

Other 325 66 244

Net cash provided by operating activities 12,532 10,260 9,604

Cash flows from investing activities

Payments for property, plant and equipment (9,355) (8,383) (8,042)

Investment in international operations (749) – (627)

Proceeds from the disposal of fixed assets 455 331 284

Proceeds from termination or sale of net investment hedges –1,134 –

Other investing activities (60) (228) (329)

Net cash used in investing activities (9,709) (7,146) (8,714)

Cash flows from financing activities

Increase/(decrease) in commercial paper 1,836 (1,533) (2,022)

Proceeds from issuance of long-term debt 2,044 4,591 3,778

Purchase of Company stock (3,232) (1,214) (193)

Dividends paid (1,328) (1,249) (1,070)

Payment of long-term debt (1,263) (3,519) (1,519)

Payment of capital lease obligations (216) (167) (173)

Proceeds from issuance of Company stock ––581

Other financing activities (63) 113 176

Net cash used in financing activities (2,222) (2,978) (442)

Effect of exchange rate changes on cash (4) (29) (250)

Net increase in cash and cash equivalents 597 107 198

Cash and cash equivalents at beginning of year 2,161 2,054 1,856

Cash and cash equivalents at end of year $ 2,758 $ 2,161 $ 2,054

Supplemental disclosure of cash flow information

Income tax paid $ 4,462 $3,196 $3,509

Interest paid 1,082 1,312 1,319

Capital lease obligations incurred 381 225 576

See accompanying notes.

33