Walmart 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

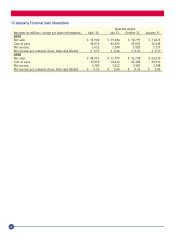

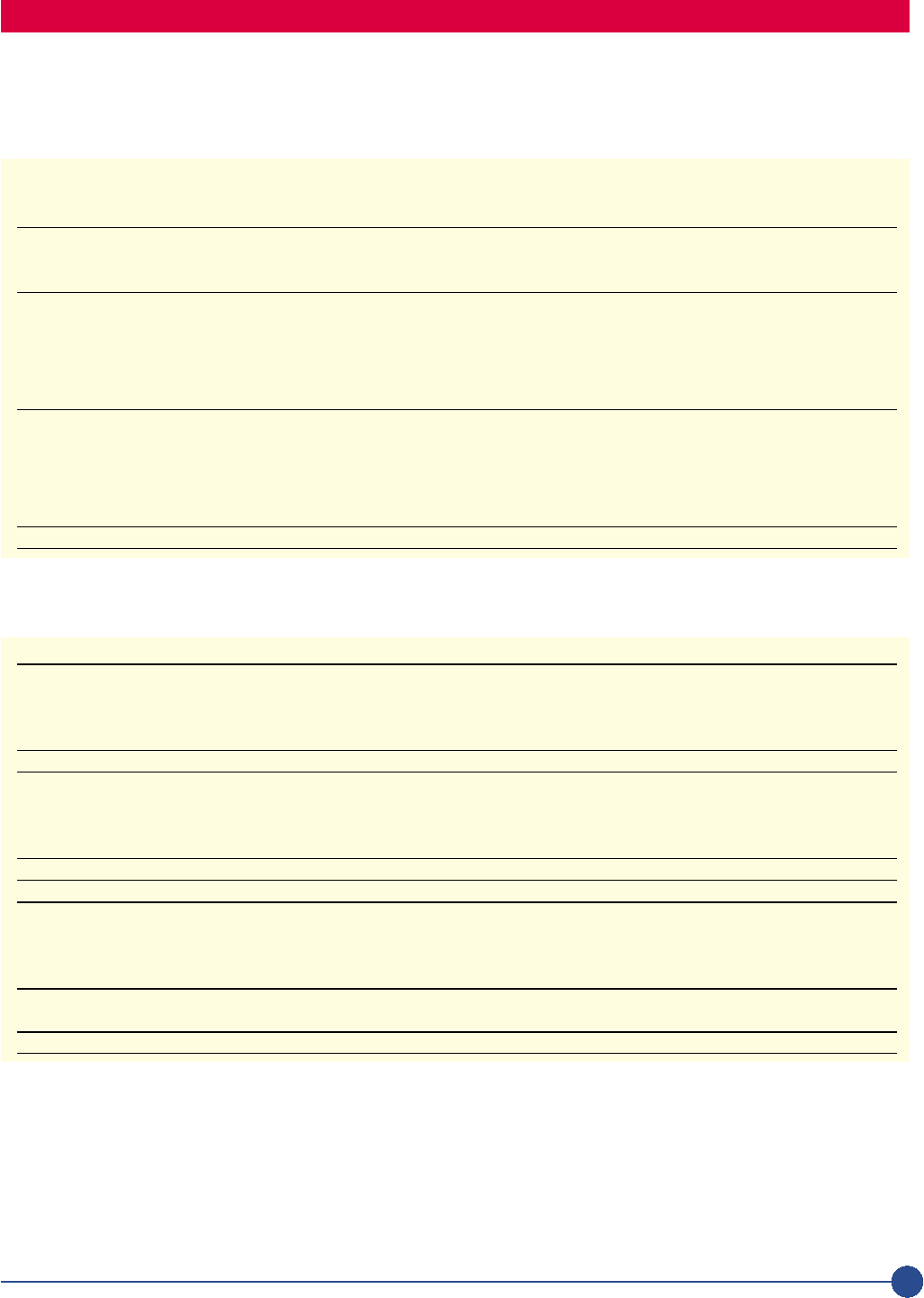

4 Other Accumulated Comprehensive Income

Comprehensive income is net income plus certain other items that are recorded directly to shareholders’ equity. The

following table gives further detail regarding the changes in the composition of comprehensive income during fiscal 2003,

2002 and 2001 (in millions):

Foreign Minimum

Currency Derivative Pension

Translation Instruments Liability Total

Balance at January 31, 2000 ($ 640) $185 $ – ($ 455)

Foreign currency translation adjustment (1,126) – – (1,126)

Change in fair value of hedging instruments – 897 – 897

Balance at January 31, 2001 ( 1,766) 1,082 – ( 684)

Foreign currency translation adjustment (472) – – (472)

Change in fair value of hedge instruments – 322 – 322

Reclassification of tax payable on terminated hedges – (426) – (426)

Reclassification to earnings to offset transaction gain on debt – (8) – (8)

Balance at January 31, 2002 ( 2,238) 970 – (1,268)

Foreign currency translation adjustment 1,113 – – 1,113

Change in fair value of hedge instruments – (164) – (164)

Reclassification to earnings to offset transaction loss on debt – 16 – 16

Subsidiary minimum pension liability – – (206) (206)

Balance at January 31, 2003 ($ 1,125) $ 822 ($ 206) ($ 509)

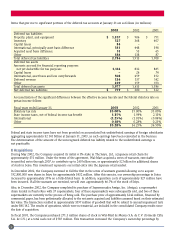

5 Income Taxes

The income tax provision consists of the following (in millions):

Fiscal years ended January 31, 2003 2002 2001

Current

Federal $ 3,377 $ 3,021 $ 2,641

State and local 235 310 297

International 355 381 412

Total current tax provision 3,967 3,712 3,350

Deferred

Federal 348 230 457

State and local 29 17 34

International 143 (62) (149)

Total deferred tax provision 520 185 342

Total provision for income taxes $ 4,487 $ 3,897 $ 3,692

Earnings before income taxes are as follows (in millions):

Fiscal years ended January 31, 2003 2002 2001

Domestic $ 10,841 $ 9,523 $ 9,203

International 1,878 1,228 913

Total earnings before income taxes and minority interest $ 12,719 $ 10,751 $ 10,116

43