Walmart 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Walmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report

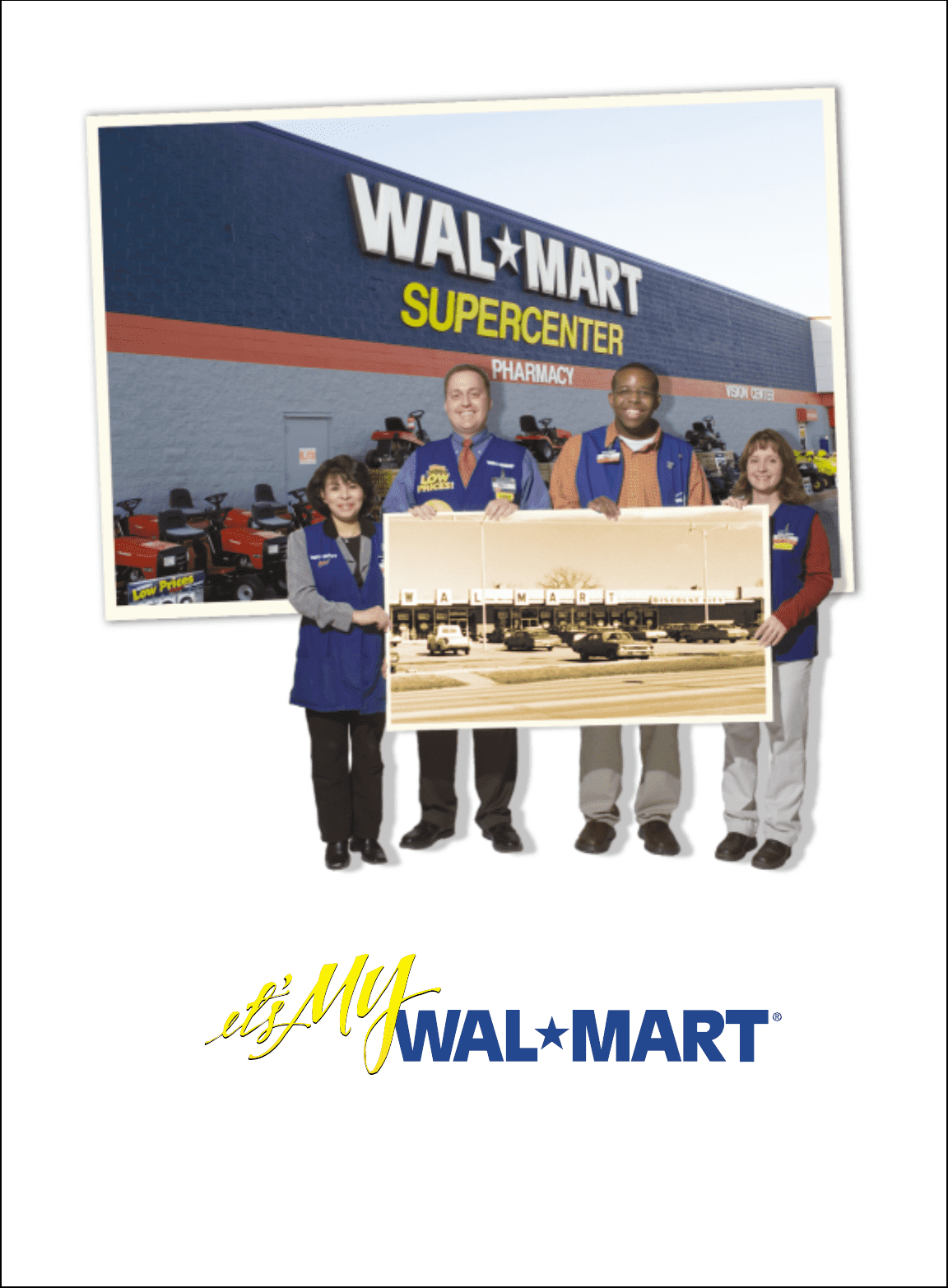

Store #1

Rogers, Arkansas

Then and Now

Table of contents

-

Page 1

Store #1 Rogers, Arkansas Then and Now 2003 Annual Report -

Page 2

... Scott, Jr. President & CEO David D. Glass Chairman of the Executive Committee of the Board $1.81 02 01 00 99 Diluted Earnings Per Share $1.40 $1.20 $.99 $1.49 03 01 02 Thomas M. Coughlin Executive Vice President; President & CEO, Wal-Mart Stores Division and SAM'S CLUB USA Michael T. Duke... -

Page 3

... success of Wal-Mart. That's what "My Wal-Mart" means: truly understanding that the shopping experience of a local Customer at a local store defines our Company and shapes our future. Front Cover Store #1, Rogers, Arkansas (from left) Sonia Barrett, Department Manager Matt Loveless, Store Manager... -

Page 4

... stand-alone company, it would rank number 33 on last year's FORTUNE 500 list based on sales. Our international business also has grown to be our second-largest division in terms of sales and earnings, trailing only the Wal-Mart Stores division. Our international growth opportunities are significant... -

Page 5

... for their support and service, and to the Wal-Mart Shareholders who invest in our Company. My best wishes to all of you in the coming year. "...thanks to our Associates, Wal-Mart was able to report record sales and record earnings in one of the most difficult business environments in recent... -

Page 6

... and acquisition opportunities, corporate policies and governance issues, and - most important to me - the identification, development, education and retention of a strong and deep pool of talent to manage Wal-Mart in the future. Wal-Mart's directors are elected annually, and the Company has... -

Page 7

... is an report back to the full board. important piece of the overall compensation of directors and senior A significant amount of the board's business is first reviewed in detail by one management. The ownership of Wal-Mart stock and options by directors of the board's three standing committees. For... -

Page 8

... of offering "opening price points" - create a better value we'll add a privatelabel product to the mix, providing brand quality at a lower price. That's how Ol' Roy® became the best-selling brand of dog food in the U.S. Wal-Mart never compromises on quality to sell for less. Consumer-testing 6 -

Page 9

..., regardless of the price. But if, despite our efforts, a Customer has a problem with a product, there is no greater value at Wal-Mart than our returnand-exchange policy, one of the most liberal satisfaction guarantees in the business. If you have a problem with a purchase, Wal-Mart will treat you... -

Page 10

... programs into all the stores," says Coughlin. "It just doesn't work. Even two stores within the same community can have very different needs." Better Merchandise, New Products Another way Wal-Mart can grow is by improving merchandise and adding new product lines. Apparel provides 8 "We will also... -

Page 11

... the consumer is going." a full line of dry groceries, half-hour photo, pharmacies with drive-through windows, and other general merchandise." In the end, Wal-Mart will continue to grow by responding to Customers on a store-by-store basis, stocking the merchandise they want and providing unmatched... -

Page 12

... shopping at Wal-Mart," says John B. Menzer, Wal-Mart International Division's president and chief executive officer. "Thanks to more than 300,000 Associates outside the United States, we're setting a global standard for Every Day Low Prices, quality merchandise and exceptional service." Building on... -

Page 13

... 2002 annual survey of associates from various leading companies. "As we grow around the world, it's important to our success that we exchange best practices among all the countries where we operate," says Craig Herkert, executive vice president and chief operating officer of Wal-Mart International... -

Page 14

... local community, also guides our charitable giving," says Betsy Reithemeyer, director of corporate affairs at Wal-Mart. "Our store, Club and distribution-center managers are community ambassadors, and they're looking for ways to make their locations an essential part of the community for the long... -

Page 15

...the Company work. That's why Wal-Mart launched in fiscal 2003 an important new program in the U.S. called the Associate in Critical Need Trust. Supported with funding from Wal-Mart, the trust also receives contributions from members of management to help Associates during times of financial hardship... -

Page 16

... cost of supplies and to count on a reliable company for many of their needs. Today, the same principles apply at each of the 525 domestic and 71 international SAM'S CLUB locations around the world. April 2003 marks the 20th we also provide our advantage [non-business] members with the opportunity... -

Page 17

...pay and benefits, and that we offer unlimited career opportunities, their opinions of Wal-Mart improve significantly. • We must be a "good neighbor": Here's what we've learned so far: In addition to supporting local charities, people want to see Wal-Mart Associates involved in important community... -

Page 18

... subsidiaries Cumulative effect of accounting change, net of tax Net income Per share of common stock: Basic net income Diluted net income Dividends Financial Position Current assets Inventories at replacement cost Less LIFO reserve Inventories at LIFO cost Net property, plant and equipment... -

Page 19

...'S CLUB membership revenue recognition as the effects of this change would not have a material impact on this summary. Therefore, pro forma information as if the accounting change had been in effect for all years presented has not been provided. The acquisition of the ASDA Group PLC and the Company... -

Page 20

... our business by building new stores, increasing sales in our existing stores and through acquisitions. We intend to continue to expand both domestically and internationally. We intend for this discussion to provide you with information that will assist you in understanding our financial statements... -

Page 21

... resulted primarily due to a shift in customer buying patterns to products that carry lower margins and an increase in food sales as a percent of our total sales. Partially offsetting the overall decrease in gross margin in fiscal 2002, the Company reduced cost of sales by $67 million as a result of... -

Page 22

...deferred tax asset related to our tax loss carry-forwards in Germany. The proposals include provisions which, if enacted, may limit the usage of such tax loss carry-forwards in any one year. During July 2001, we acquired the outstanding minority interest in Wal-Mart.com, Inc. from Accel Partners and... -

Page 23

..., excluding the units acquired in the Amigo acquisition, the International segment opened, expanded or relocated 115 units which added 8.1 million (or 8.3%) of additional unit square footage. Additionally, the impact of changes in foreign currency exchange rates positively affected the translation... -

Page 24

... corporate overhead expenses are partially offset by McLane operating income and the favorable impact of LIFO adjustments of $67 million and $176 million in fiscal 2002 and 2001, respectively. Summary of Critical Accounting Policies Management strives to report the financial results of the Company... -

Page 25

...-lived assets and goodwill associated with acquired businesses is impaired. Goodwill is evaluated for impairment annually under the provisions of FAS 142 which requires us to make judgments relating to future cash flows and growth rates as well as economic and market conditions. Revenue Recognition... -

Page 26

... shelf registration. These notes bear interest at the three-month LIBOR rate minus 0.0425% and mature in February 2005. The proceeds from the sale of these notes were used to reduce commercial paper debt and, therefore, the Company classified $1.5 billion of commercial paper as long-term debt on the... -

Page 27

... terms of this swap we will pay interest at a fixed rate of 1.915% and receive interest at the three-month LIBOR rate minus 0.0425%. This swap will mature in February 2005. Future Expansion In the United States, we plan to open approximately 45 to 55 new Wal-Mart stores and approximately 200 to 210... -

Page 28

... Rate C - U.S. commercial paper Rate D - six-month U.S. LIBOR Interest Rate Sensitivity as of January 31, 2002 Principal (Notional) Amount by Expected Maturity Average Interest (Swap) Rate (Dollar amounts in millions) Liabilities U.S. dollar denominated long-term debt including current portion Fixed... -

Page 29

... rate received - Rate A minus 0.06% Rate A - one-month U.S. LIBOR Rate B - three-month U.S. LIBOR Rate C - U.S. commercial paper The Company holds currency swaps to hedge its net investment in the United Kingdom. In addition to the instruments in the table below, the Company has designated debt... -

Page 30

... requires long-lived assets held for disposal to be measured at the lower of carrying amount or fair values less costs to sell, whether reported in continuing operations or in discontinued operations. The adoption of FAS No. 144 did not have a material impact on the Company's financial position or... -

Page 31

...net of the tax effect. The Company's estimates that the impact of changing the accounting method for the adoption of FAS 123 will have an impact of $0.02 to $0.03 per share in the year of adoption. Forward-Looking Statements This Annual Report contains statements that Wal-Mart believes are "forward... -

Page 32

...Statements of Income (Amounts in millions except per share data) Fiscal years ended January 31, Revenues: Net sales Other income Costs and Expenses: Cost of sales Operating, selling and general and administrative expenses Operating Profit...Taxes and Minority Interest Provision for Income Taxes Current... -

Page 33

... accumulated amortization Net property under capital leases Other Assets and Deferred Charges: Goodwill Other assets and deferred charges Total Assets Liabilities and Shareholders' Equity Current Liabilities: Commercial paper Accounts payable Accrued liabilities Accrued income taxes Long-term debt... -

Page 34

...income Other accumulated comprehensive income Foreign currency translation adjustment Hedge accounting adjustment Total Comprehensive Income Cash dividends ($.24 per share) Purchase of Company stock (4) Issuance of Company stock 11 Stock options exercised and other 6 Balance - January 31, 2001 4,470... -

Page 35

... of fixed assets Proceeds from termination or sale of net investment hedges Other investing activities Net cash used in investing activities Cash flows from financing activities Increase/(decrease) in commercial paper Proceeds from issuance of long-term debt Purchase of Company stock Dividends... -

Page 36

...not have a material impact on the Company's consolidated financial statements taken as a whole. Interest During Construction For interest costs to properly reflect only that portion relating to current operations, interest on borrowed funds during the construction of property, plant and equipment is... -

Page 37

... the shopping card. SAM'S CLUB Membership Revenue Recognition The Company recognizes SAM'S CLUB membership fee revenues both domestically and internationally over the term of the membership, which is 12 months. The following table provides unearned revenues, membership fees received from members and... -

Page 38

...reduction of cost of sales at the time the incentive target is earned. Other reimbursements and promotional allowances - suppliers may provide funds for specific programs including markdown protection, margin protection, new product lines, special promotions, specific advertising and other specified... -

Page 39

... financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates. Stock-based Compensation The Company has various stock option compensation plans for Associates. The Company currently accounts for those plans... -

Page 40

... requires long-lived assets held for disposal to be measured at the lower of carrying amount or fair values less costs to sell, whether reported in continuing operations or in discontinued operations. The adoption of FAS No. 144 did not have a material impact on the Company's financial position or... -

Page 41

... million of commercial paper were outstanding, respectively. At January 31, 2003, the Company had committed lines of $5,160 million with 73 firms and banks and informal lines of credit with various banks totaling an additional $73 million, which were used to support commercial paper. Long-term debt... -

Page 42

... effect on the consolidated financial statements of the Company. Fair Value Instruments The Company enters into interest rate swaps to minimize the risks and costs associated with its financing activities. Under the swap agreements, the Company pays variable rate interest and receives fixed... -

Page 43

... hedges are included in the balance sheet in the line titled "Other assets and deferred charges." Instruments Not Designated for Hedging The Company enters into forward currency exchange contracts in the regular course of business to manage its exposure against foreign currency fluctuations on cross... -

Page 44

... 1/31/2003 and 2002) Receive fixed rate, pay fixed rate cross-currency interest rate swap designated as cash flow hedge (FX notional amount: JPY 52,056 at 1/31/2003 and 2002) Derivative financial instruments not designated for hedging: Foreign currency exchange forward contracts (various currencies... -

Page 45

... that are recorded directly to shareholders' equity. The following table gives further...Current Federal State and local International Total current tax provision Deferred Federal State and local International Total deferred tax provision Total provision for income taxes Earnings before income taxes... -

Page 46

... (in millions): 2003 Deferred tax liabilities Property, plant, and equipment Inventory Capital leases International, principally asset basis difference Acquired asset basis difference Other Total deferred tax liabilities Deferred tax assets Amounts accrued for financial reporting purposes not yet... -

Page 47

... voting shares of Wal-Mart de Mexico at the end of fiscal 2003. 7 Stock Option Plans The Company follows Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees" (APB 25) and related interpretations to account for its employee stock options. Because the exercise price... -

Page 48

... Standards Act, and allege that the Company failed to pay overtime as required by the Act. Three cases regarding SAM'S CLUB managers are pending in California state court. One case regarding store assistant managers is pending in federal court in Michigan. One case regarding Home Office managers... -

Page 49

... and attorney fees and coverage of prescription contraceptives and attendant office visits. The complaint alleges that the Company's Health Plan violates Title VII's prohibition against gender discrimination in that the Reproductive Systems provision does not provide coverage for contraceptives. The... -

Page 50

... savings and profit sharing plans are made at the sole discretion of the Company, and were $73 million, $55 million and $51 million in 2003, 2002 and 2001, respectively. The Company's United Kingdom subsidiary, ASDA, has in place a defined benefit plan. The following table provides a summary... -

Page 51

...Wal-Mart Stores and SAM'S CLUB. The revenues in the "Other" category result from sales to third parties by McLane Company, Inc., a wholesale distributor. McLane offers a wide variety of grocery and non-grocery products, which it sells to a variety of retailers including the Company's Wal-Mart Stores... -

Page 52

12 Quarterly Financial Data (Unaudited) Amounts in millions (except per share information) 2003 Net sales Cost of sales Net income Net income per common share, basic and diluted 2002 Net sales Cost of sales Net income Net income per common share, basic and diluted April 30, $ 54,960 43,058 1,652 $ ... -

Page 53

Report of Independent Auditors The Board of Directors and Shareholders, Wal-Mart Stores, Inc. We have audited the accompanying consolidated balance sheets of Wal-Mart Stores, Inc. as of January 31, 2003 and 2002, and the related consolidated statements of income, shareholders' equity and cash flows ... -

Page 54

...provides reasonable assurance that Wal-Mart's assets are safeguarded and that the financial information disclosed is reliable. Our Company was founded on the belief that open communications and the highest standard of ethics are necessary to be successful. Our long-standing "open door" communication... -

Page 55

...Corporate Address: Wal-Mart Stores, Inc. 702 S.W. 8th Street Bentonville, Arkansas 72716 Telephone: (479) 273-4000 Retail Internet Site: http://www.walmart.com Corporate Internet Site: http://www.walmartstores.com The following reports are available without charge upon request by writing the Company... -

Page 56

Club #8241 Midwest City, Oklahoma The first SAM'S CLUB Then and Now 2003 Annual Report