Walgreens 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

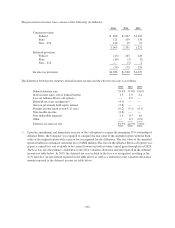

unsubordinated debt obligation of Walgreens Boots Alliance and will rank equally in right of payment with all

other unsecured and unsubordinated indebtedness of Walgreens Boots Alliance. Total issuance costs relating to

the notes, including underwriting discounts and fees, were $26 million. On August 10, 2015, the 1.8000% fixed

rate notes due September 15, 2017 in the aggregate principal amount of $1.0 billion were redeemed in full. The

redemption price was equal to 101.677% of the aggregate principal amount of the notes redeemed, plus accrued

interest thereon to, but excluding, the redemption date, and included a $17 million make whole premium, which

was recorded as interest expense on the Company’s Consolidated Statements of Earnings. Additionally, the

Company repaid the $750 million 1.000% fixed rate notes on their March 13, 2015 maturity date and the $550

million variable rate notes on their March 13, 2014 maturity date.

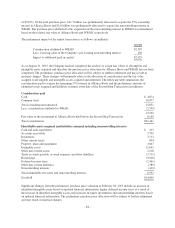

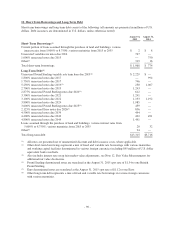

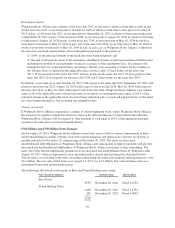

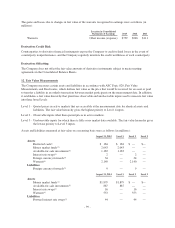

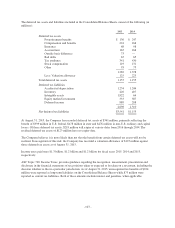

The following table details each tranche of outstanding notes as of August 31, 2015:

Notes Issued

(in millions) Maturity Date Interest Rate Interest Payment Dates

$1,200 September 15, 2022 Fixed 3.100% March 15 and September 15; commencing on March 15,

2013

500 September 15, 2042 Fixed 4.400% March 15 and September 15; commencing on March 15,

2013

$1,700

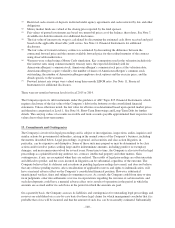

The fair value of the notes outstanding as of August 31, 2015 and August 31, 2014 was $1.6 billion and $3.4

billion (at August 31, 2014 there was $3.5 billion of issued notes outstanding), respectively. Fair value for these

notes was determined based upon quoted market prices.

Redemption Option and Change in Control

Walgreens may redeem the fixed rate notes at its option, at any time in whole, or from time to time in part, at a

redemption price equal to the greater of: (a) 100% of the principal amount of the notes being redeemed; and

(b) the sum of the present values of the remaining scheduled payments of principal and interest thereon (not

including any portion of such payments of interest accrued as of the date of redemption), discounted to the date

of redemption on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the

Treasury Rate (as defined in the applicable series of notes), plus 12 basis points for the notes due 2015, 22 basis

points for the notes due 2022 and 25 basis points for the notes due 2042. If a change of control triggering event

occurs, Walgreens will be required, unless it has exercised its right to redeem the notes, to offer to purchase the

notes at a purchase price equal to 101% of their principal amount, plus accrued and unpaid interest, if any, on the

notes repurchased to the date of repurchase.

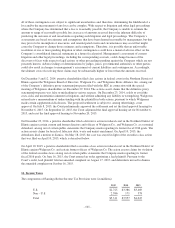

$1.0 Billion Note Issuance

On January 13, 2009, Walgreens issued notes totaling $1.0 billion bearing an interest rate of 5.250% paid

semiannually in arrears on January 15 and July 15 of each year, beginning on July 15, 2009. The notes will

mature on January 15, 2019. The notes are unsecured senior debt obligations and rank equally with all other

unsecured senior indebtedness of Walgreens. On December 31, 2014, Walgreens Boots Alliance fully and

unconditionally guaranteed the outstanding notes on an unsecured and unsubordinated basis. The guarantee, for

so long as it is in place, is an unsecured, unsubordinated debt obligation of Walgreens Boots Alliance and will

rank equally in right of payment with all other unsecured and unsubordinated indebtedness of Walgreens Boots

Alliance. The notes are not convertible or exchangeable. Total issuance costs relating to this offering including

underwriting discounts and fees, were $8 million. On August 10, 2015, $750 million aggregate principal amount

of the notes were redeemed. The redemption price was equal to 111.734% of the aggregate principal amount of

the notes redeemed, plus accrued interest thereon to, but excluding, the redemption date, and included a $88

million make whole premium, which was recorded as interest expense on the Company’s Consolidated

Statements of Earnings. The partial redemption of the notes resulted in $250 million aggregate principal amount

-94-