Walgreens 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

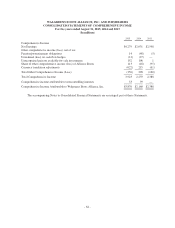

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

NOTES TO FINANCIAL STATEMENTS

Note 1. Organization

Walgreens Boots Alliance, Inc. (“Walgreens Boots Alliance”) and subsidiaries are a global pharmacy-led

wellbeing enterprise. Its operations are conducted through three reportable segments (Retail Pharmacy USA,

Retail Pharmacy International and Pharmaceutical Wholesale). See Note 19, Segment Reporting for additional

discussion.

On December 31, 2014, Walgreens Boots Alliance became the successor of Walgreen Co. (“Walgreens”)

pursuant to a merger designed to effect a reorganization of Walgreens into a holding company structure (the

“Reorganization”). Pursuant to the Reorganization, Walgreens became a wholly-owned subsidiary of Walgreens

Boots Alliance, a newly-formed Delaware corporation, and each issued and outstanding share of Walgreens

common stock, par value $0.078125, converted on a one-to-one basis into Walgreens Boots Alliance common

stock, par value $0.01.

On December 31, 2014, following the completion of the Reorganization, Walgreens Boots Alliance completed

the acquisition of the remaining 55% of Alliance Boots GmbH (“Alliance Boots”) that Walgreens did not

previously own (the “Second Step Transaction”) in exchange for £3.133 billion in cash and approximately

144.3 million shares of Walgreens Boots Alliance common stock pursuant to the Purchase and Option

Agreement dated June 18, 2012, as amended (the “Purchase and Option Agreement”). Alliance Boots became a

consolidated subsidiary and ceased being accounted for under the equity method immediately upon completion

of the Second Step Transaction. For financial reporting and accounting purposes, Walgreens Boots Alliance was

the acquirer of Alliance Boots. The consolidated financial statements (and other data) reflect the results of

operations and financial position of Walgreens and its subsidiaries for periods prior to December 31, 2014 and of

Walgreens Boots Alliance and its subsidiaries for periods from and after the effective time of the Reorganization

on December 31, 2014.

References to the “Company” refer to Walgreens Boots Alliance and its subsidiaries from and after the effective

time of the Reorganization on December 31, 2014 and, prior to that time, to the predecessor registrant Walgreens

and its subsidiaries, except as otherwise indicated or the context otherwise requires.

Note 2. Summary of Major Accounting Policies

Basis of Presentation

The consolidated financial statements include all subsidiaries in which the Company holds a controlling interest.

Investments in less than majority-owned companies in which the Company does not have a controlling interest,

but does have significant influence are accounted for as equity method investments. All intercompany

transactions have been eliminated. The preparation of financial statements in accordance with accounting

principles generally accepted in the United States of America requires management to use judgment in the

application of accounting policies, including making estimates and assumptions. The Company bases its

estimates on the information available at the time, its experience and on various other assumptions believed to be

reasonable under the circumstances. Adjustments may be made in subsequent periods to reflect more current

estimates and assumptions about matters that are inherently uncertain. Actual results may differ.

Because of the acquisition of Alliance Boots, influence of certain holidays, seasonality, foreign currency rates,

changes in vendor, payer and customer relationships and terms and other factors on the Company’s operations,

net earnings for any period may not be comparable to the same period in previous years. In addition, the positive

impact on gross profit margins and gross profit dollars typically has been significant in the first several months

after a generic version of a drug is first allowed to compete with the branded version, which is generally referred

to as a “generic conversion”. In any given year, the number of major brand name drugs that undergo a conversion

-66-