Walgreens 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148

|

|

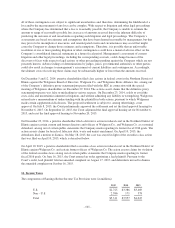

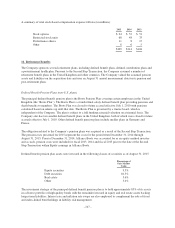

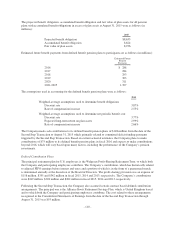

Postretirement Healthcare Plan

The Company provides certain health insurance benefits to retired U.S. employees who meet eligibility

requirements, including age, years of service and date of hire. The costs of these benefits are accrued over the

service life of the employee. The Company’s postretirement health benefit plan is not funded.

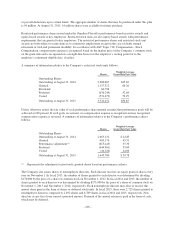

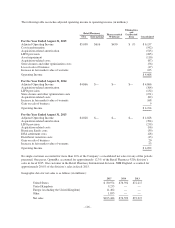

Components of net periodic benefit costs (in millions):

2015 2014 2013

Service cost $ 11 $ 8 $ 9

Interest cost 17 17 14

Amortization of actuarial loss 19 11 12

Amortization of prior service cost (24) (23) (22)

Total postretirement benefit cost $ 23 $ 13 $ 13

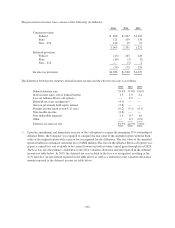

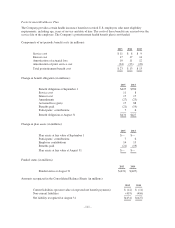

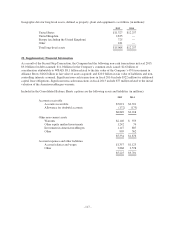

Change in benefit obligation (in millions):

2015 2014

Benefit obligation at September 1 $427 $350

Service cost 11 8

Interest cost 17 17

Amendments (27) (23)

Actuarial loss (gain) 17 88

Benefits paid (21) (19)

Participants’ contributions 7 6

Benefit obligation at August 31 $431 $427

Change in plan assets (in millions):

2015 2014

Plan assets at fair value at September 1 $— $—

Participants’ contributions 7 6

Employer contributions 14 13

Benefits paid (21) (19)

Plan assets at fair value at August 31 $— $—

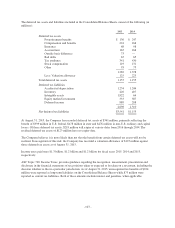

Funded status (in millions):

2015 2014

Funded status at August 31 $(431) $(427)

Amounts recognized in the Consolidated Balance Sheets (in millions):

2015 2014

Current liabilities (present value of expected net benefit payments) $ (12) $ (11)

Non-current liabilities (419) (416)

Net liability recognized at August 31 $(431) $(427)

- 111 -