Walgreens 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

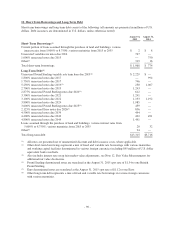

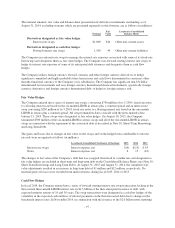

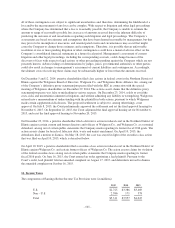

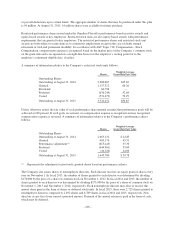

The notional amounts, fair value and balance sheet presentation of derivative instruments outstanding as of

August 31, 2014, excluding warrants which are presented separately in this footnote, are as follows (in millions):

Notional

Fair

Value

Location in Consolidated

Balance Sheets

Derivatives designated as fair value hedges:

Interest rate swaps $1,000 $16 Other non-current assets

Derivatives designated as cash flow hedges:

Forward interest rate swaps 1,500 44 Other non-current liabilities

The Company uses interest rate swaps to manage the interest rate exposure associated with some of its fixed-rate

borrowings and designates them as fair value hedges. The Company uses forward starting interest rate swaps to

hedge its interest rate exposure of some of its anticipated debt issuances and designates them as cash flow

hedges.

The Company utilizes foreign currency forward contracts and other foreign currency derivatives to hedge

significant committed and highly probable future transactions and cash flows denominated in currencies other

than the functional currency of the Company or its subsidiaries. The Company has significant non-US dollar

denominated net investments and uses foreign currency denominated financial instruments, specifically foreign

currency derivatives and foreign currency denominated debt, to hedge its foreign currency risk.

Fair Value Hedges

The Company entered into a series of interest rate swaps, converting $750 million of its 5.250% fixed rate notes

to a floating interest rate based on the six-month LIBOR in arrears plus a constant spread and an interest rate

swap converting $250 million of its 5.250% fixed rate notes to a floating interest rate based on the one-month

LIBOR in arrears plus a constant spread. All swap termination dates coincide with the notes maturity date,

January 15, 2019. These swaps were designated as fair value hedges. On August 10, 2015, the Company

terminated $500 million of the six-month LIBOR in arrears swaps and all of the one-month LIBOR in arrears

swaps in connection with the repayment of the associated debt as described in Note 10, Short-Term Borrowings

and Long-Term Debt.

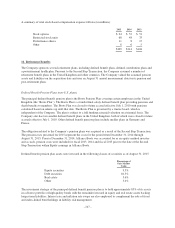

The gains and losses due to changes in fair value on the swaps and on the hedged notes attributable to interest

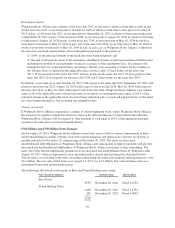

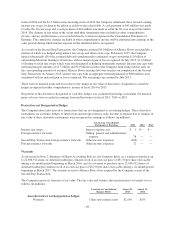

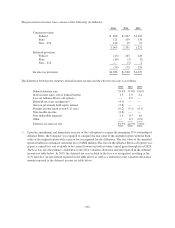

rate risk were recognized as follows (in millions):

Location in Consolidated Statements of Earnings 2015 2014 2013

Interest rate swaps Interest expense, net $(4) $(15) $ 63

Notes Interest expense, net 6 15 (43)

The changes in fair value of the Company’s debt that was swapped from fixed to variable rate and designated as

fair value hedges are included in short-term and long-term debt on the Consolidated Balance Sheets (see Note 10,

Short-Term Borrowings and Long-Term Debt). At August 31, 2015 and August 31, 2014, the cumulative fair

value adjustments resulted in an increase in long-term debt of $1 million and $12 million, respectively. No

material gains or losses were recorded from ineffectiveness during fiscal 2015, 2014 or 2013.

Cash Flow Hedges

In fiscal 2014, the Company entered into a series of forward starting interest rate swap transactions locking in the

then current three-month LIBOR interest rate on $1.5 billion of the then anticipated issuance of debt, with

expected maturity tenures of 10 and 30 years. The swap transactions were designated as cash flow hedges of the

variability in the expected cash outflows of interest payments on the then forecasted debt due to changes in the

benchmark interest rates. In November 2014, in conjunction with the issuance of the $2.0 billion notes maturing

-97-