Walgreens 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

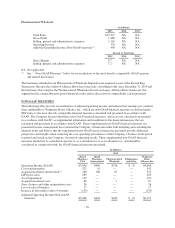

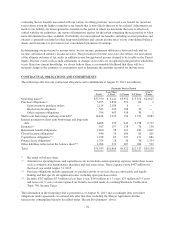

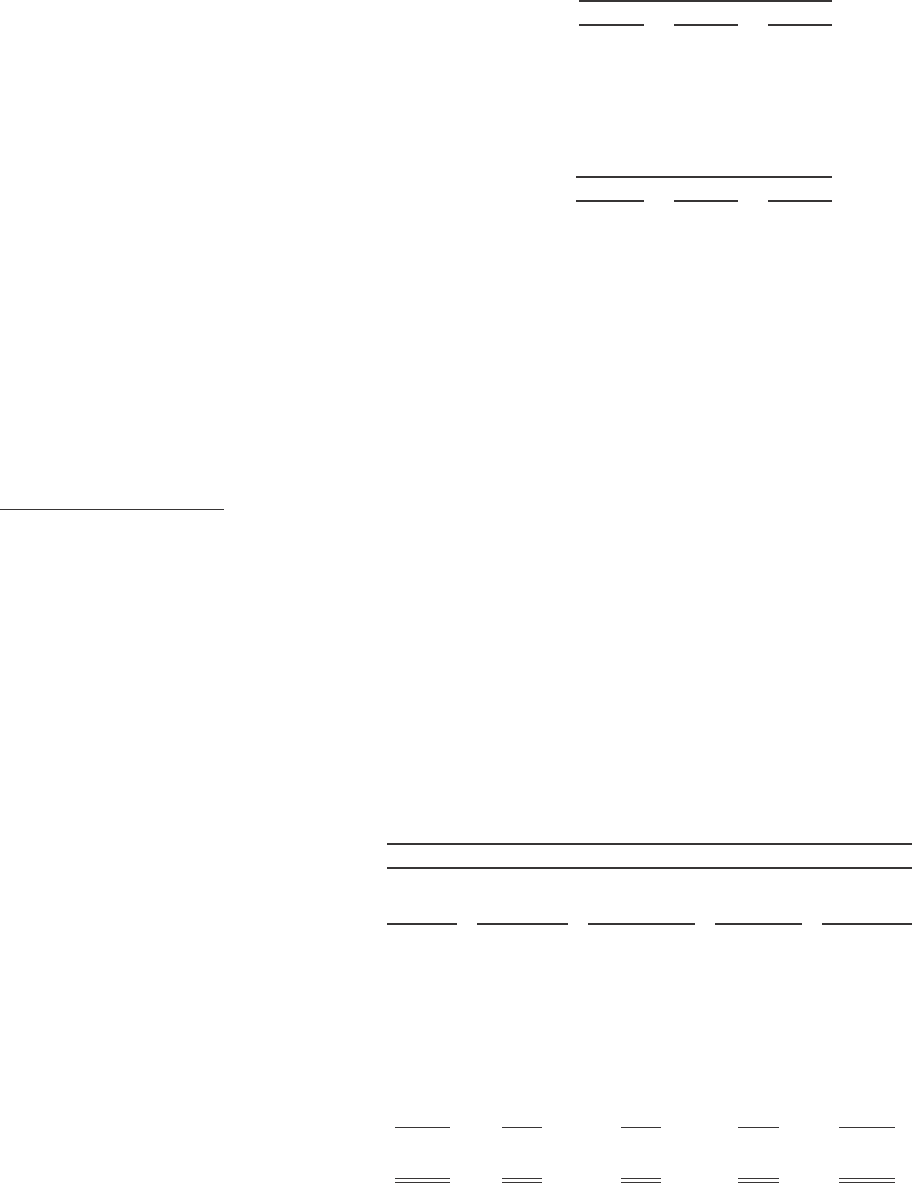

Pharmaceutical Wholesale

(in millions)

2015 2014 2013

Total Sales $15,327 NA NA

Gross Profit 1,486 NA NA

Selling, general and administrative expenses 1,110 NA NA

Operating Income 376 NA NA

Adjusted Operating Income (Non-GAAP measure)(1) 450 NA NA

Percent to Total Sales

2015 2014 2013

Gross Margin 9.7 NA NA

Selling, general and administrative expenses 7.2 NA NA

NA Not applicable

(1) See “– Non-GAAP Measures” below for reconciliations to the most directly comparable GAAP measure

and related disclosures.

The businesses included in our Pharmaceutical Wholesale Segment were acquired as part of the Second Step

Transaction. Because the results of Alliance Boots have been fully consolidated only since December 31, 2014 and

the businesses that comprise the Pharmaceutical Wholesale division are legacy Alliance Boots businesses, this

segment had no comparable prior period financial results and no discussion of comparability can be presented.

NON-GAAP MEASURES

The following tables provide reconciliations of adjusted operating income and adjusted net earnings per common

share attributable to Walgreens Boots Alliance, Inc., which are non-GAAP financial measures as defined under

SEC rules, to the most directly comparable financial measures calculated and presented in accordance with

GAAP. The Company has provided these non-GAAP financial measures, which are not calculated or presented

in accordance with GAAP, as supplemental information and in addition to the financial measures that are

calculated and presented in accordance with GAAP. These supplemental non-GAAP financial measures are

presented because management has evaluated the Company’s financial results both including and excluding the

adjusted items and believe that the supplemental non-GAAP financial measures presented provide additional

perspective and insights when analyzing the core operating performance of the Company’s business from period

to period and trends in the Company’s historical operating results. These supplemental non-GAAP financial

measures should not be considered superior to, as a substitute for or as an alternative to, and should be

considered in conjunction with, the GAAP financial measures presented.

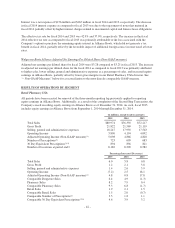

(in millions)

2015

Retail

Pharmacy

USA

Retail

Pharmacy

International

Pharmaceutical

Wholesale

Eliminations

and Other

Walgreens

Boots

Alliance, Inc.

Operating Income (GAAP) $3,890 $409 $376 $ (7) $4,668

Cost transformation 523 19 — — 542

Acquisition-related amortization(1) 260 188 67 — 515

LIFO provision 285 — — — 285

Asset impairment 110 — — — 110

Acquisition-related costs 80 — 7 — 87

Store closures and other optimization costs 56 — — — 56

Loss on sale of business 17 — — — 17

Increase in fair market value of warrants (123) — — — (123)

Adjusted Operating Income (Non-GAAP

measure) $5,098 $616 $450 $ (7) $6,157

-46-