Walgreens 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

all of these contingencies are subject to significant uncertainties and, therefore, determining the likelihood of a

loss and/or the measurement of any loss can be complex. With respect to litigation and other legal proceedings

where the Company has determined that a loss is reasonably possible, the Company is unable to estimate the

amount or range of reasonably possible loss in excess of amounts reserved due to the inherent difficulty of

predicting the outcome of and uncertainties regarding such litigation and legal proceedings. The Company’s

assessments are based on estimates and assumptions that have been deemed reasonable by management, but that

may prove to be incomplete or inaccurate, and unanticipated events and circumstances may occur that might

cause the Company to change those estimates and assumptions. Therefore, it is possible that an unfavorable

resolution of one or more pending litigation or other contingencies could have a material adverse effect on the

Company’s consolidated financial statements in a future fiscal period. Management’s assessment of current

litigation and other legal proceedings, including the corresponding accruals, could change because of the

discovery of facts with respect to legal actions or other proceedings pending against the Company which are not

presently known. Adverse rulings or determinations by judges, juries, governmental authorities or other parties

could also result in changes to management’s assessment of current liabilities and contingencies. Accordingly,

the ultimate costs of resolving these claims may be substantially higher or lower than the amounts reserved.

On December 5 and 12, 2014, putative shareholders filed class actions in federal court in the Northern District of

Illinois against the Walgreens Board of Directors, Walgreen Co., and Walgreens Boots Alliance, Inc. arising out

of the Company’s definitive proxy statement/prospectus filed with the SEC in connection with the special

meeting of Walgreens shareholders on December 29, 2014. The actions assert claims that the definitive proxy

statement/prospectus was false or misleading in various respects. On December 23, 2014, solely to avoid the

costs, risks and uncertainties inherent in litigation, and without admitting any liability or wrongdoing, Walgreens

entered into a memorandum of understanding with the plaintiffs in both actions, pursuant to which Walgreens

made certain supplemental disclosures. The proposed settlement is subject to, among other things, court

approval. On July 8, 2015, the Court preliminarily approved the settlement and set the final approval hearing for

November 6, 2015. On September 22, 2015, the Court adjourned the final approval hearing set for November 6,

2015, and reset the final approval hearing to November 20, 2015.

On December 29, 2014, a putative shareholder filed a derivative action in federal court in the Northern District of

Illinois against certain current and former directors and officers of Walgreen Co., and Walgreen Co. as a nominal

defendant, arising out of certain public statements the Company made regarding its former fiscal 2016 goals. The

action asserts claims for breach of fiduciary duty, waste and unjust enrichment. On April 10, 2015, the

defendants filed a motion to dismiss. On May 18, 2015, the case was stayed in light of the securities class action

that was filed on April 10, 2015, which is described below.

On April 10, 2015, a putative shareholder filed a securities class action in federal court in the Northern District of

Illinois against Walgreen Co. and certain former officers of Walgreen Co. The action asserts claims for violation

of the federal securities laws arising out of certain public statements the Company made regarding its former

fiscal 2016 goals. On June 16, 2015, the Court entered an order appointing a lead plaintiff. Pursuant to the

Court’s order, lead plaintiff filed an amended complaint on August 17, 2015, and defendants moved to dismiss

the amended complaint on October 16, 2015.

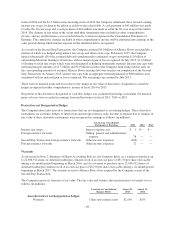

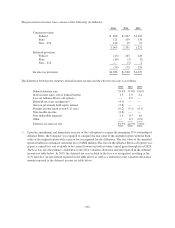

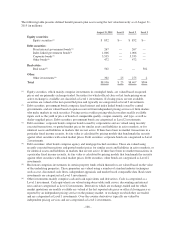

14. Income Taxes

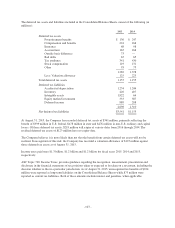

The components of Earnings Before Income Tax Provision were (in millions):

2015 2014 2013

U.S. $2,725 $3,386 $3,469

Non – U.S. 2,586 171 578

Total $5,311 $3,557 $4,047

- 101 -