Walgreens 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

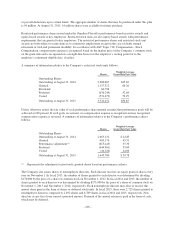

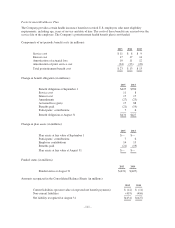

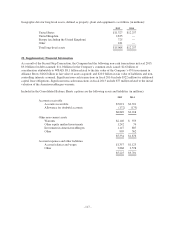

In addition, the Company continued to repurchase shares to support the needs of the employee stock plans.

Shares totaling $500 million were purchased to support the needs of the employee stock plans during fiscal 2015

as compared to $705 million in fiscal 2014. At August 31, 2015, 46.2 million shares of common stock were

reserved for future issuances under the Company’s various employee benefit plans.

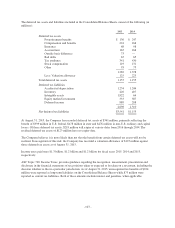

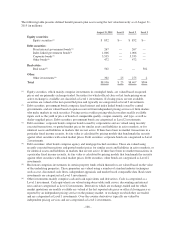

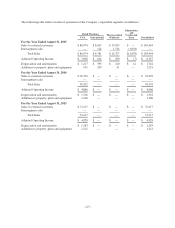

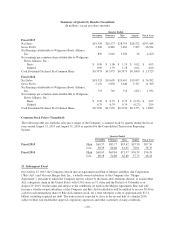

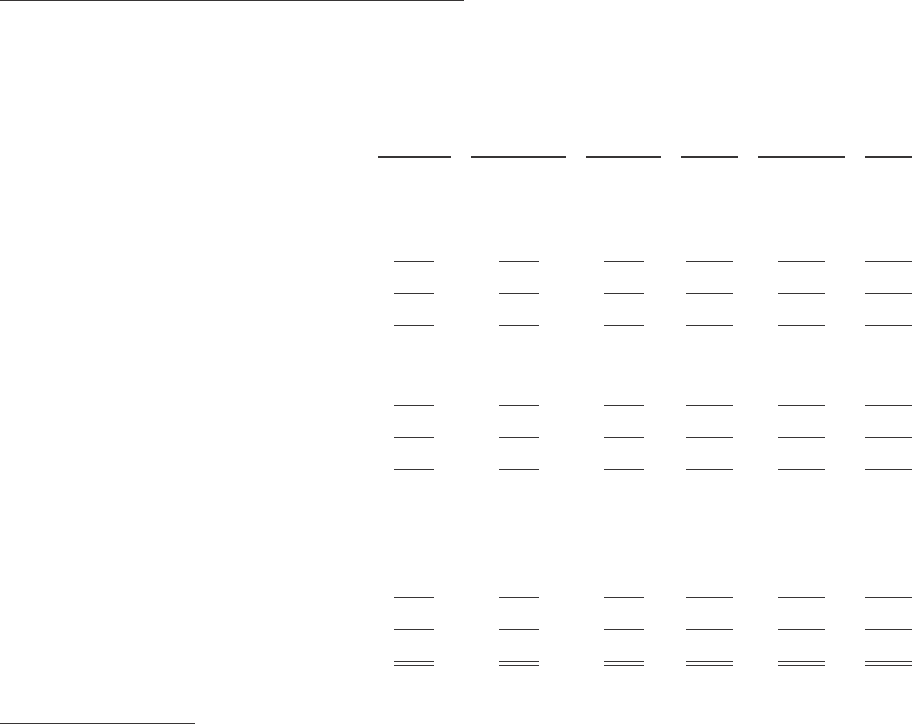

18. Accumulated Other Comprehensive Income (Loss)

The following is a summary of net changes in accumulated other comprehensive income by component and net

of tax for fiscal 2015, 2014 and 2013 (in millions):

Post-

retirement

Liability

Unrecognized

Gains on

Available-for-

Sale

Investments

Unrealized

Loss on

Cash Flow

Hedges

Share of

Alliance

Boots

OCI

Currency

Translation

Adjustments Total

Balance at August 31, 2012 $ 68 $— $— $ — $ — $ 68

Other comprehensive income (loss) before

reclassification adjustments (9) 1 — (146) (93) (247)

Tax benefit (provision) 4 — — 51 32 87

Net other comprehensive income (loss) (5) 1 (95) (61) (160)

Balance at August 31, 2013 63 1 — (95) (61) (92)

Other comprehensive income (loss) before

reclassification adjustments (77) 170 (43) (27) 330 353

Tax benefit (provision) 29 (64) 16 9 (115) (125)

Net other comprehensive income (loss) (48) 106 (27) (18) 215 228

Balance at August 31, 2014 15 107 (27) (113) 154 136

Other comprehensive income (loss) before

reclassification adjustments 23 247 (14) (57) (779) (580)

Amounts reclassified from accumulated

OCI — — (5) 230 80 305

Tax benefit (provision) (9) (95) 6 (60) 83 (75)

Net other comprehensive income (loss) 14 152 (13) 113 (616) (350)

Balance at August 31, 2015 $ 29 $259 $ (40) $ — $(462) $(214)

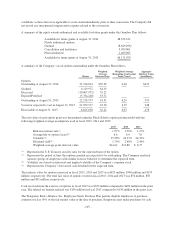

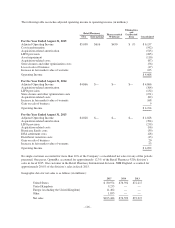

19. Segment Reporting

Prior to December 31, 2014, the Company’s operations were within one reportable segment. As a result of the

closing of the Second Step Transaction on December 31, 2014, (see Note 1, Organization, and Note 2, Summary

of Major Accounting Policies), the Company has realigned its operations into three reportable segments: Retail

Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale. The operating segments have

been identified based on the financial data utilized by the Company’s Chief Executive Officer (the chief

operating decision maker) to assess segment performance and allocate resources among the Company’s operating

segments, which have been aggregated as described below. The chief operating decision maker uses adjusted

operating income to assess segment profitability. The chief operating decision maker does not use total assets by

segment to make decisions regarding resources, therefore the total asset disclosure by segment has not been

included.

• The Retail Pharmacy USA segment consists of the legacy Walgreens business, which includes the

operation of retail drugstores and convenient care clinics, in addition to providing specialty pharmacy

services. Revenues for the segment are principally derived from the sale of prescription drugs and a

wide assortment of general merchandise, including non-prescription drugs, beauty products, photo

finishing, seasonal merchandise, greeting cards and convenience foods.

- 113 -