Walgreens 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

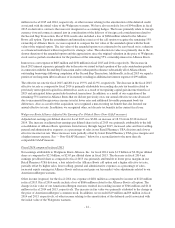

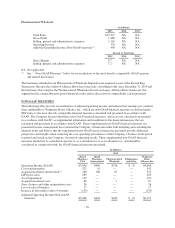

Medicare Part D mix including the strategy to continue driving 90-day prescriptions at retail; and the mix of

specialty drugs, which carry a lower margin percentage. The decrease in pharmacy margins was partially offset

by additional brand-to-generic drug conversions compared with the prior fiscal year. Retail margins were

positively impacted in fiscal 2015 primarily from the non-prescription drug, beauty and beverage and snack

categories partially offset by the electronics category.

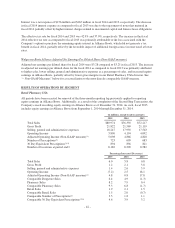

Selling, general and administrative expenses as a percentage of total sales were 22.5% in fiscal 2015 compared to

23.6% in fiscal 2014. As a percentage of total sales, expenses in fiscal 2015 were lower primarily due to store

labor efficiencies partially offset by higher costs related to the Cost Transformation Program.

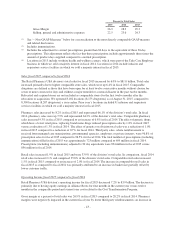

Adjusted Operating Income (Non-GAAP measure) fiscal 2015 compared to fiscal 2014

Retail Pharmacy USA division’s adjusted operating income for fiscal 2015 increased 4.8% to $5.1 billion. The

increase is primarily due to higher sales and lower selling, general and administrative expenses as a percentage of

sales partially offset by having four months of equity earnings in Alliance Boots in fiscal 2015 versus twelve

months in fiscal 2014 and lower gross margins. See “– Non-GAAP Measures” below for a reconciliation to the

most directly comparable GAAP measure.

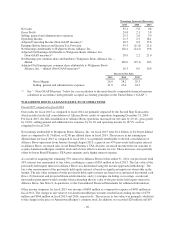

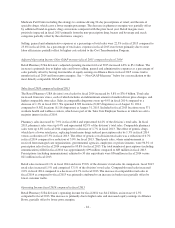

Sales fiscal 2014 compared to fiscal 2013

The Retail Pharmacy USA division’s total sales for fiscal 2014 increased by 5.8% to $76.4 billion. Total sales

increased from new stores, each of which includes an indeterminate amount of market-driven price changes, and

higher comparable store sales. Sales in comparable drugstores were up 4.9% in fiscal 2014 compared to a

decrease of 1.3% in fiscal 2013. We operated 8,309 locations (8,207 drugstores) as of August 31, 2014,

compared to 8,582 locations (8,116 drugstores) at August 31, 2013. Included in fiscal 2013 locations were 371

worksite health and wellness centers, which were part of the Take Care Employer business in which we sold a

majority interest in fiscal 2014.

Pharmacy sales increased by 7.9% in fiscal 2014 and represented 64.2% of the division’s total sales. In fiscal

2013, pharmacy sales were up 0.4% and represented 62.9% of the division’s total sales. Comparable pharmacy

sales were up 6.8% in fiscal 2014 compared to a decrease of 1.7% in fiscal 2013. The effect of generic drugs,

which have a lower retail price, replacing brand name drugs reduced prescription sales by 1.3% in fiscal 2014

versus a reduction of 5.3% in fiscal 2013. The effect of generics on division total sales was a reduction of 0.7%

in fiscal 2014 compared to a reduction of 3.0% for fiscal 2013. Third party sales, where reimbursement is

received from managed care organizations, governmental agencies, employers or private insurers, were 96.5% of

prescription sales for fiscal 2014 compared to 95.8% for fiscal 2013. The total number of prescriptions (including

immunizations) filled in fiscal 2014 was approximately 699 million compared to 683 million in fiscal 2013.

Prescriptions (including immunizations) adjusted to 30 day equivalents were 856 million in fiscal 2014 versus

821 million in fiscal 2013.

Retail sales increased 2.1% in fiscal 2014 and were 35.8% of the division’s total sales. In comparison, fiscal 2013

retail sales increased 1.5% and comprised 37.1% of the division’s total sales. Comparable retail sales increased

2.0% in fiscal 2014 compared to a decrease of 0.7% in fiscal 2013. The increase in comparable retail sales in

fiscal 2014 as compared to fiscal 2013 was primarily attributed to an increase in basket size partially offset by

lower customer traffic.

Operating Income fiscal 2014 compared to fiscal 2013

Retail Pharmacy USA division’s operating income for fiscal 2014 was $4.2 billion, an increase of 2.5%

compared to fiscal 2013. The increase is primarily due to higher sales and increased equity earnings in Alliance

Boots, partially offset by lower gross margins.

-44-