Walgreens 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result of the Company acquiring the remaining 55% interest in Alliance Boots, the Company’s previously

held 45% interest was remeasured to fair value, resulting in a gain of $563 million. This gain has been

recognized as Gain on previously held equity interest in the Consolidated Statements of Earnings. This gain is

preliminary and may be subject to change as the Company finalizes purchase accounting.

The fair value of the previously held equity interest of $8.1 billion in Alliance Boots was determined using the

income approach methodology. The fair value for trade names and trademarks was determined using the relief

from royalty method of the income approach; pharmacy licenses and customer relationships were determined

using the excess earnings method of the income approach; and loyalty card holders were determined using the

incremental cash flow method which is a form of the income approach. Personal property fair values were

determined primarily using the indirect cost approach, while real property fair values were determined using the

income, market and/or cost approach. The fair value measurements of the previously held equity interest and

intangible assets are based on significant inputs not observable in the market, and thus represent Level 3

measurements. The fair value estimates for the previously held equity interest and intangible assets are based on

(a) projected discounted cash flows, (b) historical and projected financial information, (c) synergies including

cost savings, and (d) attrition rates, as relevant, that market participants would consider when estimating fair

values.

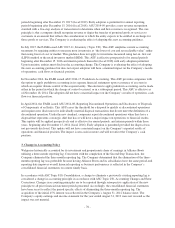

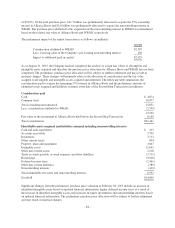

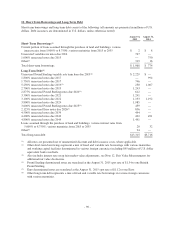

The preliminary identified definite and indefinite lived intangible assets were as follows:

Definite-Lived Intangible Assets

Weighted-Average Useful

Life (in years) Amount (in millions)

Customer relationships 12 $1,311

Loyalty card holders 12 742

Trade names and trademarks 7 399

Favorable lease interests 8 93

Total $2,545

Indefinite-Lived Intangible Assets Amount (in millions)

Trade names and trademarks $6,657

Pharmacy licenses 2,489

Total $9,146

The preliminary goodwill of $14.8 billion arising from the Second Step Transaction primarily reflects the

expected purchasing synergies, operating efficiencies by benchmarking performance and applying best practices

across the combined company, consolidation of operations, reductions in selling, general and administrative

expenses and combining workforces.

Following the completion of the Second Step Transaction, the Company has realigned its operations into three

reportable segments: Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale. The

Company determined that the preliminary goodwill should be allocated across all segments recognizing that each

segment will benefit from the expected synergies.

The preliminary goodwill allocated to the Retail Pharmacy USA segment of $7.3 billion comprises $3.5 billion

of synergy benefits allocable to the segment on a source of procurement benefit basis and $3.8 billion determined

on a “with-and-without” basis. The source of procurement benefit basis allocates the synergy benefits to the

segment whose purchase gave rise to the benefit. The “with-and-without” basis computes the difference between

the fair value of the pre-existing business before the combination and its fair value after the combination, and

since the pre-existing Walgreens business is now within the Retail Pharmacy USA segment, all of this difference

is allocated to this segment. The “with-and-without” computation recognized that if the Second Step Transaction

did not happen, then this was likely to negatively impact the existing Walgreens business, which already had a

45% interest in Alliance Boots, as the expected purchasing synergies and other benefits resulting from a full

combination would not be fully realized.

-85-