Walgreens 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

million in fiscal 2015 and 2014, respectively, of other income relating to the amortization of the deferred credit

associated with the initial value of the Walgreens warrants. We have also recorded a loss of $94 million in fiscal

2015 on derivative contracts that were not designated as accounting hedges. The losses primarily relate to foreign

currency forward contracts entered into in consideration of the delivery of foreign cash consideration related to

the Second Step Transaction. Fiscal 2014 results also included a loss of $866 million related to the Alliance

Boots call option. Upon the amendment and immediate exercise of the call option to acquire the remaining 55%

ownership of Alliance Boots, we were required to compare the fair value of the amended option with the book

value of the original option. The fair value of the amended option was estimated to be zero based on its valuation

as a financial instrument without regard for its strategic value. The reduction in value was primarily due to the

shorter duration of the amended option and the appreciation since the original valuation in the price of Walgreens

stock used as partial consideration for the purchase of the remaining 55% ownership interest in Alliance Boots.

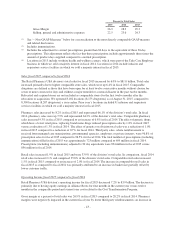

Interest was a net expense of $605 million and $156 million in fiscal 2015 and 2014, respectively. The increase in

fiscal 2015 interest expense is primarily due to the notes we issued to fund a portion of the cash consideration payable

in connection with the Second Step Transaction and to subsequently refinance substantially all of Alliance Boots

outstanding borrowings following completion of the Second Step Transaction. Additionally, in fiscal 2015 we repaid a

portion of our long-term debt in advance of its maturity resulting in additional net interest expense of $99 million.

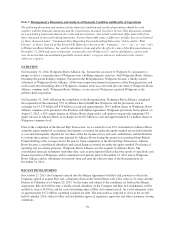

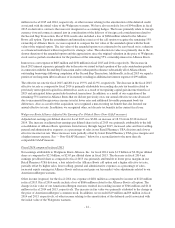

The effective tax rate for fiscal 2015 and 2014 was 19.9% and 42.9%, respectively. The decrease in the fiscal 2015

effective tax rate as compared to fiscal 2014 is primarily attributable to recording discrete tax benefits related to

previously unrecognized capital loss deferred tax assets as a result of recognizing capital gain income from fiscal

2015 and anticipated future period sale-leaseback transactions. In addition, as a result of our acquisition of the

remaining 55% interest in Alliance Boots that we did not previously own, our annual effective tax rate decreased

due to incremental foreign source income taxed at lower rates and additional favorable permanent book-tax

differences. Also as a result of the acquisition, we recognized a non-recurring tax benefit that also lowered our

annual effective tax rate. In addition, we recognized other, net discrete tax benefits in the current fiscal year.

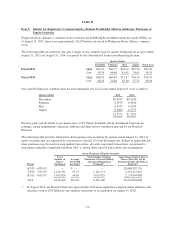

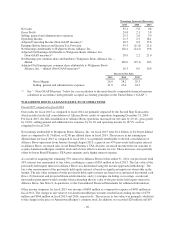

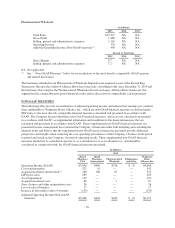

Walgreens Boots Alliance Adjusted Net Earnings Per Diluted Share (Non-GAAP measure)

Adjusted net earnings per diluted share for fiscal 2015 was $3.88, an increase of 18.3% from $3.28 in fiscal

2014. The increase in adjusted net earnings per diluted share in fiscal 2015 was primarily attributable to the full

consolidation of Alliance Boots operations from January through August 2015, increased sales and lower selling,

general and administrative expenses as a percentage of sales in our Retail Pharmacy USA division and a lower

effective income tax rate. These increases were partially offset by lower Retail Pharmacy USA gross margins and

a higher interest expense. See “– Non-GAAP Measures” below for a reconciliation to the most directly

comparable GAAP measure.

Fiscal 2014 compared to fiscal 2013

Net earnings attributable to Walgreens Boots Alliance, Inc. for fiscal 2014 were $1.9 billion or $2.00 per diluted

share as compared to $2.5 billion, or $2.67 per diluted share in fiscal 2013. The decrease in fiscal 2014 net

earnings per diluted share as compared to fiscal 2013 was primarily attributable to lower gross margins in our

Retail Pharmacy USA division, a loss related to the Alliance Boots call option and a higher effective tax rate,

partially offset by higher sales, lower selling, general and administrative expenses as a percentage of sales,

increased equity earnings in Alliance Boots and increased gains on fair market value adjustments related to our

AmerisourceBergen warrants.

Other income (expense) for the fiscal 2014 was expense of $481 million as compared to income of $120 million

in fiscal 2013. Fiscal 2014 results include a loss of $866 million related to the Alliance Boots call option. The

change in fair value of our AmerisourceBergen warrants resulted in recording income of $366 million and $111

million in fiscal 2014 and 2013, respectively. The increase in fair value was primarily attributed to the change in

the price of AmerisourceBergen’s common stock. In addition, we recorded $19 million and $9 million in fiscal

2014 and 2013, respectively, of other income relating to the amortization of the deferred credit associated with

the initial value of the Walgreens warrants.

-41-