Walgreens 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

conditions as those that were applicable to such award immediately prior to their conversion. The Company did

not record any incremental compensation expense related to the conversion.

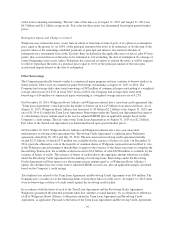

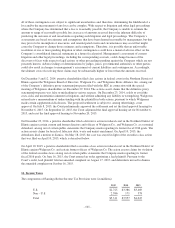

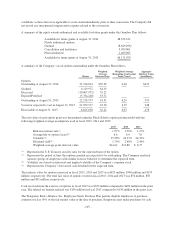

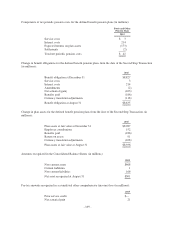

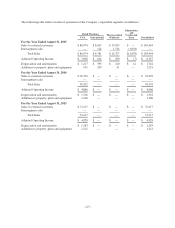

A summary of the equity awards authorized and available for future grants under the Omnibus Plan follows:

Available for future grants at August 31, 2014 48,352,242

Newly authorized options —

Granted (8,649,296)

Cancellation and forfeitures 5,059,061

Plan termination 1,409,063

Available for future grants at August 31, 2015 46,171,070

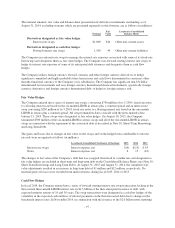

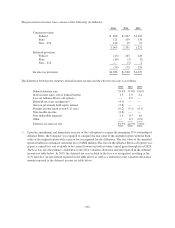

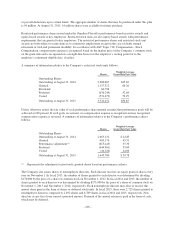

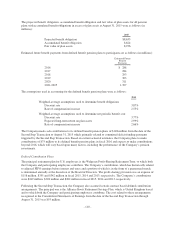

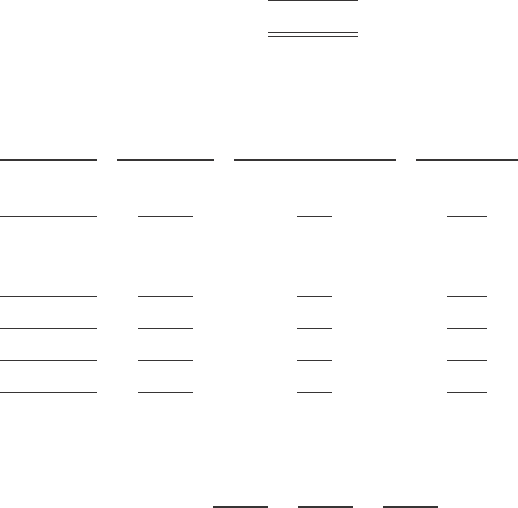

A summary of the Company’s stock options outstanding under the Omnibus Plan follows:

Shares

Weighted

Average

Exercise Price

Weighted Average

Remaining Contractual

Term (Years)

Aggregate

Intrinsic Value

(in millions)

Options

Outstanding at August 31, 2014 31,916,824 $39.28 6.40 $674

Granted 4,119,972 64.19

Exercised (10,007,975) 35.22

Expired/Forfeited (3,754,248) 53.72

Outstanding at August 31, 2015 22,274,573 43.52 6.29 959

Vested or expected to vest at August 31, 2015 21,879,917 43.20 6.25 948

Exercisable at August 31, 2015 8,825,638 32.42 4.03 478

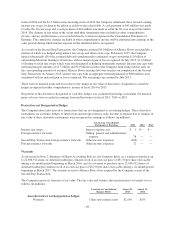

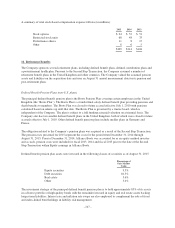

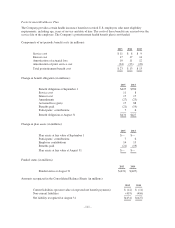

The fair value of each option grant was determined using the Black-Scholes option pricing model with the

following weighted-average assumptions used in fiscal 2015, 2014 and 2013:

2015 2014 2013

Risk-free interest rate(1) 1.97% 1.98% 1.15%

Average life of option (years)(2) 6.6 6.9 7.0

Volatility(3) 25.58% 26.27% 24.94%

Dividend yield(4) 1.79% 2.48% 2.44%

Weighted-average grant-date fair value $14.62 $12.88 $ 6.75

(1) Represents the U.S. Treasury security rates for the expected term of the option.

(2) Represents the period of time that options granted are expected to be outstanding. The Company analyzed

separate groups of employees with similar exercise behavior to determine the expected term.

(3) Volatility was based on historical and implied volatility of the Company’s common stock.

(4) Represents the Company’s forecasted cash dividend for the expected term.

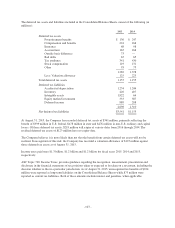

The intrinsic value for options exercised in fiscal 2015, 2014 and 2013 was $423 million, $346 million and $159

million, respectively. The total fair value of options vested in fiscal 2015, 2014 and 2013 was $54 million, $58

million and $51 million, respectively.

Cash received from the exercise of options in fiscal 2015 was $352 million compared to $490 million in the prior

year. The related tax benefit realized was $159 million in fiscal 2015 compared to $130 million in the prior year.

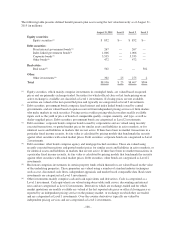

The Walgreens Boots Alliance, Inc. Employees Stock Purchase Plan permits eligible employees to purchase

common stock at 90% of the fair market value at the date of purchase. Employees may make purchases by cash

- 105 -