Walgreens 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

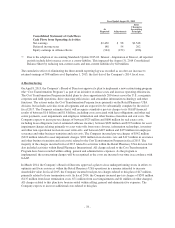

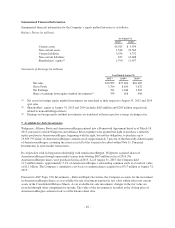

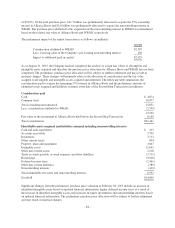

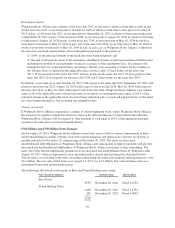

Summarized Financial Information

Summarized financial information for the Company’s equity method investees is as follows:

Balance Sheets (in millions)

At August 31,

2015(1) 2014(1)

Current assets $5,015 $ 9,074

Non-current assets 1,548 22,363

Current liabilities 3,936 9,372

Non-current liabilities 837 10,608

Shareholders’ equity(2) 1,790 11,457

Statements of Earnings (in millions)

Year Ended August 31,

2015(3) 2014(3) 2013(3)

Net sales $20,905 $37,624 $36,482

Gross Profit 3,794 8,109 7,632

Net Earnings 791 1,446 1,363

Share of earnings from equity method investments(3) 339 618 496

(1) Net assets in foreign equity method investments are translated at their respective August 31, 2015 and 2014

spot rates.

(2) Shareholders’ equity at August 31, 2015 and 2014 includes $163 million and $283 million respectively,

related to noncontrolling interests.

(3) Earnings in foreign equity method investments are translated at their respective average exchange rates.

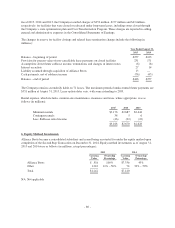

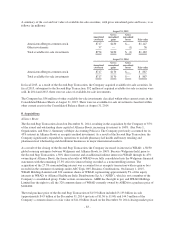

7. Available-for-Sale Investments

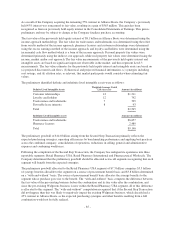

Walgreens, Alliance Boots and AmerisourceBergen entered into a Framework Agreement dated as of March 18,

2013, pursuant to which Walgreens and Alliance Boots together were granted the right to purchase a minority

equity position in AmerisourceBergen, beginning with the right, but not the obligation, to purchase up to

19,859,795 shares of AmerisourceBergen common stock (approximately 7 percent of the then fully diluted equity

of AmerisourceBergen, assuming the exercise in full of the warrants described within Note 11, Financial

Instruments) in open market transactions.

In conjunction with its long-term relationship with AmerisourceBergen, Walgreens acquired shares of

AmerisourceBergen through open market transactions totaling $493 million in fiscal 2014. No

AmerisourceBergen shares were purchased in fiscal 2015. As of August 31, 2015, the Company held

11.5 million shares, approximately 5.2% of AmerisourceBergen’s outstanding common stock at a total fair value

of $1.1 billion. The Company’s cumulative cost basis of common shares acquired was $717 million at August 31,

2015.

Pursuant to ASC Topic 320, Investments – Debt and Equity Securities, the Company accounts for the investment

in AmerisourceBergen shares as an available-for-sale investment reported at fair value within other non-current

assets in the Consolidated Balance Sheets. As an available-for-sale investment, changes in the fair value are

recorded through other comprehensive income. The value of the investment is recorded at the closing price of

AmerisourceBergen common stock as of the balance sheet date.

-82-