Walgreens 2015 Annual Report Download - page 78

Download and view the complete annual report

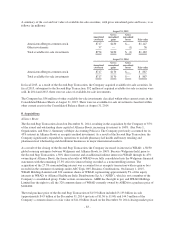

Please find page 78 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Advertising Costs

Advertising costs, which are reduced by the portion funded by vendors, are expensed as incurred or when

services have been received. Net advertising expenses, which are included in selling, general and administrative

expenses, were $491 million in fiscal 2015, $265 million in fiscal 2014 and $286 million in fiscal 2013.

Gift Cards

The Company sells gift cards to retail store customers and through its websites. The Company does not charge

administrative fees on unused gift cards. Gift cards sold in the U.S. do not have an expiration date while most gift

cards sold internationally have an expiration date. Income from gift cards sold in the U.S. is recognized when

(1) the gift card is redeemed by the customer; or (2) the likelihood of the gift card being redeemed by the

customer is remote (gift card breakage) and there is no legal obligation to remit the value of unredeemed gift

cards to the relevant jurisdictions. The Company’s gift card breakage rate is determined based upon historical

redemption patterns. Income from gift cards sold internationally is recognized when (1) the gift cards are

redeemed by the customer; or (2) the gift cards expire. Gift card breakage income, which is included in selling,

general and administrative expenses, was not significant in fiscal 2015, 2014 or 2013.

Points Earned Through Loyalty Programs

The Company’s primary rewards programs, Balance®Rewards and Boots Advantage Card, are accrued as a

charge to cost of sales at the time a point is earned. Points are funded internally and through vendor participation,

and are credited to cost of sales at the time a vendor-sponsored point is earned. Breakage is recorded as points

expire as a result of a member’s inactivity or if the points remain unredeemed after three years. Breakage income,

which is reported in cost of sales, was not significant in fiscal 2015, 2014 or 2013.

Insurance

The Company obtains insurance coverage for catastrophic exposures as well as those risks required by law to be

insured. In general, the Company’s U.S. subsidiaries retain a significant portion of losses related to workers’

compensation, property, comprehensive general, pharmacist and vehicle liability, while non-U.S. subsidiaries

manage their exposures through insurance coverage with third-party carriers. Management regularly reviews the

probable outcome of claims and proceedings, the expenses expected to be incurred, the availability and limits of

the insurance coverage, and the established accruals for liabilities. Liabilities for losses are recorded based upon

the Company’s estimates for both claims incurred and claims incurred but not reported and are not discounted.

The provisions are estimated in part by considering historical claims experience, demographic factors and other

actuarial assumptions.

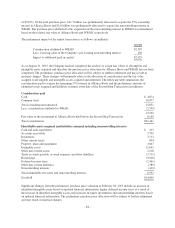

Stock Compensation Plans

In accordance with ASC Topic 718, Compensation – Stock Compensation, the Company recognizes

compensation expense on a straight-line basis over the employee’s vesting period or to the employee’s retirement

eligible date, if earlier. Total stock-based compensation expense for fiscal 2015, 2014 and 2013 was $109

million, $114 million and $104 million, respectively. The recognized tax benefit was $7 million, $31 million and

$30 million for fiscal 2015, 2014 and 2013, respectively. Unrecognized compensation cost related to non-vested

awards at August 31, 2015, was $137 million. This cost is expected to be recognized over a weighted average of

three years. See Note 15, Stock Compensation Plans for more information on the Company’s stock-based

compensation plans.

Interest

Interest paid, which is net of capitalized interest, was $472 million in fiscal 2015, $161 million in fiscal 2014 and

$158 million in fiscal 2013. Interest capitalized as a part of significant construction projects during fiscal 2015,

2014 and 2013 was immaterial.

-74-