Walgreens 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

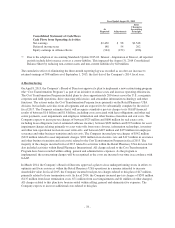

The Company accounts for income taxes according to the asset and liability method. Under this method, deferred

tax assets and liabilities are recognized based upon the estimated future tax consequences attributable to

differences between the financial statement carrying amounts of existing assets and liabilities and their respective

tax bases. Deferred tax assets and liabilities are measured pursuant to tax laws using rates expected to apply to

taxable income in the years in which those temporary differences are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax rate is recognized in income in the period that

includes the enactment date. Valuation allowances are established when necessary to reduce deferred tax assets

to the amounts more likely than not to be realized.

In determining the provision for income taxes, the Company uses income, permanent differences between book

and tax income, the relative proportion of foreign and domestic income, enacted statutory income tax rates,

projections of income subject to Subpart F rules and unrecognized tax benefits related to current year results.

Discrete events such as the assessment of the ultimate outcome of tax audits, audit settlements, recognizing

previously unrecognized tax benefits due to lapsing of the applicable statute of limitations, recognizing or de-

recognizing benefits of deferred tax assets due to future year financial statement projections and changes in tax

laws are recognized in the period in which they occur.

The Company is subject to routine income tax audits that occur periodically in the normal course of business.

U.S. federal, state, local and foreign tax authorities raise questions regarding the Company’s tax filing positions,

including the timing and amount of deductions and the allocation of income among various tax jurisdictions. In

evaluating the tax benefits associated with the various tax filing positions, the Company records a tax benefit for

uncertain tax positions using the highest cumulative tax benefit that is more likely than not to be realized.

Adjustments are made to the liability for unrecognized tax benefits in the period in which the Company

determines the issue is effectively settled with the tax authorities, the statute of limitations expires for the return

containing the tax position or when more information becomes available.

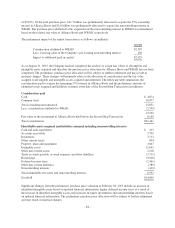

Earnings Per Share

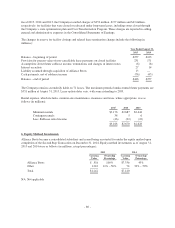

The dilutive effect of outstanding stock options on earnings per share is calculated using the treasury stock

method. Stock options are anti-dilutive and excluded from the earnings per share calculation if the exercise price

exceeds the average market price of the common shares. Outstanding options to purchase common shares that

were anti-dilutive and excluded from earnings per share totaled 2.5 million, 3.5 million and 12.3 million in fiscal

2015, 2014 and 2013, respectively.

New Accounting Pronouncements

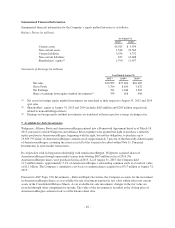

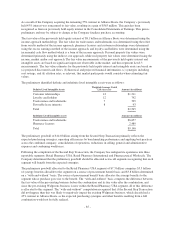

In August 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU)

2015-15, Interest – Imputation of Interest (subtopic 835-30). This ASU provides additional guidance on ASU

2015-03, Interest – Imputation of Interest. These ASUs require debt issuance costs to be presented in the balance

sheet as a direct deduction from the carrying amount of the debt liability, consistent with debt discounts or

premiums and further specify debt issuance costs as part of line-of-credit arrangements should be treated in the

manner described above. Recognition and measurement guidance for debt issuance costs are not affected. These

ASUs are effective for annual periods beginning after December 15, 2015 (fiscal 2017). As permitted, the

Company early adopted ASU 2015-03 beginning in the third quarter of fiscal 2015. The impact of this ASU

reduced non-current assets and long-term debt by $20 million at August 31, 2014, respectively. This ASU has no

impact on the statement of earnings or statement of cash flows. The additional guidance provided in ASU 2015-

15 had no material financial statement impact.

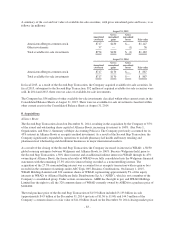

In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers (Topic 606), an update

to ASU 2014-09. This ASU amends ASU 2014-09 to defer the effective date by one year for annual reporting

-75-