Walgreens 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

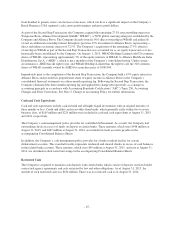

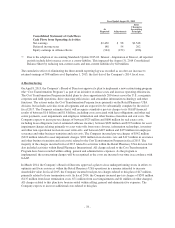

Accounts Receivable

Accounts receivable are stated net of allowances for doubtful accounts. Accounts receivable balances primarily

include amounts due from third party providers (e.g., pharmacy benefit managers, insurance companies and

governmental agencies), clients and members, as well as vendors and manufacturers. Charges to bad debt are

based on estimates of recoverability using both historical write-offs and specifically identified receivables.

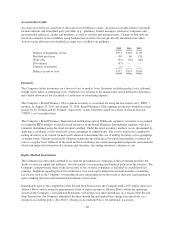

Activity in the allowance for doubtful accounts was as follows (in millions):

2015 2014 2013

Balance at beginning of year $173 $154 $ 99

Bad debt provision 90 86 124

Write-offs (53) (67) (69)

Divestitures (37) — —

Currency translation (1) — —

Balance at end of year $172 $173 $154

Inventory

The Company values inventories on a lower of cost or market basis. Inventory includes product costs, inbound

freight, direct labor, warehousing costs, overhead costs relating to the manufacture and distribution of products

and vendor allowances not classified as a reduction of advertising expense.

The Company’s Retail Pharmacy USA segment inventory is accounted for using the last-in-first-out (“LIFO”)

method. At August 31, 2015 and August 31, 2014, Retail Pharmacy USA segment inventories would have been

greater by $2.5 billion and $2.3 billion, respectively, if they had been valued on a lower of first-in-first-out

(“FIFO”) cost or market basis.

The Company’s Retail Pharmacy International and Pharmaceutical Wholesale segments’ inventory is accounted

for using the FIFO method, except for retail inventory in the Retail Pharmacy International segment, which is

primarily determined using the retail inventory method. Under the retail inventory method, cost is determined by

applying a calculated cost-to-retail ratio across groupings of similar items. The cost-to-retail ratio is applied to

ending inventory at its current owned retail valuation to determine the cost of ending inventory across groupings

of similar items. Current owned retail valuation represents the retail price for which merchandise is offered for

sale on a regular basis. Inherent in the retail method calculation are certain management judgments and estimates

which can impact the owned retail valuation and, therefore, the ending inventory valuation at cost.

Equity Method Investments

The Company uses the equity method to account for investments in companies if the investment provides the

ability to exercise significant influence, but not control, over operating and financial policies of the investee. The

Company’s proportionate share of the net income or loss of these companies is included in consolidated net

earnings. Judgment regarding the level of influence over each equity method investment includes considering

key factors such as the Company’s ownership interest, representation on the board of directors, participation in

policy-making decisions and material intercompany transactions.

Immediately prior to the completion of the Second Step Transaction, the Company held a 45% equity interest in

Alliance Boots and recorded its proportionate share of equity income in Alliance Boots within the operating

section in the Company’s Consolidated Statements of Earnings on a three-month lag. As a result of the Second

Step Transaction, the Company eliminated the three-month lag and applied this change retrospectively as a

change in accounting policy. See Note 3, Change in Accounting Policy for additional discussion.

-68-