Walgreens 2015 Annual Report Download - page 74

Download and view the complete annual report

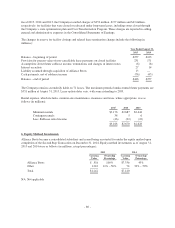

Please find page 74 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company capitalizes application stage development costs for significant internally developed software

projects, such as upgrades to the store point-of-sale system. These costs are amortized over a three to eight year

period. Amortization expense for capitalized system development costs and software was $178 million in fiscal

2015, $127 million in fiscal 2014 and $105 million in fiscal 2013. Unamortized costs at August 31, 2015 and

2014 were $1.0 billion and $676 million, respectively.

Business Combinations

Business combinations are accounted for under ASC Topic 805, Business Combinations, using the acquisition

method of accounting. The cost of an acquired company is assigned to the tangible and intangible assets

purchased and the liabilities assumed on the basis of their fair values at the date of acquisition. The determination

of fair values of assets and liabilities acquired requires estimates and the use of valuation techniques when a

market value is not readily available. Any excess of purchase price over the fair value of net tangible and

intangible assets acquired is allocated to goodwill. The final determination of the fair value of certain assets and

liabilities is completed within the one year measurement period as allowed under ASC Topic 805, Business

Combinations. Transaction costs associated with business combinations are expensed as they are incurred.

Goodwill and Other Intangible Assets

Goodwill represents the excess of the purchase price over the fair value of assets acquired and liabilities

assumed. The Company accounts for goodwill and intangibles under ASC Topic 350, Intangibles – Goodwill and

Other, which does not permit amortization, but requires the Company to test goodwill and other indefinite-lived

assets for impairment annually or whenever events or circumstances indicate that impairment may exist.

Intangible assets are amortized on a straight line basis over their estimated useful lives. See Note 9, Goodwill and

Other Intangible Assets for additional disclosure regarding the Company’s intangible assets.

Warrants

Walgreens, Alliance Boots and AmerisourceBergen Corporation (“AmerisourceBergen”) entered into a

Framework Agreement dated as of March 18, 2013, pursuant to which (1) Walgreens and Alliance Boots

together were granted the right to purchase a minority equity position in AmerisourceBergen, beginning with the

right, but not the obligation, to purchase up to 19,859,795 shares of AmerisourceBergen common stock

(approximately 7 percent of the then fully diluted equity of AmerisourceBergen, assuming the exercise in full of

the warrants described below) in open market transactions; (2) Walgreens and Alliance Boots collectively were

issued (a) warrants to purchase up to 22,696,912 shares of AmerisourceBergen common stock at an exercise

price of $51.50 per share exercisable during a six-month period beginning in March 2016, and (b) warrants to

purchase up to 22,696,912 shares of AmerisourceBergen common stock at an exercise price of $52.50 per share

exercisable during a six-month period beginning in March 2017. The parties and affiliated entities also entered

into certain related agreements governing relations between and among the parties thereto, including the

Shareholders Agreement and the Transaction Rights Agreement.

Pursuant to the Reorganization and Second Step Transaction discussed in Note 1, Organization, and Note 2,

Summary of Major Accounting Policies, Walgreens and Alliance Boots became wholly-owned subsidiaries of

Walgreens Boots Alliance effective December 31, 2014. The Company holds all AmerisourceBergen warrants

issued to Walgreens and Alliance Boots in its consolidated subsidiaries.

The warrants are valued at the date of issuance and the end of the period using a Monte Carlo simulation. Key

assumptions used in the valuation include risk-free interest rates using constant maturity treasury rates; the

dividend yield for AmerisourceBergen’s common stock; AmerisourceBergen’s common stock price;

AmerisourceBergen’s equity volatility; the number of shares of AmerisourceBergen’s common stock

outstanding; the number of AmerisourceBergen’s employee stock options and the exercise price; and the details

-70-