Walgreens 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

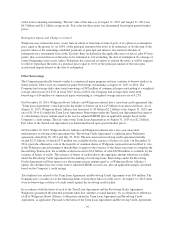

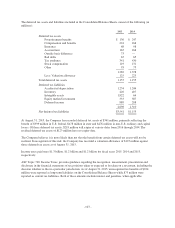

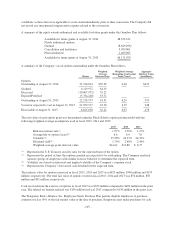

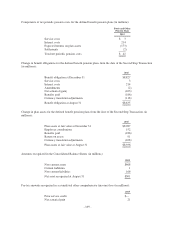

The deferred tax assets and liabilities included in the Consolidated Balance Sheets consist of the following (in

millions):

2015 2014

Deferred tax assets

Postretirement benefits $ 130 $ 247

Compensation and benefits 224 166

Insurance 68 98

Accrued rent 167 166

Outside basis difference 73 —

Bad debts 67 65

Tax attributes 341 430

Stock compensation 119 131

Other 93 75

1,282 1,378

Less: Valuation allowance 125 223

Total deferred tax assets 1,157 1,155

Deferred tax liabilities

Accelerated depreciation 1,234 1,244

Inventory 420 407

Intangible assets 1,822 64

Equity method investment 333 387

Deferred income 889 208

4,698 2,310

Net deferred tax liabilities $3,541 $1,155

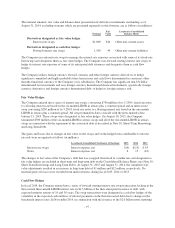

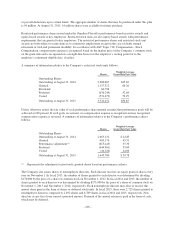

At August 31, 2015, the Company has recorded deferred tax assets of $341 million, primarily reflecting the

benefit of $399 million in U.S. federal, $478 million in state and $476 million in non-U.S. ordinary and capital

losses. Of these deferred tax assets, $218 million will expire at various dates from 2016 through 2034. The

residual deferred tax assets of $123 million have no expiry date.

The Company believes it is more likely than not that the benefit from certain deferred tax assets will not be

realized. In recognition of this risk, the Company has recorded a valuation allowance of $125 million against

those deferred tax assets as of August 31, 2015.

Income taxes paid were $1.3 billion, $1.2 billion and $1.2 billion for fiscal years 2015, 2014 and 2013,

respectively.

ASC Topic 740, Income Taxes, provides guidance regarding the recognition, measurement, presentation and

disclosure in the financial statements of tax positions taken or expected to be taken on a tax return, including the

decision whether to file in a particular jurisdiction. As of August 31, 2015, unrecognized tax benefits of $224

million were reported as long-term liabilities on the Consolidated Balance Sheets while $73 million were

reported as current tax liabilities. Both of these amounts include interest and penalties, when applicable.

- 103 -