Walgreens 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

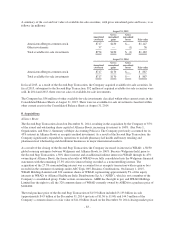

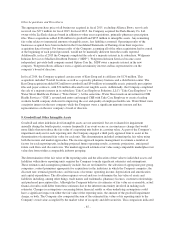

Other Acquisitions and Divestitures

The aggregate purchase price of all businesses acquired in fiscal 2015, excluding Alliance Boots, net of cash

received was $371 million for fiscal 2015. In fiscal 2015, the Company acquired Liz Earle Beauty Co. Ltd,

owner of the Liz Earle skincare brand in addition to other asset acquisitions, primarily pharmacy prescription

files. These acquisitions added $126 million to goodwill and $255 million to intangible assets. Any remaining

fair value relates to immaterial amounts of tangible assets, less liabilities assumed. Operating results of the

businesses acquired have been included in the Consolidated Statements of Earnings from their respective

acquisition dates forward. Pro forma results of the Company, assuming all of the other acquisitions had occurred

at the beginning of each period presented, would not be materially different from the results reported.

Additionally, in fiscal 2015 the Company completed the sale of a majority interest in its subsidiary, Walgreens

Infusion Services to Madison Dearborn Partners (“MDP”). Walgreens Infusion Services became a new

independent, privately-held company named Option Care Inc. MDP owns a majority interest in the new

company. Walgreens Boots Alliance owns a significant minority interest and has representatives on the

company’s board of directors.

In fiscal 2014, the Company acquired certain assets of Kerr Drug and its affiliates for $170 million. This

acquisition included 76 retail locations as well as a specialty pharmacy business and a distribution center. The

Kerr Drug acquisition added $42 million to goodwill and $54 million to intangible assets, primarily prescription

files and payer contracts, with $74 million allocated to net tangible assets. Additionally, the Company completed

the sale of a majority interest in its subsidiary, Take Care Employer Solutions, LLC (“Take Care Employer”) to

Water Street Healthcare Partners (“Water Street”). At the same time, Water Street made an investment in CHS

Health Services (“CHS”), an unrelated entity and merged CHS with Take Care Employer to create a leading

worksite health company dedicated to improving the cost and quality of employee health care. Water Street owns

a majority interest in the new company while the Company owns a significant minority interest and has

representatives on the new company’s board of directors.

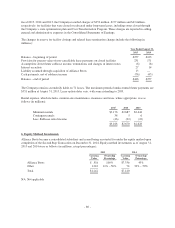

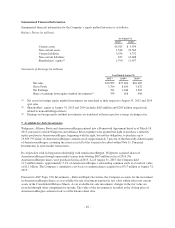

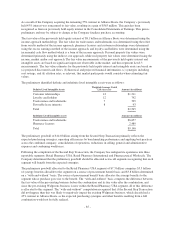

9. Goodwill and Other Intangible Assets

Goodwill and other indefinite-lived intangible assets are not amortized, but are evaluated for impairment

annually during the fourth quarter, or more frequently if an event occurs or circumstances change that would

more likely than not reduce the fair value of a reporting unit below its carrying value. As part of the Company’s

impairment analysis for each reporting unit, the Company engaged a third party appraisal firm to assist in the

determination of estimated fair value for each unit. This determination included estimating the fair value using

both the income and market approaches. The income approach requires management to estimate a number of

factors for each reporting unit, including projected future operating results, economic projections, anticipated

future cash flows and discount rates. The market approach estimates fair value using comparable marketplace fair

value data from within a comparable industry grouping.

The determination of the fair value of the reporting units and the allocation of that value to individual assets and

liabilities within those reporting units requires the Company to make significant estimates and assumptions.

These estimates and assumptions primarily include, but are not limited to: the selection of appropriate peer group

companies; control premiums appropriate for acquisitions in the industries in which the Company competes; the

discount rate; terminal growth rates; and forecasts of revenue, operating income, depreciation and amortization

and capital expenditures. The allocation requires several analyses to determine the fair value of assets and

liabilities including, among other things, trade names and trademarks, pharmacy licenses, customer relationships

and purchased prescription files. Although the Company believes its estimates of fair value are reasonable, actual

financial results could differ from those estimates due to the inherent uncertainty involved in making such

estimates. Changes in assumptions concerning future financial results or other underlying assumptions could

have a significant impact on either the fair value of the reporting units, the amount of the goodwill impairment

charge, or both. The Company also compared the sum of the estimated fair values of its reporting units to the

Company’s total value as implied by the market value of its equity and debt securities. This comparison indicated

-87-