Walgreens 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

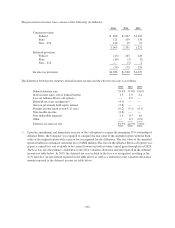

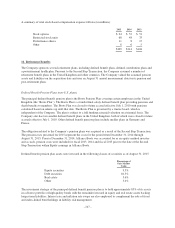

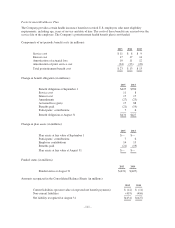

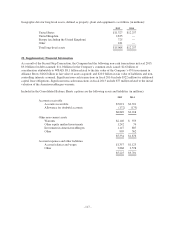

Amounts recognized in accumulated other comprehensive (income) loss (in millions):

2015 2014

Prior service credit $(231) $(228)

Net actuarial loss 223 225

Amounts expected to be recognized as components of net periodic costs for fiscal year 2016 (in millions):

2016

Prior service credit $(27)

Net actuarial loss 19

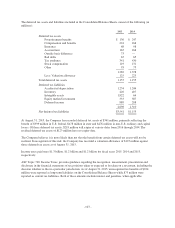

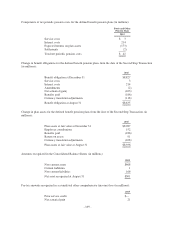

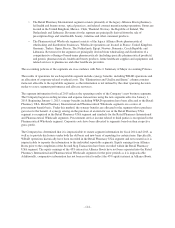

The discount rate assumption used to compute the postretirement benefit obligation at year-end was 4.78% for

2015, and 4.40% for 2014. The discount rate assumption used to determine net periodic benefit cost was 4.40%,

5.05% and 4.15% for fiscal years ending 2015, 2014 and 2013, respectively.

The consumer price index assumption used to compute the postretirement benefit obligation was 2.00% for 2015

and 2014.

Future benefit costs were estimated assuming medical costs would increase at a 7.15% annual rate, gradually

decreasing to 5.25% over the next nine years and then remaining at a 5.25% annual growth rate thereafter. A one

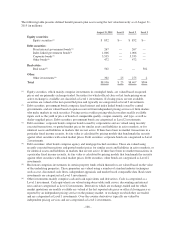

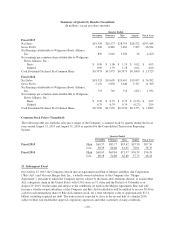

percentage point change in the assumed medical cost trend rate would have the following effects (in millions):

1% Increase 1% Decrease

Effect on service and interest cost $ (1) $ 1

Effect on postretirement obligation 17 (13)

Estimated future federal subsidies are immaterial for all periods presented. Future benefit payments are as

follows (in millions):

Estimated Future

Benefit Payments

2016 $10

2017 11

2018 12

2019 13

2020 14

2021-2025 98

The expected benefit to be paid net of the estimated federal subsidy during fiscal year 2016 is $10 million.

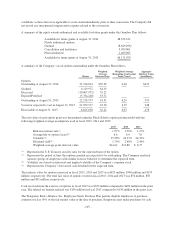

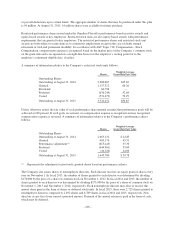

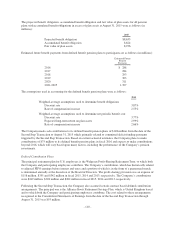

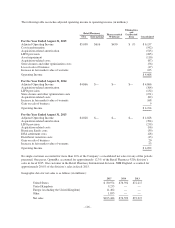

17. Capital Stock

In connection with the Company’s capital policy, the Board of Directors has authorized share repurchase

programs. In August 2014, the Company’s Board of Directors authorized the 2014 stock repurchase program

which authorizes the repurchase of up to $3.0 billion of the Company’s common stock prior to its expiration on

August 31, 2016. The Company purchased 8.2 million shares under the 2014 stock repurchase program in fiscal

2015 at a cost of $726 million.

The Company determines the timing and amount of repurchases based on its assessment of various factors

including prevailing market conditions, alternate uses of capital, liquidity, the economic environment and other

factors. The timing and amount of these purchases may change at any time and from time to time. The Company

has repurchased, and may from time to time in the future repurchase, shares on the open market through Rule

10b5-1 plans, which enable a company to repurchase shares at times when it otherwise might be precluded from

doing so under insider trading laws.

- 112 -