Walgreens 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

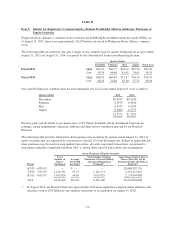

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read

together with the financial statements and the related notes included elsewhere herein. This discussion contains

forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from

those discussed in forward-looking statements. Factors that might cause a difference include, but are not limited

to, those discussed under “Cautionary Note Regarding Forward-Looking Statements” below and in “Risk

Factors” in Part I, Item 1A of this Form 10-K. References herein to the “Company”, “we”, “us”, or “our” refer

to Walgreens Boots Alliance, Inc. and its subsidiaries from and after the effective time of the Reorganization on

December 31, 2014 and, prior to that time, to its predecessor Walgreen Co. and its subsidiaries, and in each

case do not include unconsolidated partially-owned entities, except as otherwise indicated or the context

otherwise requires.

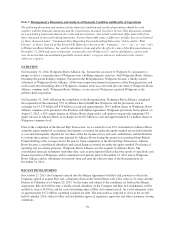

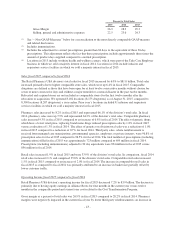

OVERVIEW

On December 31, 2014, Walgreens Boots Alliance, Inc. became the successor of Walgreen Co. pursuant to a

merger to effect a reorganization of Walgreens into a holding company structure, with Walgreens Boots Alliance

becoming the parent holding company. Pursuant to the Reorganization, Walgreens became a wholly-owned

subsidiary of Walgreens Boots Alliance, a Delaware corporation formed for purposes of the Reorganization, and

each issued and outstanding share of Walgreens common stock was converted into one share of Walgreens Boots

Alliance common stock. Walgreens Boots Alliance, as successor to Walgreens, replaced Walgreens as the

publicly-held corporation.

On December 31, 2014, following the completion of the Reorganization, Walgreens Boots Alliance completed

the acquisition of the remaining 55% of Alliance Boots GmbH that Walgreens did not previously own in

exchange for £3.133 billion ($4.874 billion) in cash and approximately 144.3 million shares of Walgreens Boots

Alliance common stock pursuant to the Purchase and Option Agreement. Walgreens previously had acquired, on

August 2, 2012, a 45% equity interest in Alliance Boots along with a call option to acquire the remaining 55%

equity interest in Alliance Boots in exchange for $4.025 billion in cash and approximately 83.4 million shares of

Walgreens common stock.

Prior to the completion of the Second Step Transaction, we accounted for our 45% investment in Alliance Boots

using the equity method of accounting. Investments accounted for under the equity method are recorded initially

at cost and subsequently adjusted for our share of the net income or loss and cash contributions and distributions

to or from these entities. Net income reported by Alliance Boots during this period was translated from British

Pounds Sterling at the average rate for the period. Upon completion of the Second Step Transaction, Alliance

Boots became a consolidated subsidiary and ceased being accounted for under the equity method. For financial

reporting and accounting purposes, Walgreens Boots Alliance was the acquirer of Alliance Boots. The

consolidated financial statements (and other data, such as prescriptions filled) reflect the results of operations and

financial position of Walgreens and its subsidiaries for periods prior to December 31, 2014 and of Walgreens

Boots Alliance and its subsidiaries for periods from and after the effective time of the Reorganization on

December 31, 2014.

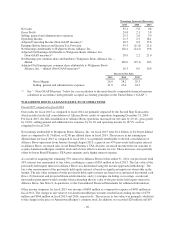

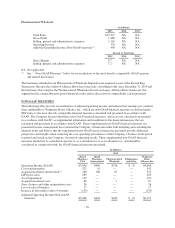

RECENT DEVELOPMENT

On October 27, 2015, the Company entered into the Merger Agreement with Rite Aid, pursuant to which the

Company agreed to acquire Rite Aid, a drugstore chain in the United States with 4,561 stores in 31 states and the

District of Columbia as of August 29, 2015. On the terms and subject to the conditions set forth in the Merger

Agreement, Rite Aid will become a wholly-owned subsidiary of the Company and Rite Aid stockholders will be

entitled to receive $9.00 in cash for each outstanding share of Rite Aid common stock, for a total enterprise value

of approximately $17.2 billion, including acquired net debt. The transaction is expected to close in the second

half of calendar 2016, subject to Rite Aid stockholder approval, regulatory approvals and other customary closing

conditions.

-36-