Walgreens 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

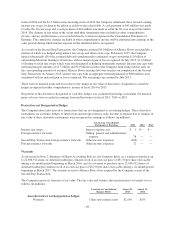

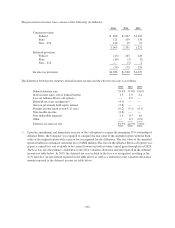

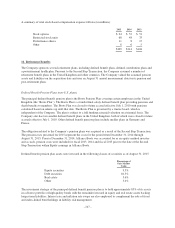

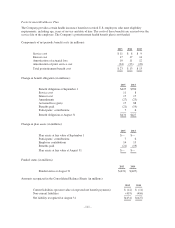

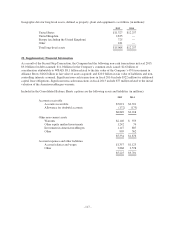

The following table presents defined benefit pension plan assets using the fair value hierarchy as of August 31,

2015 (in millions).

August 31, 2015 Level 1 Level 2 Level 3

Equity securities:

Equity securities(1) $ 852 $— $ 852 $—

Debt securities:

Fixed interest government bonds(2) 267 — 267 —

Index linked government bonds(2) 1,006 — 1,006 —

Corporate bonds(3) 5,535 — 5,535 —

Other bonds(4) 472 — 472 —

Real estate:

Real estate(5) 502 — — 502

Other:

Other investments(6) 302 25 275 2

Total $8,936 $ 25 $8,407 $504

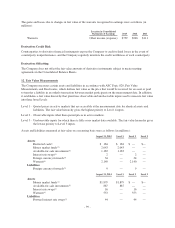

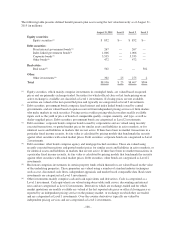

(1) Equity securities, which mainly comprise investments in comingled funds, are valued based on quoted

prices and are primarily exchange-traded. Securities for which official close or last trade pricing on an

active exchange is available are classified as Level 1 investments. If closing prices are not available,

securities are valued at the last quoted bid price and typically are categorized as Level 2 investments.

(2) Debt securities: government bonds comprise fixed interest and index linked bonds issued by central

governments, and are valued based on quotes received from independent pricing services or from dealers

who make markets in such securities. Pricing services utilize pricing which considers readily available

inputs such as the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as

dealer-supplied prices. Debt securities: government bonds are categorized as Level 2 investments.

(3) Debt securities: corporate bonds comprise bonds issued by corporations and are valued using recently

executed transactions, or quoted market prices for similar assets and liabilities in active markets, or for

identical assets and liabilities in markets that are not active. If there have been no market transactions in a

particular fixed income security, its fair value is calculated by pricing models that benchmark the security

against other securities with actual market prices. Debt securities: corporate bonds are categorized as Level

2 investments.

(4) Debt securities: other bonds comprise agency and mortgage-backed securities. These are valued using

recently executed transactions and quoted market prices for similar assets and liabilities in active markets, or

for identical assets and liabilities in markets that are not active. If there have been no market transactions in

a particular fixed income security, its fair value is calculated by pricing models that benchmark the security

against other securities with actual market prices. Debt securities: other bonds are categorized as Level 2

investments.

(5) Real estate comprises investments in certain property funds which themselves are valued based on the value

of the underlying properties. These properties are valued using a number of standard industry techniques

such as cost, discounted cash flows, independent appraisals and market based comparable data. Real estate

investments are categorized as Level 3 investments.

(6) Other investments mainly comprise cash and cash equivalents and derivatives. Cash is categorized as a

Level 1 investment. Cash equivalents are valued using observable yield curves, discounting and interest

rates and are categorized as Level 2 investments. Derivatives which are exchange-traded and for which

market quotations are readily available are valued at the last reported sale price or official closing price as

reported by an independent pricing service on the primary market, or exchange on which they are traded,

and are categorized as Level 1 investments. Over-the-counter derivatives typically are valued by

independent pricing services and are categorized as Level 2 investments.

- 108 -