Walgreens 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

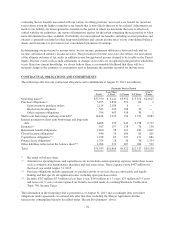

respect to the 2017 Notes was equal to 101.677% of the aggregate principal amount of such notes to be

redeemed, plus accrued interest thereon to, but excluding, the redemption date. The redemption price with

respect to the 2019 Notes was equal to 111.734% of the aggregate principal amount of such notes to be

redeemed, plus accrued interest thereon to, but excluding, the redemption date.

On August 10, 2015, upon the completion of the redemptions described above, the Walgreens guarantees of the

WBA notes and the Term Loan Agreement and the Revolving Credit Agreement were unconditionally released

and discharged in accordance with their terms.

Pending Transaction. The cash consideration payable to Rite Aid stockholders pursuant to the Merger

Agreement described under “Recent Development” above is expected to be financed with a combination of cash

on hand and debt financing. On October 27, 2015, the Company entered into a bridge facility commitment letter

(the “Commitment Letter”) with UBS Securities LLC and UBS AG, Stamford Branch for a $12.8 billion senior

unsecured bridge facility (the “Facility”). Subject to certain customary terms and conditions, the Facility may be

used to fund, in part, the cash consideration payable to Rite Aid stockholders pursuant to the Merger Agreement,

to repay the indebtedness of Rite Aid to be repaid in connection with the transaction and to pay related fees and

expenses.

Borrowings under the Facility will bear interest at a fluctuating rate equal to, at our option, LIBOR or the

applicable base rate, plus a margin calculated as described in the Commitment Letter. We will also pay certain

customary fees as described in the Commitment Letter. The Facility, if funded, will mature 364 days after the

initial borrowings; provided that the Company can extend up to $3.0 billion of the Facility for an additional 90

day period if desired. The closing of the Facility and the availability of the loans thereunder are subject to the

satisfaction of certain customary conditions as provided in the Commitment Letter. The definitive loan

documentation for the Facility will contain certain customary representations and warranties, affirmative,

negative and financial covenants and events of default consistent with the terms set forth in the Commitment

Letter and otherwise substantially similar to the terms set forth in our existing revolving credit agreement, dated

as of November 10, 2014, in all material respects unless otherwise mutually and reasonably agreed.

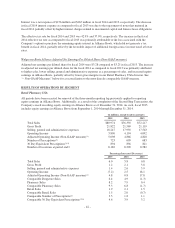

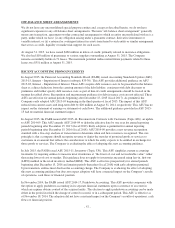

As of October 28, 2015, the credit ratings of Walgreens Boots Alliance were:

Rating Agency Long-Term Debt Rating

Commercial

Paper Rating Outlook

Moody’s Baa2 P-2 On review for downgrade

Standard & Poor’s BBB A-2 Negative

In connection with the pending acquisition of Rite Aid, we expect that each of these rating agencies will review

and update their ratings of our credit to reflect their assessment of the transaction and related matters. There can

be no assurance that any particular rating will be assigned. In assessing our credit strength, both Moody’s and

Standard & Poor’s consider various factors including our business model, capital structure, financial policies and

financial performance. Our credit ratings impact our borrowing costs, access to capital markets and operating

lease costs. The rating agency ratings are not recommendations to buy, sell or hold our debt securities or

commercial paper. Each rating may be subject to revision or withdrawal at any time by the assigning rating

agency and should be evaluated independently of any other rating.

Pursuant to our arrangements with AmerisourceBergen, we have the right, but not the obligation, to purchase a

minority equity position in AmerisourceBergen over time through open market purchases and pursuant to

warrants to acquire AmerisourceBergen common stock. We can acquire up to 19,859,795 shares in the open

market, which represents approximately 7% of the outstanding AmerisourceBergen common stock on a fully

diluted basis, assuming exercise in full of the warrants. The amount of permitted open market purchases is

subject to increase in certain circumstances. We have purchased a total of approximately 11.5 million

AmerisourceBergen shares in the open market. We have funded and plan to continue funding these purchases

over time. Share purchases may be made from time to time in open market transactions or pursuant to

instruments and plans complying with Rule 10b5-1.

-52-