Walgreens 2015 Annual Report Download - page 75

Download and view the complete annual report

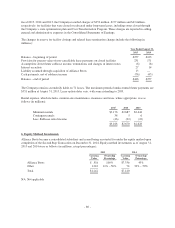

Please find page 75 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.specific to the warrants. The Company reports its warrants at fair value within other non-current assets in the

Consolidated Balance Sheets. A deferred credit from the day-one valuation attributable to the warrants granted to

Walgreens is being amortized over the life of the warrants. Gains and losses due to changes in the fair value on

warrants are recognized in other income in the Consolidated Statements of Earnings. See Note 11, Financial

Instruments, for additional disclosure regarding the Company’s warrants.

Financial Instruments

The Company uses derivative instruments to hedge its exposure to interest rate and currency risks arising from

operating and financing activities. In accordance with its risk management policies, the Company does not hold

or issue derivative instruments for trading or speculative purposes.

Derivatives are recognized on the Consolidated Balance Sheets at their fair values. When the Company becomes

a party to a derivative instrument and intends to apply hedge accounting, it formally documents the hedge

relationship and the risk management objective for undertaking the hedge which includes designating the

instrument for financial reporting purposes as a fair value hedge, a cash flow hedge, or a net investment hedge.

The accounting for changes in fair value of a derivative instrument depends on whether the Company had

designated it in a qualifying hedging relationship and further, on the type of hedging relationship. The Company

applies the following accounting policies:

• Changes in the fair value of a derivative designated as a fair value hedge, along with the gain or loss on

the hedged asset or liability attributable to the hedged risk, are recorded in the Consolidated Statements

of Earnings.

• The effective portion of changes in the fair value of a derivative designated as a cash flow hedge is

recorded in accumulated other comprehensive income (loss) in the Consolidated Statements of

Comprehensive Income and reclassified into earnings in the period or periods during which the hedged

item affects earnings.

• The effective portion of changes in the fair value of a derivative designated as a hedge of a net

investment in a foreign operation is recorded in cumulative translation adjustments within accumulated

other comprehensive income (loss) in the Consolidated Statements of Comprehensive Income.

Recognition in earnings of amounts previously recorded in cumulative translation adjustments is

limited to circumstances such as complete or substantially complete liquidation of the net investment in

the hedged investments in foreign operations.

• Changes in the fair value of a derivative not designated in a hedging relationship are recognized in the

Consolidated Statements of Earnings along with the ineffective portions of changes in the fair value of

derivatives designated in hedging relationships.

Cash receipts or payments on a settlement of a derivative contract are reported in the Consolidated Statements of

Cash Flows consistent with the nature of the underlying hedged item.

For derivative instruments designated as hedges, the Company assesses, both at the hedge’s inception and on an

ongoing basis, whether the derivatives that are used in hedging transactions are highly effective in offsetting

changes in fair values or cash flows of hedged items. Highly effective means that cumulative changes in the fair

value of the derivative are between 80% and 125% of the cumulative changes in the fair value of the hedged

item. In addition, when the Company determines that a derivative is not highly effective as a hedge, hedge

accounting is discontinued. When it is probable that a hedged forecasted transaction will not occur, the Company

discontinues hedge accounting for the affected portion of the forecasted transaction, and reclassifies any gains or

losses in accumulated other comprehensive income (loss) to earnings in the Consolidated Statements of Earnings.

When a derivative in a hedge relationship is terminated or the hedged item is sold, extinguished or terminated,

hedge accounting is discontinued prospectively.

-71-