Walgreens 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

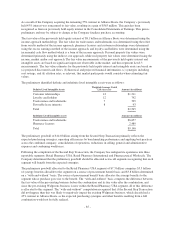

Year Ended August 31, 2013

As

Reported Adjustments

After

Change in

Accounting

Principle

Consolidated Statement of Cash Flows

Cash Flows from Operating Activities:

Net earnings $2,450 $ 98 $2,548

Deferred income taxes 148 54 202

Equity earnings in Alliance Boots (344) (152) (496)

(1) Due to the adoption of Accounting Standards Update 2015-03, Interest – Imputation of Interest, all reported

periods include debt issuance costs as a contra-liability. This impacted the August 31, 2014 Consolidated

Balance Sheet by reducing non-current assets and non-current liabilities by $20 million.

The cumulative effect of eliminating the three-month reporting lag was recorded as an after-tax increase to

retained earnings of $98 million as of September 1, 2013, the first day of the Company’s 2014 fiscal year.

4. Restructuring

On April 8, 2015, the Company’s Board of Directors approved a plan to implement a new restructuring program

(the “Cost Transformation Program”) as part of an initiative to reduce costs and increase operating efficiencies.

The Cost Transformation Program included plans to close approximately 200 stores across the U.S.; reorganize

corporate and field operations; drive operating efficiencies; and streamline information technology and other

functions. The actions under the Cost Transformation Program focus primarily on the Retail Pharmacy USA

division, but includes activities from all segments and are expected to be substantially complete by the end of

fiscal 2017. The Company estimates that it will recognize cumulative pre-tax charges to its GAAP financial

results of between $1.6 billion and $1.8 billion, including costs associated with lease obligations and other real

estate payments, asset impairments and employee termination and other business transition and exit costs. The

Company expects to incur pre-tax charges of between $525 million and $600 million for real estate costs,

including lease obligations (net of estimated sublease income), between $650 million and $725 million for asset

impairment charges relating primarily to asset write-offs from store closures, information technology, inventory

and other non-operational real estate asset write-offs, and between $425 million and $475 million for employee

severance and other business transition and exit costs. The Company incurred pre-tax charges of $542 million

($223 million related to asset impairment charges, $202 million in real estate costs and $117 million in severance

and other business transition and exit costs) related to the Cost Transformation Program in fiscal 2015. The

majority of the charges incurred in fiscal 2015 related to activities within the Retail Pharmacy USA division, but

also included activities within Retail Pharmacy International. All charges related to the Cost Transformation

Program have been recorded within selling, general and administrative expenses. As the program is

implemented, the restructuring charges will be recognized as the costs are incurred over time in accordance with

GAAP.

In March 2014, the Company’s Board of Directors approved a plan to close underperforming stores in efforts to

optimize and focus resources within the Retail Pharmacy USA operations in a manner intended to increase

shareholder value. In fiscal 2015, the Company incurred total pre-tax charges related to this plan of $17 million,

primarily related to lease termination costs. In fiscal 2014, the Company incurred pre-tax charges of $209 million

($137 million from lease termination costs, $71 million from asset impairments and $1 million of other charges).

All charges related to this plan have been recorded within selling, general and administrative expenses. The

Company expects to incur no additional costs related to this plan.

-78-